COVID-19 is having a disproportionate impact on long-term care provider (LTCP) residents and staff compared to the general population. This article explores the potential impact COVID-19 may have on medical professional liability (MPL) and workers’ compensation (WC) claims within LTCPs.

According to the Centers for Disease Control and Prevention (CDC),1 over 65,000 LTCP facilities provided services for over 8.3 million people in the United States during 2016 as shown in the table in Figure 1.

Figure 1: Long-Term Care Providers and People Served

| Long-Term Care Sector | Providers | People Served | Licensed beds |

|---|---|---|---|

| Adult Day Services Centers | 4,600 | 286,300 | NA |

| Home Health Agencies | 12,200 | 4,455,700 | NA |

| Hospices | 4,300 | 1,426,000 | NA |

| Nursing Homes | 15,600 | 1,347,600 | 1,700,000 |

| Assisted Living | 28,900 | 811,500 | 1,000,000 |

| Total | 65,600 | 8,327,100 | NA |

The CDC also estimated that 1.5 million nurses, aides, and social workers are employed by these facilities.

According to a recent New York Times article, at least 4,100 LTCP facilities have COVID-19 cases and at least 7,100 people living in or connected to nursing homes have died of COVID-19 within the United States.2 We will focus on nursing homes and assisted living facilities in this article. The majority of states have temporarily closed adult day care centers due to “stay-at-home” orders. Home health agencies generally provide service within a patient’s home and may not be as prone to COVID-19 as residents within a facility. While COVID-19 may affect hospices that provide end-of-life care, the impact on liability is likely to be less.

The following is a process to estimate the MPL costs associated with COVID-19. Each LTCP should consult with its actuary to fine-tune these estimates for its own unique operation. In order to estimate the medical professional liability associated with COVID-19, we took the following steps:

- Estimate number of resident deaths associated with COVID-19

- Estimate the percentage of claims filed for the deaths above

- Estimate the per claim indemnity and per claim defense cost for each COVID-19 claim

- Estimate the percentage of COVID-19 claims that will settle with an indemnity payment

The Institute for Health Metrics and Evaluation (IHME)3 currently estimates the number of COVID-19 deaths in the United States will be approximately 135,000. While there is a great uncertainty regarding this number, we will use it for purposes of this analysis. At the time of the New York Times article, about one-fifth of the COVID-19 deaths were attributed to LTCP residents. We can then estimate 26,900 overall COVID-19 deaths associated with nursing homes and assisted living facilities from the IHME overall estimate.

It is difficult to assess how many COVID-19 claims associated with nursing homes and assisted living facilities will ultimately be filed. While it is unclear what percentage of COVID-19 deaths will result in a claim, we assumed 50% in this report. However, in some states,4 healthcare associations are requesting immunity from the COVID-19 pandemic, which may affect the ultimate number of claims filed.

Next, we need to estimate the cost of each COVID-19 claim. Based on internal Milliman LTCP data, we estimate 50% of filed claims will settle with an indemnity and these claims will average $300,000 per claim (including defense costs). We estimate the remaining claims will cost $20,000 for defense expenses.

Multiplying the above numbers together, we estimate the total MPL cost for nursing homes and assisted living facilities due to COVID-19 to be approximately $2.2 billion. This translates to an estimated MPL cost per bed of $800, derived by dividing the total estimated loss and defense costs by the total number of beds (2.7 million).

The above estimates are completely dependent on the assumptions outlined in this article. Significant differences will ultimately transpire and different states, types of facilities, and locations with COVID-19 clusters will have varying degrees of effects due to a multitude of factors. Overall LTCP MPL costs (other than COVID-19) may decrease due to overlapping claims not filed due to a resident passing because of COVID-19.

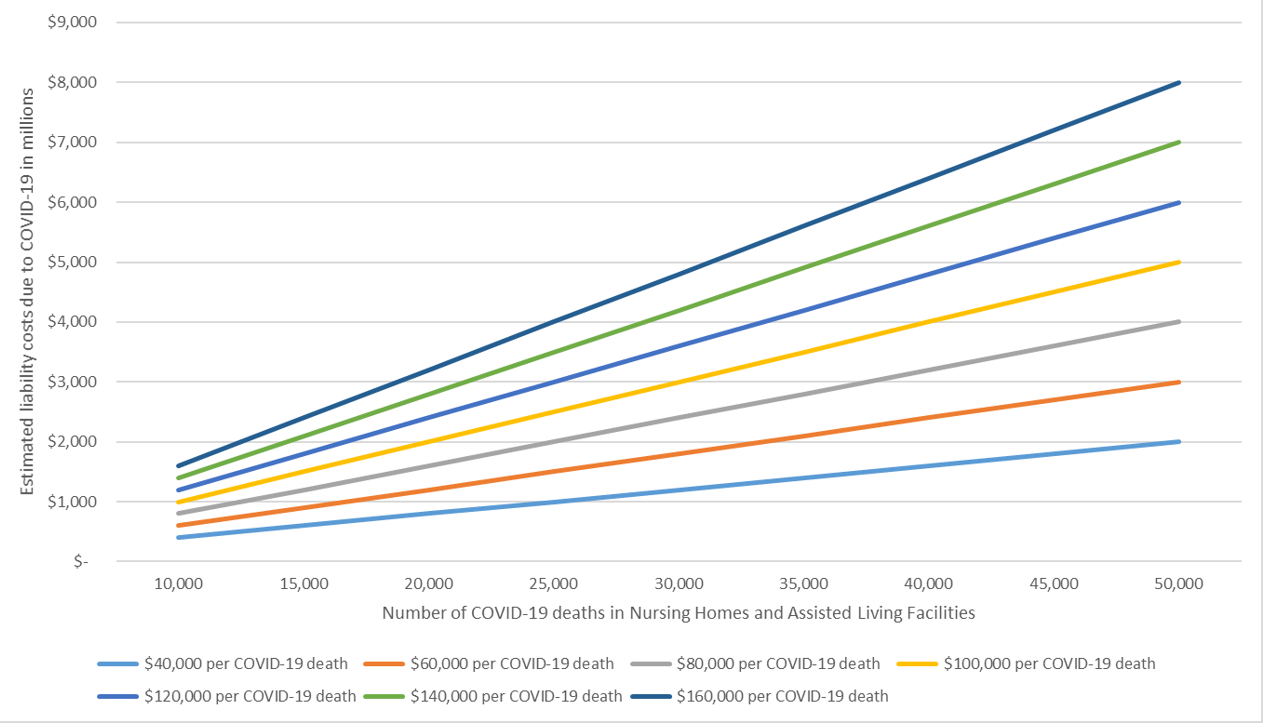

As an example of the variability of our estimates, we calculated scenarios for various COVID-19 death assumptions and claim costs. We varied COVID-19 deaths in nursing homes and assisted living facilities deaths from 10,000 to 50,000 residents. Our current assumptions assume the cost per COVID-19 death is $80,000.5 We varied this amount from $40,000 to $160,000. The chart in Figure 2 shows the difference in the total COVID-19 medical professional liability estimates to be between $400 million and $8 billion. This shows the wide range of estimates and suggests the ultimate result may fall outside these estimates.

Figure 2: Estimated COVID-19 Liability Costs for Nursing Homes and Assisted Living Facilities

The LTCP industry already has an aggressive plaintiff attorney system in place. However, we expect the plaintiff attorneys may not file many claims related to COVID-19 in the short term due to negative reactions from people observing a catastrophic pandemic during these times. On the other hand, as the world returns to normal, potential jurors may be emotionally driven by quick decisions and actions6 that were made in the fog of the pandemic.

Additional issues for LTCPs

LTCPs will also be affected by employees who become ill due to COVID-19. A recent article7 explored the evolving issues related to WC and COVID-19. Many states have enacted conclusive presumptions of COVID-19 claims for certain first responders and healthcare providers. The National Council on Compensation Insurance (NCCI) estimated8 the additional costs due to COVID-19 for first responders and healthcare workers to be between $1 billion to $16.2 billion in a large group of states. From this study, we approximate the additional cost for healthcare workers to be between $106 to $1,684 per employee. However, the Workers’ Compensation Insurance Rating Bureau of California (WCIRB)9 issued a research brief, which estimated the cost of COVID-19 claims for 1.3 million essential critical infrastructure employees in California to be $6 billion. This estimate would translate to a WC cost of about $4,750 per employee. It should be noted there is a huge range regarding these estimates and California WC costs are higher than in most other states.

Other liability concerns for LTCPs include employment practices, whereby an employee alleges unsafe working conditions such as personal protective equipment (PPE) not provided or not safe. LTCPs may also be affected by Directors and Officers Liability (D&O) coverage.10

Many larger LTCP entities partially self-insure themselves through large deductibles and excess and captive insurance programs for both medical professional liability and WC exposures. Therefore, a portion of the costs of COVID-19 claims will be borne directly by these entities, with insurers often covering excess costs. In addition, several insurers were already exiting the LTCP market prior to the COVID-19 pandemic due to increasing claim values and higher claim frequencies.11 This was already increasing premiums LTCPs were paying to insurers while providing less coverage.

Additional issues for insurers

Insurance carriers providing coverage to LTCP will be affected by COVID-19. Coverage for medical professional liability may be provided on an occurrence- or claims-made basis. Future claims-made policies may cover COVID-19 claims that are occurring today. For example, if an LTCP claims-made annual policy is effective at the beginning of the year (January 1, 2020), then COVID-19 claims may not be reported for several years and fall under the coverage of future year claims-made policies. Additionally, some states may require the insurer to provide tail coverage when a claims-made policy is canceled, which could mitigate an insurer’s attempt to evade COVID-19 claims by canceling claims-made policies.

Future cash flows to LTCP may be a problem because people would rather care for loved ones at home than expose them to COVID-19 at a facility. Therefore, the collection of deductibles may be an issue for many LTCP insurers.

Conclusion

COVID-19 is affecting the LTCP industry in many ways. Currently, the fight is for patients’ lives and employee safety. Once the pandemic is mitigated, liability issues will evolve and could potentially become an additional major financial blow12 to the LTCP industry. Additionally, the CDC13 is warning of a potential second wave of COVID-19 next winter that may be more difficult than the current pandemic.

1CDC. Long-term Care Providers and Services Users in the United State, 2015-16.

2Stockman, F. et al. (April 17, 2020). "They’re death pits": Virus claims at least 7,000 lives in U.S. nursing homes. New York Times. Retrieved on April 29, 2020, from https://www.nytimes.com/2020/04/17/us/coronavirus-nursing-homes.html.

3IHME (May 4, 2020). COVID-19 Projections. Retrieved on May 5, 2020, from https://covid19.healthdata.org/united-states-of-america.

4Hauck, G. (April 11, 2020). "Got my blood boiling:" Florida nursing homes ask governor for immunity from coronavirus lawsuits. USA Today. Retrieved on April 29, 2020, from https://www.usatoday.com/story/news/health/2020/04/11/coronavirus-florida-nursing-homes-covid-lawsuits-ron-desantis/2977441001/.

5$80,000 = 50% X [ 50% X 300,000 + 50% X 20,000].

6Tully, T. (April 17, 2020). After anonymous tip, 17 bodies found at nursing home hit by virus. New York Times. Retrieved on April 29, 2020, from https://www.nytimes.com/2020/04/15/nyregion/coronavirus-nj-andover-nursing-home-deaths.html.

7Blais, A. & Fleming, C.M. (April 9, 2020). If You Contract COVID-19 at Work, Is That a Compensable Workers' Compensation Claim? Retrieved on April 29, 2020, from https://us.milliman.com/en/insight/If-you-contract-COVID-19-at-work-is-that-a-compensable-workers-compensation-claim.

8NCCI Research Brief. (April 2020). COVID-19 and Workers Compensation: Modeling Potential Impacts. Retrieved on May 5, 2020, from https://www.ncci.com/Articles/Pages/Insights-COVID-19-WorkersComp-Modeling-Potential-Impacts.pdf.

9WCIRB (2020). Cost Evaluation of Potential Conclusive COVID-19 Presumption in California Workers’ Compensation. Research Brief. Retrieved on April 29, 2020, from https://www.wcirb.com/sites/default/files/documents/wcirb_april_2020_cost_evaluation_of_conclusive_covid-19_presumption.pdf.

10Soich, R. (April 3, 2020). In Light of the COVID-19 Crisis, Do You Have the Necessary Directors and Officers Coverage? Retrieved on April 29, 2020, from https://us.milliman.com/en/insight/In-light-of-the-COVID-19-crisis-do-you-have-the-necessary-Directors-and-Officers-coverage.

11Ironshore. 3 Trends Disrupting Professional Liability Insurance for the Long-Term Care Sector. Risk & Insurance. Retrieved on April 29, 2020, from https://riskandinsurance.com/3-trends-disrupting-professional-liability-insurance-for-the-long-term-care-sector-2.

12Goldstein, M., Gebeloff, R., & Silver-Greenberg, J. (April 21, 2020). Pandemic’s costs stagger the nursing home industry. New York Times. Retrieved on April 29, 2020, from https://www.nytimes.com/2020/04/21/business/coronavirus-nursing-home-finances.html.

13Sun, L.H. (April 21, 2020). CDC director warns second wave of coronavirus is likely to be even more devastating. Washington Post. Retrieved on April 29, 2020, from https://www.washingtonpost.com/health/2020/04/21/coronavirus-secondwave-cdcdirector/.