What do Part D plan sponsors need to consider when rebates cease to exist?

On February 6, 2019, the Trump Administration published a proposed rule to remove the safe harbor for drug manufacturer rebates under the federal Anti-Kickback Statute.1 This proposed rule may be effective as soon as 2020, and would have major and broad impacts to federally funded prescription drug programs, especially Medicare Part D.

Recent focus on rebates

In recent years, rising prices of prescription drugs have been a concern for beneficiaries, payers, and the federal government. Another concern has been the lack of transparency about the true cost of a drug due to the complex ecosystem that can make a payer’s price lower than the actual point-of-sale (POS) price.2 This may be due to rebates paid by drug manufacturers (often for favorable formulary placement) to pharmacy benefit managers (PBMs) and payers. In the current environment, rebates are shared with all beneficiaries through lower premiums but they do not directly lower cost sharing.

Given the design of the Part D program and the complex nature of the sharing of costs among the member, the federal government, and the Part D plan sponsors, the savings generated from rebates3 are not shared equally and directly among these stakeholders. Part D plan sponsors may use the savings from rebates to lower premiums (including the Part D direct subsidy and the low income premium subsidy). If rebates were instead applied at the POS, then they could lower beneficiary cost sharing, manufacturers' coverage gap discount program (CGDP) payments, and reinsurance costs, possibly leading to premium increases. Because Part D is a competitive market where premiums are a primary driver of enrollment, Part D plan sponsors typically use rebates to reduce premiums rather than providing POS discounts.4

The topic of rebates has been hotly debated and many industry experts believe that by not applying rebates at the POS, plan sponsors create a financial burden on users of rebated products. Rebates also receive scrutiny because they lead to a lack of transparency about the true cost of a drug and the current environment may be further driving increased list prices for prescription drugs.5

The Centers for Medicare and Medicaid Services (CMS) has released several communications and proposals addressing the issue of high drug costs and the financial burden on beneficiaries using rebated medications. These proposals have ranged from eliminating rebates to having plan sponsors apply a percentage of the rebates at the POS.6 In May 2018, the Trump Administration released American Patients First, a blueprint to lower drug prices and reduce out-of-pocket costs,7 which includes moving at least a portion of rebates to the POS.

On January 31, 2019, the U.S. Department of Health and Human Services (HHS) released a proposed rule changing the current discount safe harbor under the Anti-Kickback Statute of the Social Security Act. This proposal would remove the safe harbor protecting rebates after the POS, or other direct and indirect remuneration (DIR) from drug manufacturers, paid to Medicare Part D plan sponsors, Medicaid managed care organizations (MCOs), and the PBMs providing services to these organizations. This proposal also would create two new safe harbors, one allowing payments from drug manufacturers to payers as long as they are included at the POS and one allowing certain payments from manufacturers to PBMs for services provided to the manufacturer by the PBM. While this proposed rule only applies to Medicare Part D and Medicaid MCOs, the Secretary of HHS has also asked Congress to pass a law that would extend this regulation to the commercial market.8

Timing for plan sponsors is critical but uncertain

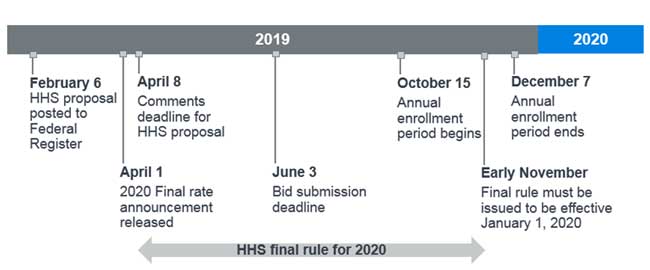

The HHS proposed rule was published in the Federal Register on February 6, 2019. The 61-day period during which interested parties can comment on the rule will end on April 8, 2019. If finalized, the new safe harbor for POS manufacturer rebates will become effective 60 days after the final rule publication date, which is unknown. Although there is uncertainty regarding when the final rule could be issued, the proposed rule suggests a January 1, 2020, effective date is possible. Given the calendar year cycle of Part D bids and the operational changes required to implement this new process for POS rebates, HHS could decide to delay the effective date to 2021 or allow for an update to the 2020 bids.

The timing and effective date of the final rule publication is crucial for the 2020 Part D bid submissions, which are due to CMS by June 3, 2019. According to the 2020 Part II of the Advance Notice,9 the CMS final rate announcement will be released on April 1, 2019. Figure 1 displays a timeline of key dates for the 2020 bid submission along with the proposed rule, where the final rule must be issued by early November 2019 to be effective January 1, 2020.10

Figure 1: 2020 bid submission timeline with proposed rule key dates

Because the final rate announcement will be released prior to the proposal comment period deadline, it may or may not address the new safe harbor changes to rebates. If the proposal is finalized and effective for 2020, we speculate that CMS could adjust Part D bids in several ways, including:

1. Two bids submissions for June 3, 2019

a. No changes (status quo) – bids prepared under prior safe harbor rules

b. Incorporate proposed changes – bids submitted on a “net price” basis (or with POS manufacturer rebates)

2. Prepare bids under prior safe harbor rules (status quo) for June 3, 2019. However, CMS could allow a one-time update to the bids submitted in June to allow plan sponsors to incorporate final rule changes. While this scenario is possible, it would introduce many complex changes that would need to apply to Part D plans and possibly Medicare Advantage plans before the annual enrollment period (AEP) for 2020 starts in October 2019.

3. Prepare bids under prior safe harbor rules (status quo) for June 3, 2019, and no updates to the bids submitted to account for the final rule. Although in this scenario, CMS may also allow plan sponsors to produce the bids under the current or new safe harbor instead of the current rules, and plan sponsors would then have to decide which method is more likely to occur. In this scenario, plan sponsors would be at risk for any additional cost. Part D risk sharing provisions, at an additional expense to federal government, may partially mitigate this extra plan cost.

Under any bid submission approach, it is critical for plan sponsors, manufacturers, and PBMs to take action now to understand the implications of the new safe harbor proposal and how it could potentially affect the Part D bids for 2020. If there are complications with how the 2020 bids are filed, relative to the results of the proposed rule, there could be additional federal government costs related to the risk corridors program, although the impact of this has not been analyzed in this proposed rule.

Estimated impact on Part D stakeholders

The proposed rule outlined multiple analyses11 of the impacts to the Part D program stakeholders from the CMS Office of the Actuary and work commissioned from independent consulting firms, including Milliman’s report “Impact of Potential Changes to the Treatment of Manufacturer and Pharmacy Rebates.”12 The analyses showed a wide range of possible outcomes due to differences in assumptions, including how rebates may evolve in the post-rule environment and the market behavioral responses.

Of the scenarios reported, the CMS Office of the Actuary projected the largest costs to the federal government ($196.1 billion over 10 years). The CMS actuary assumed that drug manufacturers would retain a portion of rebates instead of all rebates being converted to POS price reductions. HHS states that “it is difficult to accurately quantify the benefits of this proposed rule due to the complexity and uncertainty of stakeholder response,”13 and this is consistent with the ranges presented in the proposed rule. The range of scenarios attempt to predict how plan sponsors, PBMs, and drug manufacturers may react on a macro level if this proposed rule goes into effect; however, it is possible that the actual results of this proposed rule will not align with these projections.

It should also be noted that the beneficiary cost sharing savings will benefit only a fraction of non-low income subsidy beneficiaries, while the premium increase will affect all Part D beneficiaries. Note that low income subsidy members will see minimal impact as their out-of-pocket costs are subsidized by the federal government.

Challenges and opportunities for Part D plan sponsors in a post-rebates world

As plan sponsors begin planning for the possible changes in the proposed rule, there are many factors to consider, including:

1. Considerations for plan sponsor and PBM relationship

a. Necessary contracting updates. Most PBM contracts will need to be revised to incorporate the potential extra cost of administering POS rebates. Plan sponsors need to assess the current contract provisions and if they relate to the proposed rule. Additionally, because rebates may need to be fully passed through to the plan sponsors, rebate guarantees will be subject to new risks. This may affect the level of rebate guarantees that PBMs are willing to provide as these guarantees would become downside only arrangements for the PBM.

b. Timing. Plan sponsors need to find out what PBMs intend to do if the proposed rule is implemented and how soon the PBM will implement its strategy. PBMs may delay contracting for some drugs until after Part D bids are submitted in June so they have more time to negotiate rebates with drug manufacturers. Manufacturers will have to decide on the level of rebates to offer now that rebates may be transparent to PBMs, plan sponsors, and beneficiaries through Medicare Plan Finder.

c. Generic versus brand drugs. Plan sponsors may find generic drug discounts bring the most value in contracting with their PBM and thus they may push PBMs to provide more of the total contract savings through generic drug discounts to lower premiums. It should be noted that the PBM may be making formulary decisions on behalf of their clients if the contract dictates that the PBM controls the formulary.

d. Bid preparation support. Plan sponsors should start discussing what data and information the PBM is willing and able to share in an effort to better estimate the impact of the proposed rule on the filed Part D bids.

2. The operational costs of reporting rebates at the POS

a. Administrative change. Currently there is limited infrastructure for drug manufacturers, PBMs, plan sponsors, and pharmacies to share information about rebates at the POS. Building out this capability will take time and add extra costs to the Part D program in the form of administrative expenses. Plan sponsors should expect that PBMs will seek to increase the fixed PBM fees to cover not only this additional administrative burden, but also to cover any rebates PBMs are not currently passing through.

b. Projection models. Plan sponsors will need to enhance current pricing models to handle the projected impacts of rebates applied at the specific drug level. Many plan sponsors do not currently have access to this level of detail from their PBMs and this may lead to increased non-benefit expenses to model and report properly. Timing for building out these enhancements is critical and plans will need to be ready for this before the final rule is issued to have time to incorporate changes into 2020 bids.

3. 2020 Part D bid mechanics

a. Multiple bid filing scenarios in June. Due to the uncertain timing of the finalized rule, plan sponsors will need to consider modeling scenarios with and without POS rebates. The impacts on the standardized Part D bids will be significant.

b. Uncertainty in bid estimates. Estimating the impact of POS rebates will be difficult given the timing of the re-contracting that needs to occur among plan sponsors and PBMs, PBMs and pharmacies, and PBMs and manufacturers. Some of the contracts may not be final before the bid submission deadline and plan sponsors may need to rely on the best information available at that time.

c. Estimating the direct subsidy paid by CMS. The direct subsidy is based on the competitive bid process so any changes to rebates can create large swings in the direct subsidy and premium. Because premium is a major driver of enrollment in all Part D plans, especially in the standalone Part D (PDP) market, it will be more difficult for plan sponsors to predict their competitive positioning and this could lead to over/under pricing premiums. While the Part D risk corridors help alleviate the risk to plan sponsors, they do not eliminate the risk, and thus plan sponsors will need to consider the additional risk when setting their bid risk margins.

d. Actuarial equivalence. Lower POS drug costs may require plan sponsors to revise their cost- sharing structures so they meet actuarial equivalence testing against the defined standard bid. This will be particularly true for plans with copays on brand drugs.

e. Part C revenue and benefits. Many Medicare Advantage Prescription Drug (MA-PDs) plans buy down the Part D premium using Part C “rebate” dollars (generated from MA bids projecting savings compared to the county/region benchmarks). Any increase in the Part D premiums could increase the amount of Part C rebate dollars spent buying down Part D premiums. Plan sponsors will need to make trade-offs between supplemental benefits and Part D premium offsets.

f. TBC and OOPC. CMS has not indicated how this would affect meaningful differences testing for PDP plans or total beneficiary cost (TBC) requirements, in particular the limit in year-over-year TBC changes for MA-PD plans. CMS will need to provide guidance on how the out-of-pocket costs (OOPC) calculator will consider POS rebates. The TBC limit represents the maximum allowable annual combined change in Part B premium, MA-PD premium, and OOPC changes. This test may need to be adjusted to account for any extra premium this regulatory change may produce.

4. Differing levels of impact on plan sponsors

a. MA-PD versus PDP. MA-PD plan sponsors typically have lower rebates compared to nationwide PDP carriers due to both volume and negotiation power. Plan sponsors that have not fully leveraged rebates to minimize net plan costs and premiums will be less affected by the proposed rule than nationwide PDP plans. In addition, PDP carriers targeting low-income (LI) beneficiaries tend to have the most restrictive formularies and thus generally higher rebates, which means the proposed rule will have a greater impact on them. These plans need to make sure that their premiums fall below the regional LI benchmark (LIB) so that they can auto-enroll LI beneficiaries. The regional LIBs are set competitively and the proposed POS rebate changes will make it difficult to predict the outcome of this competitive bidding process.

b. MA-PD versus Medicare Supplement/PDP. If PDP plans are affected more than MA-PD plans in terms of premium, it may lead to MA-PD plans gaining more market share compared to beneficiaries purchasing the combination of a Medicare Supplement plan plus a PDP.

c. Risk adjustment. Because the risk-adjusted direct subsidy will likely increase if the proposed rule is implemented, there may be a greater focus by plan sponsors on risk score coding to increase revenue. MA-PD plan sponsors have greater ability to impact Part D risk scores compared to PDP carriers because the risk scores are based on medical claims and not prescription drug claims. POS rebates may affect the RxHCC risk adjustment model, which is currently calibrated on Part D claims costs before rebates. Because of this, CMS will need to recalibrate the RxHCC model to reflect the change in the expected plan liability.

5. Other levers for reducing plan costs

a. Formulary changes. Plan sponsors could move toward leaner formularies to help shift utilization to lower cost drugs. The current financial incentives that keep some higher-priced, higher-rebated drugs in a preferred position on the formulary will be weakened or eliminated with POS rebates. Formulary changes may include removing brands/biologics from the formulary where generics/biosimilars are available or placing these brands/biologics on a higher tier, adding new generics/biosimilars to their formularies sooner, and putting more emphasis on utilization management (e.g., prior authorization, step therapy, and cost sharing). However, MA-PD plans will need to consider TBC limitations when evaluating stricter formularies (PDPs are not explicitly subject to TBC). TBC may limit the changes allowable in a single year, which may force formulary changes to be made over multiple years. From a PDP perspective, formulary changes will need to consider meaningful difference requirements (MA-PDs are not subject to this requirement).

b. Indication-based formularies. In August 2018, CMS announced that in calendar year 2020, it will allow Part D indication-based formularies, where plan sponsors can restrict coverage to specific indications for a certain drug.14 Indication-based formularies will provide plan sponsors more negotiating power with manufacturers and could result in reduced patient and government costs. However, rebates will have reduced value to plan sponsors if the proposed POS rebates rule is finalized and implemented.

c. Value-based contracting. Value-based contracting between drug manufacturers and plan sponsors is becoming more common. There are 35 value-based contracts publicly available as of the second quarter of 2018, although most only apply to the commercial market.15,16These agreements include financial (such as capitation arrangements), adherence, and outcomes value-based contracting. Plan sponsors may be motivated to move toward value-based rebate arrangements as these may still be allowed after the POS. If the proposed rule is finalized, POS rebates, along with CMS’s interest in pharmaceutical value-based contracts,17 could further promote more of these arrangements in the Part D market so plan sponsors can take advantage of the potential savings.

Impacts to other stakeholders

Drug manufacturers and PBMs will need to understand how plan sponsors may respond to the proposed rule and how these responses will affect them. It is important to note that the impact of the proposed rule, if finalized, will vary by drug manufacturer and by PBM. While the impacts to drug manufacturers and PBMs is worthy of a deeper dive themselves, we list a few considerations below.

Drug manufacturers: In most cases, rebate agreements between manufacturers and PBMs are negotiated to preserve or enhance a drug’s position on the PBM’s formulary, often relative to competitors. However, with POS rebates, plan sponsors may emphasize lower-priced drugs as the financial incentive to favor higher-priced, higher-rebated drugs diminishes. Plan sponsors may focus first on the highest-priced drugs with high rebates (e.g., some hepatitis C treatments) and lower-priced alternatives when considering formulary changes, but we expect pressure on all high-rebated brand drugs. In addition, POS rebates could boost utilization of biosimilar alternatives as the rebates for the branded biologic will provide less financial value to the plan under the proposal. In turn, this could encourage more biosimilar launches.

Under the proposed rule, CGDP payments are estimated to be lower by about $2 billion annually, assuming no change to the total costs net of manufacturer rebates.18 Beneficiaries paying less at the POS, and therefore moving more slowly through the Part D benefit phases, drive these savings because beneficiaries will remain in the deductible or initial coverage level phases longer or may not even reach the gap when they previously would have. However, based on the CMS Advance Notice Part II,19 the 2020 true out-of-pocket (TrOOP) amount is $6,350, which is about 25% higher than the 2019 TrOOP of $5,100.20 This large increase in the 2020 TrOOP, which was expected based on earlier legislation, will result in higher CGDP payments as it will take longer for beneficiaries to move from the gap into the catastrophic phase. The large increase in the 2020 TrOOP amount is reflected in the savings stated above, therefore, POS rebate savings outweigh the increased CGDP costs due to the much higher 2020 TrOOP.

Similar to plan sponsors and PBMs, manufacturers will also need to add infrastructure to support POS rebates, which may lead to additional administrative expenses. In addition, as stated above, manufacturers’ rebates will become more transparent with POS rebates. Therefore, manufacturers will need to understand how this transparency will impact negotiations with plan sponsors and PBMs, including those in the commercial market, and the levels of rebates they are willing to offer to one plan or PBM versus another.

PBMs: Part D contracts between PBMs and plan sponsors, unlike in the commercial market, pass through all discounts and most manufacturer rebates. Therefore, POS rebates have less of a direct impact to the PBM bottom line. However, there may be financial pressure due to lower net value provided to plan sponsors that could reduce negotiating leverage in setting margins. Also, some PBMs own PDPs, which may affect financial results.

Other considerations impacting the Part D program

There is uncertainty whether the proposed rule will be finalized in time for the 2020 Part D plan year,21 but the Trump Administration has attempted to address the rising costs of prescription drugs through other recent communications and proposals. In addition to the February 2019 HHS proposed rule, there are other potential changes and new programs that could have significant effects on Part D plan sponsors.

Pharmacy DIR Proposed Rule

On November 30, 2018, CMS and HHS published a proposed rule that includes changes to pharmacy DIR (price concessions paid from pharmacies to plan sponsors) under Medicare (CMS-4180-P).22 The proposal contains revisions to the definition of the negotiated price of a drug and requires that incentive-based pharmacy price concessions paid from pharmacies to plan sponsors are reflected at the POS as early as 2020. The November 2018 proposed rule does not affect drug manufacturer rebates because it only addresses pharmacy DIR, and has not been finalized at this point.

Part D Payment Modernization Model

CMS announced on January 18, 2019,23 that it will be launching a new Part D model that allows plan sponsors to take risk on the reinsurance portion of CMS funding for Part D in an effort to lower overall Part D spending and beneficiary out-of-pocket costs. Little information about this program is available and the request for applications has not been released at the time of this publishing.

Summary

This is a critical time for Part D plan sponsors to get ready for the 2020 plan year. The proposed changes from HHS and CMS lead to a lot of uncertainty, questions, and additional work to prepare for the potential and significant changes. The time spent now considering challenges, opportunities, and options will lead to better results if the proposal is finalized.

1The proposed rule is published in the Federal Register: https://www.federalregister.gov/documents/2019/02/06/2019-01026/fraud-and-abuse-removal-of-safe-harbor-protection-for-rebates-involving-prescription-pharmaceuticals

2See Milliman’s white paper “A primer on prescription drug rebates: Insights into why rebates are a target for reducing prices”. By Gabriela Dieguez, Maggie Alston, and Samantha Tomicki. May 21, 2018. Retrieved on February 14, 2019, from: https://www.milliman.com/en/insight/a-primer-on-prescription-drug-rebates-insights-into-why-rebates-are-a-target-for-reducing.

3Also referred to as direct and indirect remuneration (DIR) in the Part D program. See more information about DIR in Milliman’s white paper “Medicare Part D DIR: Direct and indirect remuneration explained.” By Deana Bell and Tracy Margiott. January 29, 2018. Retrieved on February 14, 2019, from http://www.milliman.com/insight/2018/Medicare-Part-D-DIR-Direct-and-indirect-remuneration-explained/.

4“Under the current Part D benefit design, price concessions that are applied post-point-of-sale, as DIR, reduce plan liability, and thus premiums, more than price concessions applied at the point of sale.” Department of HHS, CMS (November 2017). Medicare Program; Contract Year 2019 Policy and Technical Changes to the Medicare Advantage, Medicare Cost Plan, Medicare Fee-for-Service, the Medicare Prescription Drug Benefit Programs, and the PACE Program, p. 309. Retrieved February 8, 2019, from: https://s3.amazonaws.com/public-inspection.federalregister.gov/2017-25068.pdf.

5See https://www.drugchannels.net/2018/04/the-gross-to-net-rebate-bubble-topped.html

6Milliman (February 8, 2019). Changing the rebate game: A primer on HHS's proposed rule to shift drug rebates to POS. Figure 2. By Maggie Alston, Carol Bazell, and David Mike. Retrieved February 11, 2019, from http://us.milliman.com/insight/2019/Changing-the-rebate-game-A-primer-on-HHSs-proposed-rule-to-shift-drug-rebates-to-POS/.

7HHS (May 2018). American Patients First. Retrieved February 6, 2019, from https://www.hhs.gov/sites/default/files/AmericanPatientsFirst.pdf.

8STAT (February 1, 2019) Azar calls on Congress to help eliminate drug rebates. Retrieved February 8, 2019, from https://www.statnews.com/2019/02/01/azar-calls-on-congress-to-help-eliminate-drug-rebates/.

9CMS (January 30, 2019) Advance Notice of Methodological Changes for Calendar Year (CY) 2020 for Medicare Advantage (MA) Capitation Rates, Part C and Part D Payment Policies and 2020 Draft Call Letter. Retrieved February 6, 2019, from https://www.cms.gov/Medicare/Health-Plans/MedicareAdvtgSpecRateStats/Downloads/Advance2020Part2.pdf.

10Milliman (February 8, 2019). Changing the rebate game, op cit.

11HHS (February 6, 2019), Proposed rule. Pages 82-111., op cit.

12Milliman (January 31, 2019). Impact of Potential Changes to the Treatment of Manufacturer Rebates. By Jake Klaisner, Katie Holcomb, and Troy Filipek. Retrieved February 4, 2019, from https://aspe.hhs.gov/system/files/pdf/260591/MillimanReportImpactPartDRebateReform.pdf.

13HHS (February 6, 2019), Proposed rule, page 77., op cit.

14CMS (August 29, 2018). Indication-Based Formulary Design Beginning in Contract Year (CY) 2020. Retrieved February 8, 2019, from https://www.cms.gov/Research-Statistics-Data-and-Systems/Computer-Data-and-Systems/HPMS/Downloads/HPMS-Memos/Weekly/SysHPMS-Memo-2018-Aug-29th.pdf.

15Pharmaceutical Research and Manufacturers of America (June 21, 2018). Value-Based Contracts: 2009 - Q2 2018. The Value Collaborative.

16The Novo Nordisk – Human contract was not included because no active source for the contract could be found.

17Kelley, C. (September 4, 2018). Value-Based Payment Experiments For Drugs To Be Key. Pink Sheet.

18Klaisner, J., Holcomb, K., & Filipek, T. (January 31, 2019). Impact of Potential Changes to the Treatment of Manufacturer Rebates, Appendix A1, Scenario 1. Milliman Client Report. Table 3., op cit.

19CMS (January 30, 2019) Advance Notice, op cit.

20See Milliman’s white paper “Don’t TrOOP off the cliff: True out-of-pocket amount poses challenges starting in 2020”. By Van Phan and Todd M. Wanta. June 20, 2018. Retrieved on February 14, 2019, from: http://www.milliman.com/insight/2018/Dont-TrOOP-off-the-cliff-True-out-of-pocket-amount-poses-challenges-starting-in-2020/

21Milliman (February 8, 2019). Changing the rebate game, op cit.

22CMS (November 30, 2018). Modernizing Part D and Medicare Advantage To Lower Drug Prices and Reduce Out-of-Pocket Expenses, Retrieved February 8, 2019, from https://www.federalregister.gov/documents/2018/11/30/2018-25945/modernizing-part-d-and-medicare-advantage-to-lower-drug-prices-and-reduce-out-of-pocket-expenses.

23CMS (January 18, 2019) Part D Payment Modernization Model Fact Sheet, Retrieved February 8, 2019, from https://www.cms.gov/newsroom/fact-sheets/part-d-payment-modernization-model-fact-sheet.