This blog is the first in a series of six that will highlight considerations for and impact of employee benefit plans on mergers and acquisitions (M&A) transactions. To learn how Milliman consultants can help your organization with the employee benefits aspects of M&As, click here.

This blog is the first in a series of six that will highlight considerations for and impact of employee benefit plans on mergers and acquisitions (M&A) transactions. To learn how Milliman consultants can help your organization with the employee benefits aspects of M&As, click here.Seventy-five percent of U.S. employers in the 2017 Global Capital Confidence Barometer survey say they plan to pursue M&A deals in the next 12 months.

This follows a year that saw a number of large transactions AT&T and Time Warner for $84 billion, Bayer's acquisition of Monsanto for $66 billion, and the merger of Sunoco Logistics Partners and Energy Transfer Partners in a $21 billion all-stock deal.

No matter whether it's a billion-dollar transaction or something much, much smaller, employee benefit plans are a critical component of the deal. They can impact the purchase or sale price, and create both financial and compliance risks if comprehensive due diligence is not completed.

The following tips will be helpful as you consider the employee benefits component of the deal no matter which side of the table you re on.

1. UNDERSTAND THE RISKS

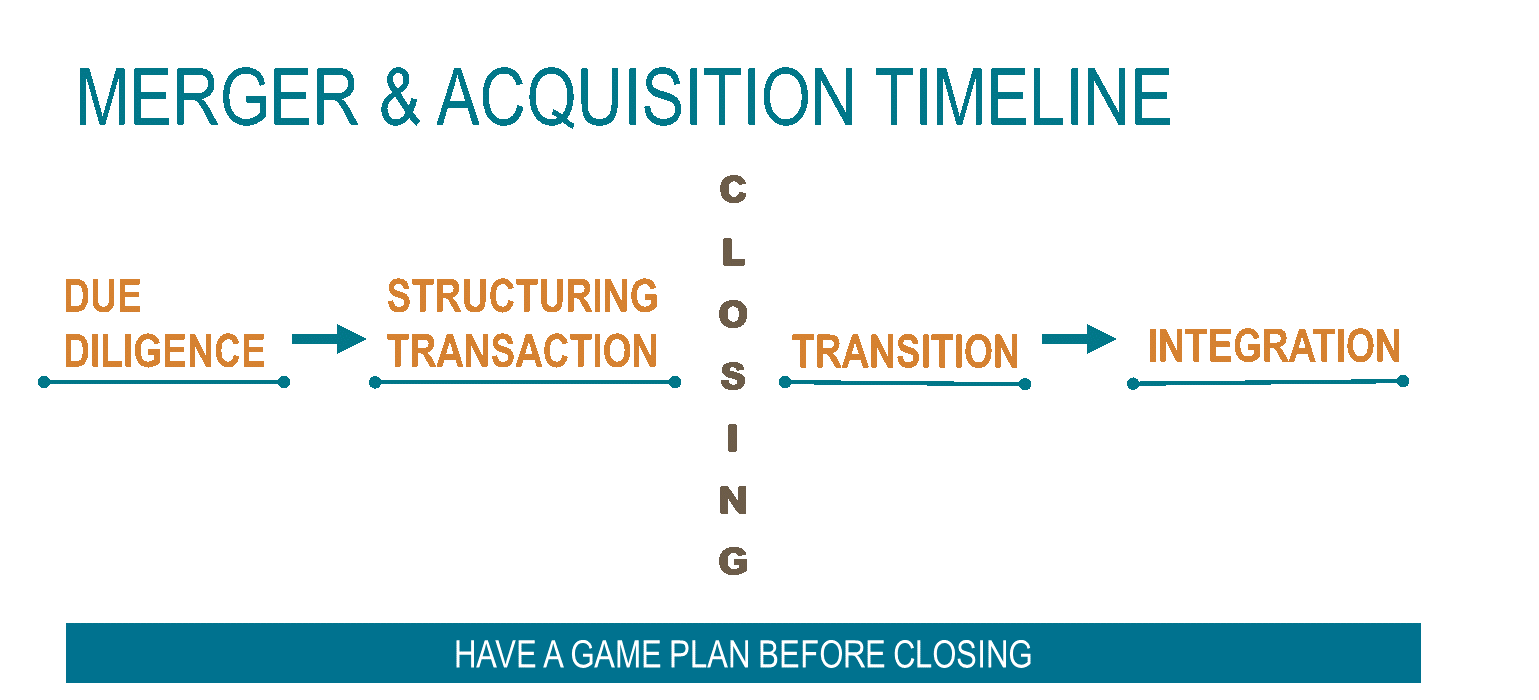

Due diligence is a critical first step in a merger or acquisition transaction. Because the new entity (buyer or merged organization) is generally responsible for the employee benefit plans, including liabilities, it's important to have a clear and complete picture of the plans and any associated risks before the deal is closed.

Don t rely on the seller's representation of the condition of the benefit plans. Market conditions may have changed since the plans were valued including changes in asset performance and market interest rates. There may be unfunded pension liabilities, tax penalties that are due to noncompliance, or even potential lawsuits because of nondisclosed but promised retiree benefits. They all can impact the purchase price and the deal negotiation.

Be sure to get your employee benefits consultant, plan actuary, and recordkeeper involved early in the due diligence phase. If you wait to think about benefits until after closing, it's too late. The deal is done and you may have unintentionally acquired some risk, and without proper adjustments to the purchase price

In addition, appropriate, well-timed communication is critical to talent management the most critical asset in the deal. Retention of key management is sensitive and important. Communicating the strategic vision and benefits of the transaction to employees is a key component to the success of any transaction.

2. PUT IT IN PERSPECTIVE

As you consider the impact of benefit plans on the transaction, also take into account how the type of deal asset or stock can impact the buyer's or seller's perspective. See the chart below for a high-level overview.

3. ASK GOOD QUESTIONS

Finally, don t wait until after closing to develop a game plan for integration. Ask questions. Consider options. Dig into the details.

For example:

- Will you terminate, spin off, merge, or go with stand-alone compensation and benefit plans?

- How will you map investments?

- Will you reenroll current employees? Auto-enroll new employees?

- Are there union issues?

- How will you handle vesting and loans?

- What's the impact of current legal or regulatory activity?

- How do the employee demographics differ?

- How do the two cultures fit?

- Which benefit plans and features best fit the new company strategy and its employees?

- What should the new executive and broad-based compensation programs look like?

- What acquired employees are critical to retain?

- What communication and programs need to be in place to retain key talent?

All are good questions and how you answer them can impact the transaction and potentially the sale price. Know the answers up-front and you can mitigate risk and ease the transition.