2022 midyear risk transfer summary

Pension risk transfer (PRT) has become a buzzword with corporate plan sponsors looking to de-risk their defined benefit pension plans. A PRT can be a transfer of a portion of the pension liability for a subset of the participant population (generally retirees) or a full transfer of all participants (those that do not elect a lump sum distribution) to close out a pension plan termination.

This trend in the PRT market of breaking records initially started in 2012 with a couple of jumbo transactions exceeding $1 billion and evolved into an onslaught of activity in recent years. Based on data from the Secure Retirement Institute (SRI) U.S. Group Annuity Risk Transfer Sales Survey, single premium sales through June 2022 totaled $17.8 billion.1 This is more than double the $8.8 billion recorded through the first half of 2021.

Historically, 65 to 75% of PRT transactions occur in the second half of the year, but so far in 2022, Q1 and Q2 have both broken records for PRT activity, with $5.3 billion and $12.5 billion in sales, respectively (see Figure 1). This is already 47% of the record $38.1 billion total in 2021. And it does not look like the momentum is expected to slow down. This article will explore the continued surge in the PRT market.

Figure 1: Total PRT single premium sales by quarter ($ billions)

Economic factors

What could be fueling the group annuity market this early in the year? One possible explanation is that 2022 is seeing a rise in interest rates that has not been seen in a number of years. As of July, the U.S. Federal Reserve (the Fed) had raised interest rates four times in 2022, for a combined 2.25 percentage points. These rate hikes have had an impact on both the discount rates for accounting liability and the annuity purchase rates for PRT. As shown in Figure 2, the FTSE Above Median AA Curve (FTSE AM) is one of the many yield curves a plan sponsor may use to develop the discount rate for their accounting liability. Since December 31, 2021, the FTSE AM discount rates (short, intermediate, and long duration) have increased 170 to 180 basis points (bps) through June 30, 2022. What is unknown to plan sponsors is whether these higher rates will be short lived, especially since plan sponsors have had to endure the impact of historically low rates on their pension liability for some time. Many may have seen the rate hikes as an opportunity to de-risk their plan in anticipation of an interest rate reversal.

Figure 2: FTSE Above Median AA Curve discount rates

On the flip side of rising interest rates and lower pension plan liabilities were spiraling market returns. Through June 30, 2022, the S&P 500 Index fell 20% with the close of its worst first half in 52 years. Fixed income assets did not fare any better as there is an inverse relationship between interest rates and bond prices (i.e., higher rates mean lower bond prices). With the drop in pension liability countered by the drop in plan assets, it would seem that plan sponsors might table their PRT plans, but in reality, PRT activity has soared. It is likely the negative liability return exceeded the negative asset return, meaning the decrease in pension liability was greater than the asset loss.

In addition, some plan sponsors saw an improvement in their pension plan’s funded status at the end of 2021 and may have made changes to their investment policy to preserve the improved funded status or may even have determined that plan termination was within reach. Since the plan termination process can take six to 18 months to complete, we may be seeing an increase in PRT activity in the first half of 2022 from plan sponsor actions taken in 2021.

Group annuity market capacity and competition

Since 2012, the year that kicked off PRT buyouts, the number of insurers in the group annuity market has grown from 10 to 18. For the most part, each insurer’s appetite is based on premium size (small, mid, large); demographics (retirees only, retirees and deferreds); and specific plan provisions. As a result, no two opportunities are alike and an insurer’s ability to quote will depend on these factors along with their capacity. With a higher volume of PRT comes more competitive pricing, but this may also come with fewer insurers having the capacity or desire to quote on every opportunity that goes out to bid, especially as we approach the second half of the year.

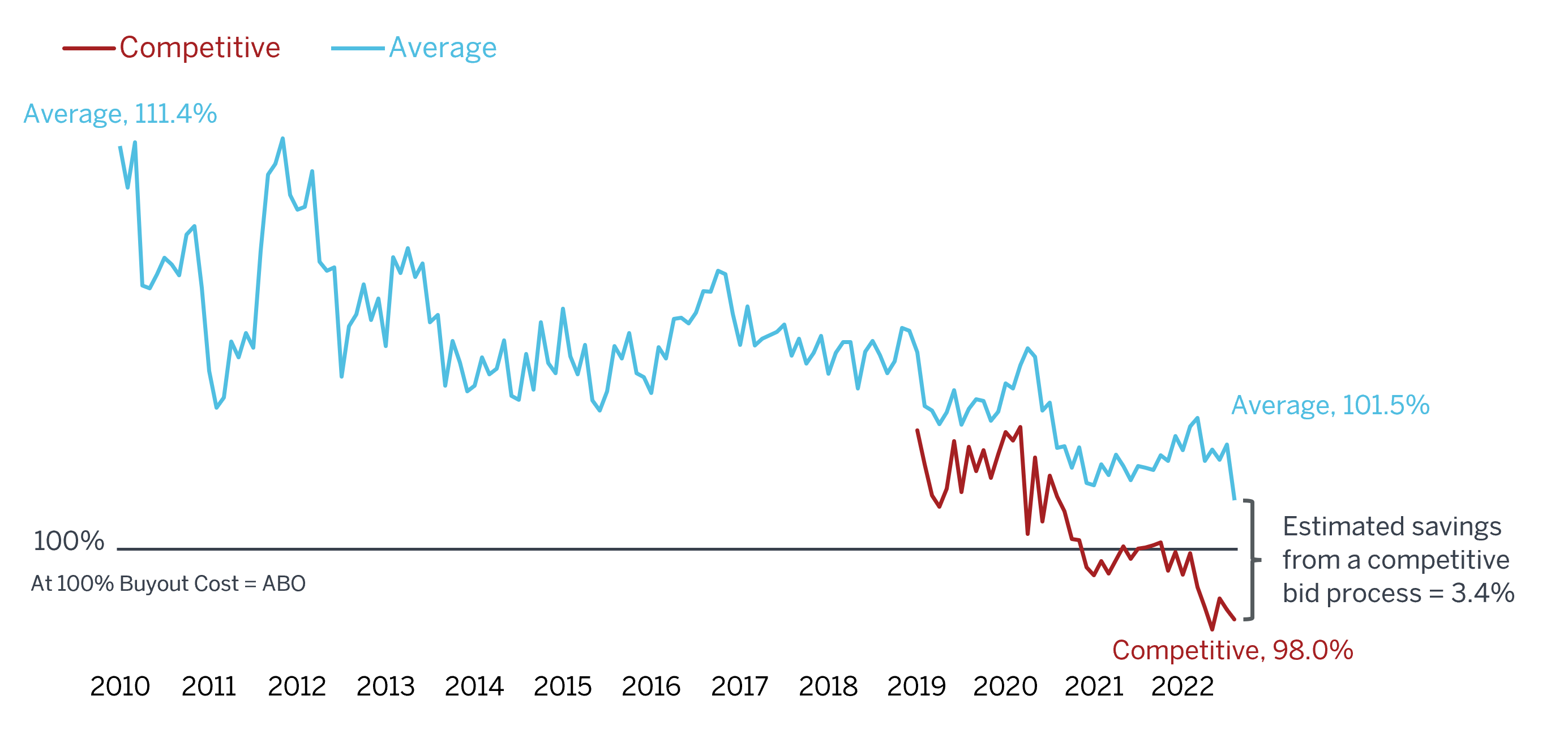

According to the Milliman Pension Buyout Index, the first half of 2022 saw some of the lowest competitive retiree buyout costs since its first publication. Figure 3 illustrates retiree buyout costs with two different metrics: The red line represents only the most competitive insurers' rates from each month, while the blue line represents a straight average of all insurers' rates in the study. Plan sponsors looking to de-risk a portion of their pension plan may see the competitive retiree buyout cost as an opportunity to shed pension liability at or below the value they are holding on their books. And in a year where we have seen interest rates rise, seeing the annuity purchase rates move relatively in tandem with accounting discount rates may have provided plan sponsors with the incentive to capitalize on the Fed’s rate hikes.

Figure 3: Milliman Pension Buyout Index as of July 31, 2022

Expectations for the second half of 2022

If the first half of 2022 is any indication of what is to come in the second half, then we are on track for another record-breaking year in the PRT space. The true test will be insurer capacity and whether insurers will become even more selective in the opportunities they engage and whether fewer insurers quoting on opportunities have an impact on competitive pricing. Plan sponsors as fiduciaries must also take into consideration the requirements outlined in the U.S. Department of Labor’s Interpretive Bulletin 95 1 in selecting an insurer for their group annuity. And, with an uptick in the number of plans going through the annuity selection process for the first time, it will be prudent for plan sponsors to seek expert guidance in the selection process to ensure the criteria are satisfied.

1 Includes single premium buyouts and buy-ins (see Appendix for definitions).

Appendix – Definitions

Definitions are from the SRI U.S. Group Annuity Risk Transfer Sales Survey.

Single premium buyouts are group annuity contracts used to assume certain benefit liabilities of a terminating U.S. pension plan or, in some cases, a plan settlement of specific groups. A single premium group annuity contract is issued to the plan trustee or employer in exchange for a single sum; and certificates are issued to individual annuitants, which may be groups of immediate and/or deferred plan participants.

Single premium buy-ins are group annuity contracts used to assume certain benefit liabilities of a U.S. pension plan or, in some cases, a plan settlement of specific groups. The annuity contract is issued to the plan trustee or employer in exchange for a single sum. The plan trustee or employer holds the contract as a plan asset and retains overall plan liability. Certificates are not issued to individual annuitants.