While the COVID-19 pandemic is first and foremost a public health crisis challenging communities around the globe, the turmoil the crisis has caused in financial markets also raises profound and potentially long-lasting concerns for pension plan sponsors. Large losses in equity markets mean that, for many sponsors, the assets held to pay plan benefits may have dropped 20% in just a matter of weeks. At the same time Treasury bond yields have plummeted while the market interest rates for high quality corporate bonds – which drive the measurement of liabilities for corporate pension plans for many purposes – have experienced large and volatile swings. In these circumstances, many plan sponsors may be taking stock and wondering what comes next.

This article provides a high-level summary of recent experience relevant to pension plans, along with considerations regarding possible implications for key measurements and requirements for single-employer pension plans. There is so much that is uncertain at the moment – from the ultimate progression of the pandemic, to extreme daily market volatility, and the evolving governmental response to the crisis – that it is scarcely possible to overstate the fluidity of the situation. However, the discussion below can provide a snapshot of where things stand as of the end of the first quarter of the year and help frame the items for plan sponsors to consider as things continue to evolve.

Recent market turmoil

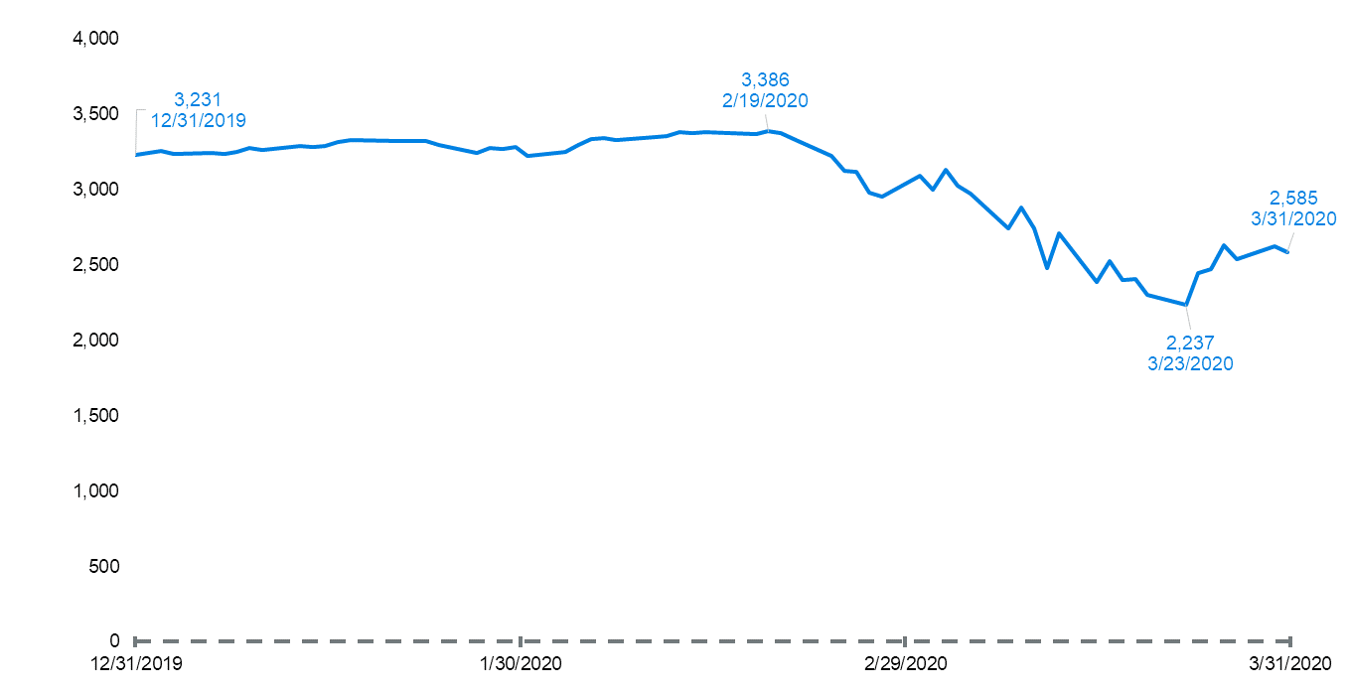

In recent weeks, there have been no shortage of headline-grabbing market movements. Dramatic (and in some cases record-breaking) plunges in equity indexes have occurred alongside rapidly changing bond markets, all while the CBOE Volatility Index (VIX) has rocketed to levels not seen since the global financial crisis of 2008. For illustration, two examples are shown below:

The S&P 500 index started 2020 well over 3,200, and closed as high as 3,386 on February 19. Subsequently, in less than five weeks, it lost over a third of its value, dropping to 2,237 on March 23. While the index has experienced strong gains in recent days, it still is approximately 20% lower than at year-end 2019.

Figure 1: S&P 500 Index year-to-date

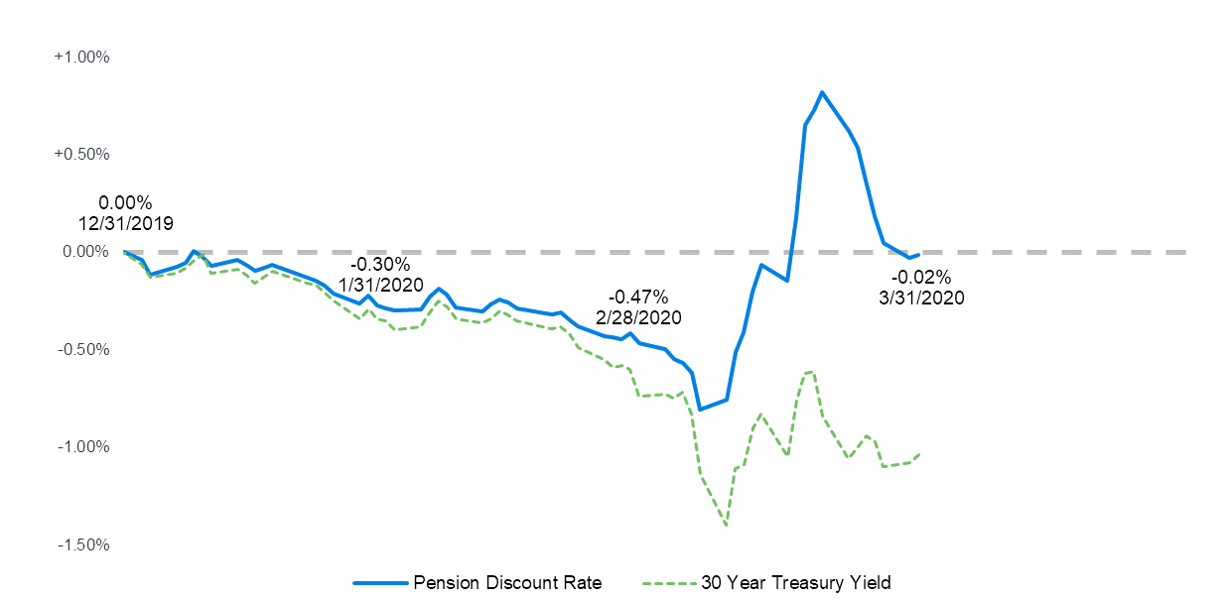

At the start of 2020, yields for both long-term Treasury bonds and for high-quality corporate bonds were already at low levels compared to historical ranges. The graph below shows the relative change in the yield for both a 30-year Treasury bond and a representative pension discount rate (based on a corporate bond yield curve applied to a typical distribution of pension plan cash flows) compared to their December 31, 2019, starting point. Early in the year, both sets of yields drifted lower, but then fell even further at the end of February as the COVID-19 crisis took hold in the United States and the Federal Reserve cut interest rates and announced new bond buying programs. However, since early March, the spread between corporate bond rates and Treasuries has widened dramatically. While the 30-year Treasury rate is still about 100 basis points lower than at the beginning of the year, the illustrative pension discount rate is now about the same as the starting point for 2020 after being significantly higher for much of the second half of March.

Figure 2: Year-to-date change

These discount rates are calculated for a sample pension plan based on Merrill Lynch's C0A2 index of US corporate AA rated bonds using the methodology from Milliman's Daily Pension Tracker (MDPT). Changes in the discount rate for individual plans will vary based on duration and discount rate methodology. Future actuarial measurements may differ significantly from the current measurements presented in these graphs due to many factors. The calculations presented in these graphs have been made for a specific purpose, which is an estimate of recent movements in accounting discount rates. Results for other purposes may be significantly different than the results in these graphs; other calculations may be needed for other purposes.

Because higher discount rates lead to lower measured liabilities for a pension plan, if the spike in the pension discount rate observed in late March were to recur, it would offset some of the effect of the lower asset values when assessing a plan’s funded status. However, recent changes have been dramatic and it is uncertain whether the widened spread will persist or, if the spread narrows, whether that occurs through increasing Treasury rates, decreasing corporate bond rates, or both.

Effects on single-employer pension plans

Asset losses

The financial market disruption caused by the pandemic will significantly harm the funded status of pension plans, at least in the short term. While the long-term effect will depend on the length of the downturn and the speed and magnitude of the subsequent recovery, it should also be noted that all plans will not be affected to the same extent. Plans with asset allocations weighted more heavily toward equity investments will have suffered more, while plan sponsors that have shifted investments to fixed income asset classes as part of a liability-driven investing (LDI) strategy will have fared better up to this point. The table below illustrates this for three hypothetical investment policies:

Figure 3: Q1 2020 Asset return for hypothetical pension plan under different asset allocations

| 70% Equity/ 30% fixed income | -13% |

| 50% Equity/ 50% fixed income | -8% |

| 30% Equity/ 70% fixed income | -2% |

Hypothetical asset returns are based on Q1 2020 index returns. The equity portion of the portfolio is assumed to be invested 60% in the Russell 3000 Index and 40% in the MSCI ACWI ex-US Index. Fixed income returns are based on the Bloomberg Barclay’s US Long Government/Credit Bond Index.

Another differentiator regarding how plans may weather the storm will be how “mature” the plan is—that is, the extent to which the plan’s liability is weighted toward retirees. Plans that are retiree-heavy often have annual benefit payments that exceed the contribution made each year. While this negative cash flow position is typical for a mature plan, it is harder for such plans to recover from prolonged asset downturns. By contrast, plans that are cash flow positive do not have to liquidate investments as dramatically during a downturn and are better positioned to benefit from a subsequent recovery.

Employer accounting measurements

Under FASB accounting rules, corporate plan sponsors of single-employer pension plans must reflect any plan underfunding on their balance sheet. Results are based on asset values and interest rates at the fiscal year-end measurement date.

- For plans with a calendar fiscal year, how markets react between now and December 31 will determine how dramatically the crisis affects their results.

- For plans with a mid-year measurement date, the effect of the crisis will have to be recognized sooner, with less time for potential recovery.

While plans have suffered asset losses, if corporate bond yields end up higher than they began the year, this will reduce the measured liabilities and help cushion the blow to the plan’s funded status. Accounting rules reflect interest rates at a point in time, so even a temporary increase in interest rates is meaningful for a plan sponsor if it occurs at the measurement date. Conversely, if corporate bond rates decline (as Treasuries have), this will cause an even larger drop in funded status.

Plan sponsors should also be aware of the potential for certain events – such as layoffs or other actions that significantly reduce the number of active participants in the plan – to trigger special accounting treatment and a mid-year re-measurement. This could result in the plan’s depressed funded status appearing on the employer’s balance sheet ahead of the typical schedule.

Plan funding and benefit restrictions

Sponsors of tax-qualified single-employer plans are subject to regulatory requirements governing:

- Minimum contribution requirements, which specify amounts a sponsor must contribute for a given plan year. The minimum requirement reflects any funding shortfall in a plan, so a decline in funded status increases the required contribution. Under current rules, new shortfalls are amortized in the required contribution over a seven-year period.

- Benefit restrictions, which provide that plans below certain funded status thresholds may be restricted from paying certain forms of benefit (e.g., lump sums), or even may have to cease benefit accruals entirely. This can lead plan sponsors to make significant one-time contributions to bring the plan above the funding thresholds and escape restrictions.

Determinations for both of these purposes reflect measurements from an annual valuation date. However, unlike for accounting results, these are not as strictly based on market results as of a single point in time. Many plans use a smoothed asset value that recognizes gains and losses over a two-year period, which will cushion the near-term effect of whatever level of loss may result from full-year 2020 asset experience. In addition, interest rates also reflect average values over time, which can mute the impact of sudden movements in bond yields.

For calendar year plans, the recent market downturn will not affect the January 1, 2020, actuarial valuation or the funding requirements and benefit restrictions determined from that measurement. The effect will first appear in funding requirements calculated at January 1, 2021. For plans with different valuation dates, it will be reflected earlier.

The CARES Act, signed into law on March 27, 2020, provides plan sponsors with additional flexibility in two regards:

- Delay of required contributions – Plan sponsors can defer funding contributions otherwise required during calendar year 2020 until January 1, 2021. Interest must be added to contribution amounts when they are eventually made.

- Benefit restriction lookback – For the 2020 plan year, plan sponsors may choose to determine benefit restrictions based on the plan’s funded status at the 2019 valuation date. This may prove particularly helpful for plans with mid-year measurement dates because there will be little time for markets to recover prior to the valuation date.

Looking ahead

As with so much about the current crisis, the long-term effect of the pandemic on pension plans is uncertain. Outcomes will depend on how events unfold both in financial markets and in the wider world. In the meantime, plan sponsors should work with their advisers to stay informed about the consequences for their plans and their businesses. Some areas to consider are:

- How do recent asset losses change projected plan contribution requirements?

- What is the impact on the company’s balance sheet if markets don’t bounce back? What if interest rates drop and/or assets decline further?

- How has the plan’s investment policy held up through the crisis, and is the plan positioned as intended for the future? Should the asset allocation be re-balanced?

- Will the company make use of the flexibility provided to plan sponsors in the CARES Act? Would such a delay conflict with an adopted plan funding policy or any collective bargaining agreements?

- How will the crisis affect workforce behavior, including willingness of employees to retire?

- What are the consequences of any workforce actions taken during the crisis?

While keeping current on the evolving landscape and addressing these questions will not prevent the coming months from being a significant challenge, it will improve the ability of sponsors to navigate the crisis in the long-term interest of both the sponsor and plan participants.