The Internal Revenue Service (IRS) and the Social Security Administration have announced the 2024 cost-of-living adjustment values for tax-qualified retirement plans and Social Security benefits. The Pension Benefit Guaranty Corporation (PBGC) has published the 2024 single-employer and multiemployer defined benefit (DB) pension plan premium rates. This Client Action Bulletin provides the limits for 2024, along with the corresponding limits for 2023 and 2022.

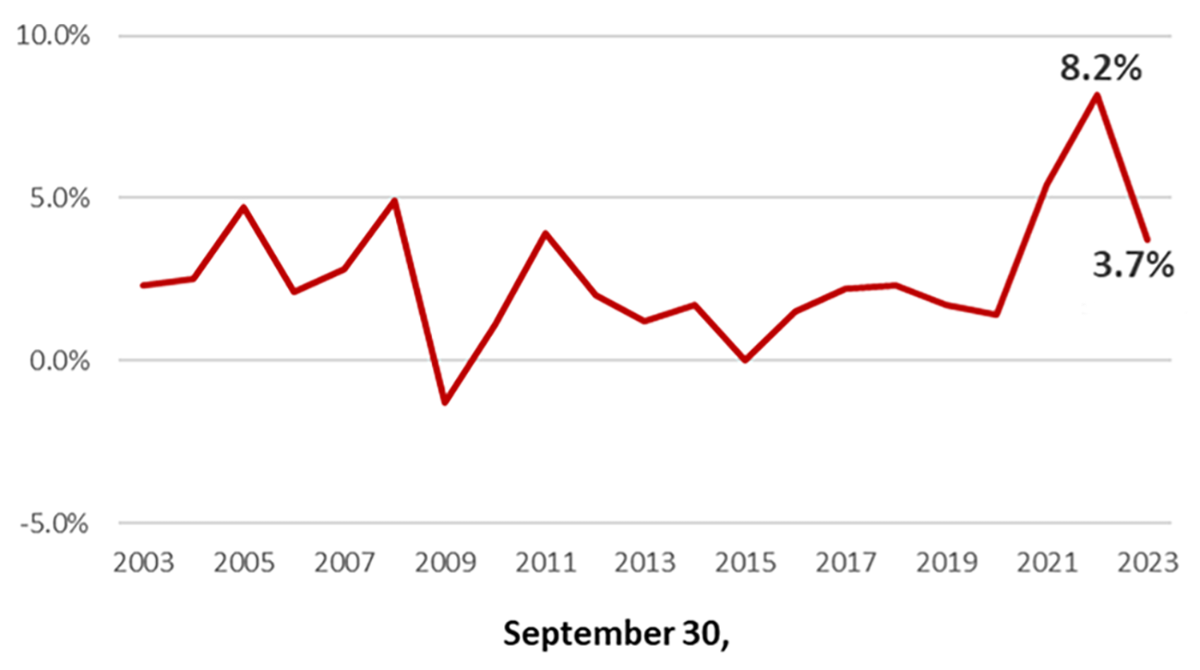

Historical rolling 12-month changes in the Consumer Price Index (CPI), as reported by the U.S. Bureau of Labor Statistics, as of each September 30, from 2003 through the current federal fiscal year (FFY), are shown in Figure 1.

Figure 1: Historical 12-month percentage change each September 30, Consumer Price Index, all items, not seasonally adjusted

Source: U.S. Bureau of Labor Statistics.

The CPI as reported by the BLS for the 12 months ended September 30, 2023, was 3.7%, the same as the 12 months ended August 31, 2023. It is down significantly from the 8.2% annual change in CPI as of September 30, 2022, but still higher than the 2.5% average annual change over the past 10 and 20 years.

Definitions

Please refer to the tables in this bulletin for the 2024 values compared to the corresponding 2023 and 2022 values. Notes for the items in the tables:

- The maximum annual DB plan annuity is specified under Internal Revenue Code (IRC) §415(b)(1)(A) and may need adjustment for a participant’s retirement age or benefit form.

- The maximum annual addition to a defined contribution (DC) plan is specified under IRC §415(c)(1)(A) and is the sum of any employee tax-deferred or Roth deferral contributions and employer contributions (matching, profit-sharing, or other nonelective), but excludes catch-up contributions.

- The employee’s annual DC plan contribution is specified under IRC §402(g)(1) and is limited to the maximum §401(k)/§403(b)/§457 deferral value for the year.

- “UVB” in the PBGC section of the table refers to unfunded vested benefits for single-employer and multiple employer DB plans. It is the deficit, if any, between the PBGC variable rate premium (VRP) value of accrued benefits and the value of the plan’s assets. There are no VRPs for multiemployer DB plans.

- “OASDI” is the Social Security Old-Age, Survivors, and Disability Insurance program. The OASDI payroll tax rate is 6.20% on wages up to the taxable wage base. Both the employer and the employee pay OASDI payroll tax.

- The Medicare Hospital Insurance payroll tax is 1.45% on all wages and is paid by both the employer and the employee. Employees are subject to an additional 0.9% payroll tax withholding on wages over $200,000 ($250,000 for married couples filing jointly).

- An individual who attains the Social Security full (normal) retirement age (SSNRA) of 66 and 8 months in 2024 (i.e., born in 1958) will be eligible to commence unreduced Social Security benefits in 2024. People born prior to 1958 have a lower SSNRA, and those born in 1959, will have a higher SSNRA, with a maximum age of 67 for those born in 1960 or later.

- “HSA” is a tax-qualified health savings account. “HDHP” is a tax-qualified high-deductible health plan.

New limits under SECURE 2.0

SECURE 2.0 made changes to DC plans, some of which are required and some of which are optional. Certain changes will impact how the limits described earlier in this bulletin apply or create new limits starting in 2024 as described below.

- Qualified student loan payments: Plan sponsors may elect to treat qualified student loan payments as elective deferrals eligible for employer matching contributions. An employee’s aggregate qualified student loan payments for the year treated as elective deferrals may not exceed the limit in definition 3 above (or if less, the employee’s IRC §415(c)(3) compensation for the year), reduced by the employee’s actual elective deferrals for the year.

- Pension-linked emergency savings accounts (ESA): Plan sponsors may add ESAs to their DC plans. Non-highly compensated employees may contribute to these accounts on a Roth basis, and the portion of the account attributable to participant contributions cannot exceed the lesser of $2,500 or such other amount designated by the plan sponsor. The $2,500 will be indexed for inflation.

- Roth catch-up contributions: Plans that offer catch-up contributions must require participants whose wages (as defined in IRC §3121(a)) in the prior calendar year exceeded $145,000 to make catch-up contributions on a Roth basis. The $145,000 will be indexed for inflation. The IRS recently announced a two-year administrative transition period, giving plans until December 31, 2025, to implement the new rule.

Starting in 2025, higher catch-up limits will apply for plans that offer catch-up contributions for participants aged 60, 61, 62, or 63. The limit is the greater of $10,000 or 150% of the regular catch-up limit, as indexed for inflation.

Please visit our website to learn more about how SECURE 2.0 affects retirement savings. The site contains numerous articles and podcasts to help you navigate the new law.

Plan sponsor action

Defined contribution savings plans, §401(k), §403(b), or §457, tax-deferred or Roth: In addition to updating administrative systems to reflect the 2024 limits, plan sponsors may wish to review the contribution patterns over the last few years of their participants who were or are contributing at the maximum IRS limits. For those with a profit-sharing feature, it may be of interest to assess how many participants could be affected by the expected increase in both the savings plan total limit and the compensation limit. If a nonqualified savings plan feature exists, there could be a reduction in the necessary amount to finance in a rabbi trust or to leave it as an unfunded, unsecured obligation of the plan sponsor.

Defined benefit pension plans: Note that the maximum annual annuity value above (also known as the “415 limit”) applies to the benefit payable at a participant’s retirement date. This limit is actuarially adjusted if the retirement date is before age 62 or after age 65, or if the participant’s elected form of payment is different from a single life annuity. For employers that sponsor nonqualified DB plans, qualified plan limit increases could reduce nonqualified plan projected benefits.

For additional information about the 2024 cost-of-living adjustments for retirement plans, Social Security benefits, and HSAs and HDHPs, please contact your Milliman consultant.

Sources: IRS Notice 2023-75, 2024 Social Security Fact Sheet, Social Security National Average Wage Index web page, PBGC premiums web page, IRS Revenue Procedure 2023-23.IRS, PBGC, and Social Security Values for 2024, 2023, and 2022

| IRS QUALIFIED RETIREMENT PLAN COMPENSATION AND BENEFITS LIMITS |

2024 | 2023 | 2022 |

|---|---|---|---|

| MAXIMUM ANNUAL ANNUITY PENSION FOR DB PLANS | $275,000 | $265,000 | $245,000 |

| MAXIMUM ANNUAL ADDITION FOR DC PLANS | $69,000 | $66,000 | $61,000 |

| MAXIMUM §401(K), §403(B), §457 DEFERRAL FOR DC PLANS | $23,000 | $22,500 | $20,500 |

| “CATCH-UP” CONTRIBUTION LIMIT FOR DC PLANS | $7,500 | $7,500 | $6,500 |

| COMPENSATION LIMIT | $345,000 | $330,000 | $305,000 |

| HIGHLY COMPENSATED EMPLOYEE (HCE) | $155,000 | $150,000 | $135,000 |

| KEY EMPLOYEE/OFFICER COMPENSATION | $220,000 | $215,000 | $200,000 |

| PORTION OF EMERGENCY SAVINGS ACCOUNT IN DC PLANS ATTRIBUTABLE TO PARTICIPANT CONTRIBUTIONS |

$2,500 | N/A | N/A |

| PRIOR YEAR WAGE THRESHOLD TRIGGERING ROTH CATCH-UP CONTRIBUTIONS TO DC PLANS |

$145,000 | N/A | N/A |

| PBGC FLAT RATE AND VARIABLE RATE PREMIUMS FOR DEFINED BENEFIT PENSION PLAN SUBJECT TO IRS RULES |

2024 | 2023 | 2022 |

|---|---|---|---|

| SINGLE-EMPLOYER PLAN FLAT-RATE PREMIUM PER PARTICIPANT | $101 | $96 | $88 |

| SINGLE-EMPLOYER PLAN VARIABLE-RATE PREMIUM (VRP) PER $1,000 OF UNFUNDED VESTED BENEFITS (UVB) |

$52 | $52 | $48 |

| MAXIMUM SINGLE-EMPLOYER PLAN VRP PER PARTICIPANT | $686 | $652 | $598 |

| MULTIEMPLOYER PLAN FLAT RATE PREMIUM | $37 | $35 | $32 |

| SOCIAL SECURITY ADMINISTRATION | 2024 | 2023 | 2022 |

|---|---|---|---|

| SOCIAL SECURITY TAXABLE WAGE BASE (SSTWB) | $168,600 | $160,200 | $147,000 |

| MAXIMUM OASDI PAYROLL TAX (6.2% OF SSTWB) PAID BY BOTH THE EMPLOYEE AND THE EMPLOYER |

$10,453.20 | $9,932.40 | $9,114.00 |

| MAXIMUM MONTHLY SOCIAL SECURITY BENEFIT AT SSNRA | $3,822 | $3,627 | $3,345 |

| NATIONAL AVERAGE WAGE BASE USED TO ADJUST LIMITS | $63,795.13 | $60,575.07 | $55,628.60 |

| IRS QUALIFIED EMPLOYER HEALTH INSURANCE PLAN BENEFIT LIMITS | 2024 | 2023 | 2022 |

|---|---|---|---|

| SELF-ONLY HEALTH INSURANCE PLAN COVERAGE | |||

| HSA ANNUAL CONTRIBUTION | $4,150 | $3,850 | $3,650 |

| HDHP MINIMUM DEDUCTIBLE | $1,600 | $1,500 | $1,400 |

| HDHP MAXIMUM OUT-OF-POCKET COST | $8,050 | $7,500 | $7,050 |

| FAMILY HEALTH INSURANCE PLAN COVERAGE | |||

| HSA ANNUAL CONTRIBUTION | $8,300 | $7,750 | $7,300 |

| HDHP MINIMUM DEDUCTIBLE | $3,200 | $3,000 | $2,800 |

| HDHP MAXIMUM OUT-OF-POCKET COST | $16,100 | $15,000 | $14,100 |

| ALL HEALTH INSURANCE PLAN COVERAGES | |||

| HSA “CATCH-UP” CONTRIBUTION FOR AGES 55 AND OLDER | $1,000 | $1,000 | $1,000 |