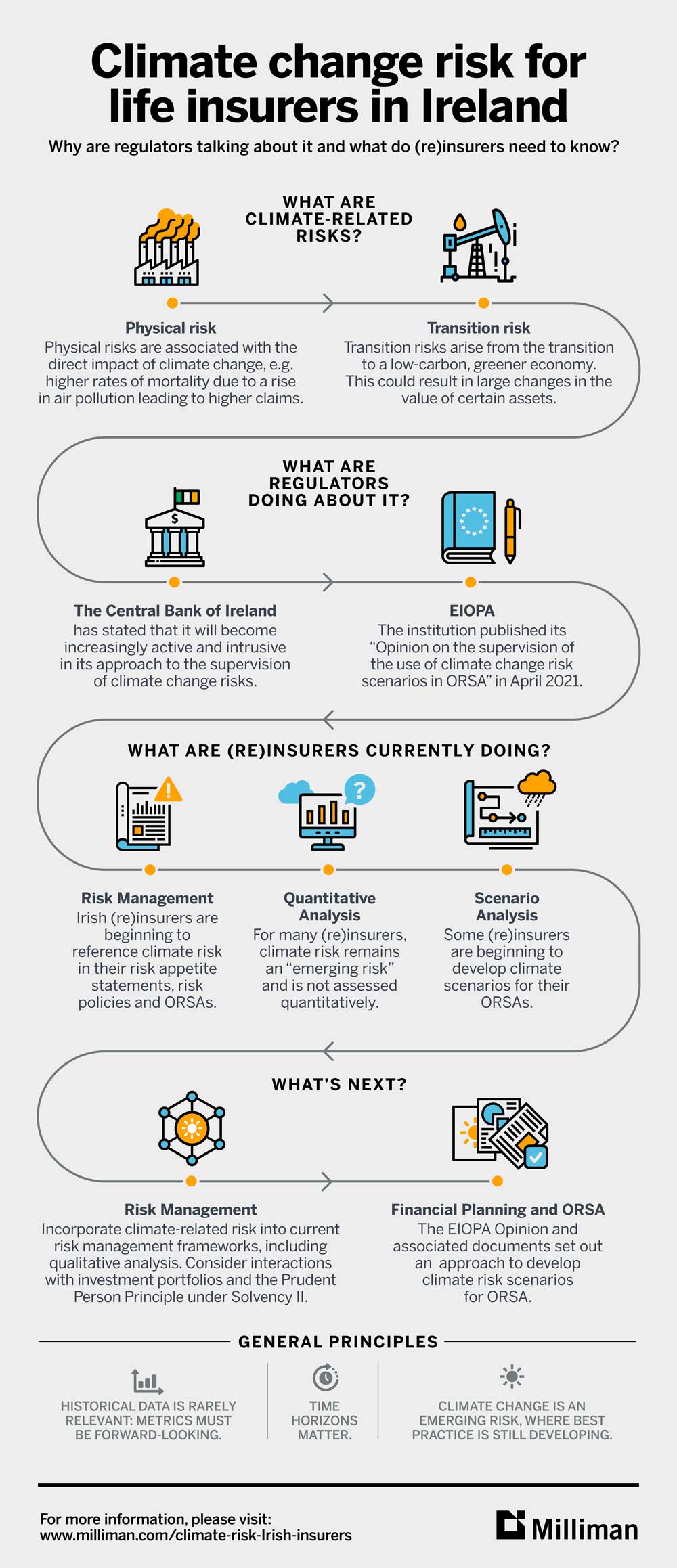

Regulators have started to look to the financial services industry to better understand the challenges posed by climate-related risks, including the transition to a low-carbon economy. In Ireland, the Central Bank of Ireland (CBI) has been vocal about the move towards a climate resilient financial system at recent events and has made it clear that climate change is on its agenda of priorities. The European Insurance and Occupational Pensions Authority (EIOPA) has also started to publish consultation papers on how to integrate climate-related risks into the Solvency II framework. The aim of this briefing note is to provide a “beginner’s guide” to climate risk for Irish insurers, an introduction to what the CBI and EIOPA are currently doing in relation to climate-related risk and what insurers could do to increase understanding of climate-related risk.

Below is an infographic that provides a “beginners guide” to climate risk for Irish insurers