Introduction

As healthcare costs continue to soar, interest has grown in value-based payment models that could replace traditional fee-for-service payments. Value-based payment models can encourage better quality of care at a potentially lower cost, but in order for these models to be sustainable, they need to be designed in a way that is fair to all parties involved. Providers participating in value-based payment models such as capitation or shared savings take on a substantial portion of health insurance risk for the patients that are attributed to them through these programs. Furthermore, employers and insurers with a stake in these arrangements ought to have a keen interest in creating a viable payment mechanism that creates continuity of high-value services for members and meets long-term strategic goals. Care should be taken in the development of value-based payment models to ensure an appropriate balance of upside and downside risk for providers.

A well-constructed provider risk-sharing program ties reimbursement to risks that providers can meaningfully influence, while limiting provider exposure to risks over which they have no control. Risk adjustment is often proposed as a mechanism for limiting the payment risk associated with variation in underlying patient morbidity. Risk adjusters are tools that use member demographics, healthcare claims, or other data to identify underlying morbidity risk factors, so that those factors can be isolated and adjusted for.

Risk adjuster mechanisms are often evaluated in terms of the improvement in R2 (a measure of the degree to which they’re able to explain variation in healthcare costs) and other statistical measures. While informative, these typical measures do not provide immediate or concrete information about the impact that risk adjustment may have on reimbursement programs.

In this paper, we explore and quantify the extent to which risk adjustment can reduce the inappropriate variation in reimbursement that is due to underlying patient morbidity. We have used Milliman Advanced Risk Adjusters™ (MARA™) for this analysis. MARA is a suite of risk adjustment tools for population analysis that is perfectly suited for budgeting, pricing and underwriting, claim payment, stratifying risks, and many other predictive modeling applications for the health insurance industry.

Transferring risk through provider payment

A traditional fee-for-service payment arrangement can create an incentive for providers to over-treat as providers are paid based on the volume of care delivered without regard to the quality of the care. Value-based payment models provide an important alternative. They should be designed and implemented in a fashion that properly manages providers’ exposure to risks that are outside of their control and aligns incentives between all parties to achieve the triple aim of improving the patient experience, improving the health of populations, and reducing the cost of healthcare.

Value-based payment models come in a variety of forms across the entire continuum of financial risk and can have upside risk only, downside risk only, or two-sided risk. Examples of each include the following:

- Upside risk only

- Payment for care coordination

- Pay-for-performance bonuses

- Shared savings

- Downside risk only

- Nonpayment for preventable readmissions or hospital-acquired complications

- Two-sided risk

- Bundled payments for specific episodes of care

- Capitated payments for specific types of care or care for specific diagnoses

- Shared risk

- Full capitation

Most of these payment models involve defining a set of services that should be included in a value-based payment and estimating the target costs for those services. For providers, risk targets might be based on the specific care provided or some set of broader services. Actual performance is measured against target performance to determine the extent of any financial rewards or penalties that might accrue to the provider.

Because the financial rewards or penalties that providers face in a value-based payment model are dependent on the development of accurate cost targets, it is important that cost targets be developed in a rigorous and credible fashion. Risk adjustment provides an important tool to enhance the accuracy of cost target estimates and to reduce exposure risks that are outside of the provider’s control.

How much does risk adjustment improve the accuracy of provider reimbursement?

In order to demonstrate how risk adjustment can be used to improve the accuracy of provider reimbursement, we used a large database of commercial healthcare claims to develop sample provider reimbursement calculations, both with and without risk adjustment. We used the Truven MarketScan Commercial Claims and Encounters database, a large research database composed primarily of large group healthcare claims in the United States, and concurrent MARA risk scores for this analysis.

For our analysis, we focused on a scenario where a provider delivers professional care in an outpatient setting and is considering a valuebased payment model that would place it at risk for all outpatient professional services delivered to its patients. The first step in such an arrangement would be to calculate the target costs for outpatient professional services for this provider’s patients.

The accuracy of the cost target estimates would be dependent on the standard deviation of the costs for the panel of attributed patients. All else being equal, a lower standard deviation means that adjusted actual costs are more likely to fall within a narrow range of the target costs, while a higher standard deviation means that actual costs are less likely to fall within a narrow range of the target costs.

In general, the standard deviation is lower for larger sample sizes (or in this case, larger panel sizes) and higher for smaller sample sizes. Risk adjustment can be used to help reduce the standard deviation in expected costs regardless of the panel size, though the effect is more pronounced for smaller panel sizes.

Using the Truven MarketScan data, we developed target cost estimates for a range of provider panel sizes and examined the standard deviation in costs with and without using risk adjustment for 5,000 simulations per provider panel size. The following table shows, for a variety of panel sizes, the target (mean) costs for outpatient professional services, the standard deviation without risk adjustment, the standard deviation with risk adjustment, and the percentage reduction in the standard deviation that is due to risk adjustment.

Risk adjustment has the strongest impact in improving the standard deviation for group sizes that would not typically be considered credible, particularly those with panel sizes below 500. The use of risk adjustment may help providers that are otherwise unsure of the accuracy of their cost targets to be more confident in the approach used to set their targets, and would help protect them from risks in underlying patient morbidity that are outside of their influence.

Figure 1: Impact of risk adjustment for outpatient professional cost targets

| Provider panel size | Mean outpatient professional costs PMPM | Standard deviation without adjustment | Standard deviation with adjustment | Reduction in SD from risk adjustment |

| 10 | $116.06 | $106.92 | $66.30 | 38% |

| 25 | $115.92 | $67.13 | $44.38 | 34% |

| 50 | $115.86 | $45.47 | $35.15 | 23% |

| 75 | $115.65 | $35.25 | $27.98 | 21% |

| 100 | $116.41 | $34.37 | $28.63 | 17% |

| 500 | $116.19 | $14.58 | $12.16 | 17% |

| 1,000 | $115.72 | $10.47 | $8.82 | 16% |

| 2,000 | $116.04 | $7.34 | $6.22 | 15% |

| 3,000 | $115.91 | $5.95 | $4.94 | 17% |

| 5,000 | $115.97 | $4.53 | $3.92 | 14% |

| 10,000 | $115.96 | $3.21 | $2.72 | 15% |

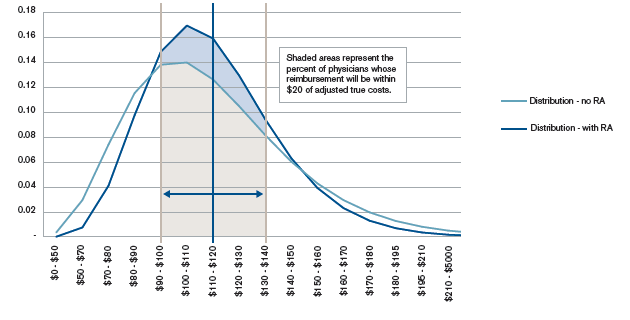

The chart below provides a graphic demonstration of how risk adjustment improves the percentage of providers for whom actual reimbursement is within a +/- $20 corridor of actual payment. For a panel of 75 individuals:

- Without risk adjustment, 59% of physicians will be reimbursed within $20 of the adjusted cost of care.

- With risk adjustment, 70% of physicians will be reimbursed within $20 of the adjusted cost of care.

This represents a meaningful improvement in the percentage of physicians who will be more accurately reimbursed.

How can this be used to improve the accuracy of value-based payment?

The long-term viability of value-based payment mechanisms is predicated on these payments being fair and accurate for participating physicians. In this context, we are defining an accurate payment as one that minimizes physicians’ financial exposure to risks they cannot meaningfully influence. While physicians can direct a patient’s health outcomes over time, the risk score is a reasonable indicator of a patient’s underlying health and the volume of medically necessary services that will be required. As such, we consider risk score indicative of risk that would be beyond a provider’s ability to influence (at least, not significantly).

Figure 2: Probability distribution of outpatient professional costs for a panel size of 75 (with and without risk adjustment)

Conclusion

As value-based payment models are more widely adopted, the need to structure reimbursement in a way that is fair to physicians is essential. While risk adjusters have long been described as a mechanism that improves the accuracy of physician payment, quantifying the expected improvement is essential in order for health plans, employers, and providers to continue to understand:

- The improvement in accurate payment that can be achieved for midsize panels through the application of risk adjustment.

- The residual risks of inaccurate payment that remain after the application of risk adjustment. Quantifying the residual risks can invite the opportunity for further refinement of the payment contract to minimize remaining risks.

Guidelines issued by the American Academy of Actuaries require actuaries to include their professional qualifications in actuarial communications. Colleen Norris is a member of the American Academy of Actuaries and meets the qualification standards for performing the analyses in this report.