On August 13, the Federal Housing Finance Administration (FHFA) announced an Adverse Market Refinance Fee of 0.50% applicable to refinance mortgages purchased by Freddie Mac and Fannie Mae (the Enterprises). The intent of the fee is to help buffer the Enterprises’ finances from adverse market conditions and to increase their capital position as the FHFA prepares to release them from conservatorship. The fee was set to apply to loans delivered on or after September 1, 2020, but it was later revised to take effect for loans delivered on or after December 1, 2020.1 In addition to delaying the implementation of the fee, the updated announcement also exempts loans with a loan balance below $125,000 from the fee.

Since the announcement of the fee, there have been various articles written speculating on the underlying intent of the fee and its impact on borrowers. The way this fee may affect the mortgage market and borrowers is not straightforward. We will provide clarity on the fee and its potential impact; specifically, we will demonstrate how the fee will likely have a limited impact on borrowers looking to refinance their mortgages into a lower interest rate. Our analysis of outstanding mortgage loans indicates the majority of existing, performing mortgages (in excess of 95%) would benefit from a refinance even after the fee is priced into the interest rate. The sections below provide a primer on how a mortgage is priced, discuss the purpose of the fee, and quantify the effect of the fee to borrowers and the Enterprises.

Mortgage Banking 101

For most loans, the interest rate is made up of two distinct components: the cost of funds to the lender, and a spread to the cost of funds.2

The cost of funds is how much it costs the lender (or investor) to fund the loan. When lenders originate loans, they typically borrow funds and charge the borrower a higher interest rate than it costs them to make the loan. This spread (the difference between the two interest rates) represents the fees charged to the borrower to cover expenses, credit risk, and to leave room for a profit margin.

The housing market is unique. Most loans that are originated are not funded in this capacity. Rather, mortgages are typically originated by one entity and immediately sold to investors. Most mortgage loans in the United States are funded through this model and sold to the Enterprises. The interest rate does depend on the above standard formula, but it takes a roundabout way to get there.

Freddie Mac and Fannie Mae are not lenders themselves; rather, they purchase loans from mortgage originators, package the loans into securities (known as mortgage-backed securities), and guarantee the credit risk for investors. Mortgages are generally packaged into pools with similar interest rates; this way, investors purchase pools of mortgages with similar and predictable durations. In this model, the “cost of funds” is the interest payments to the investors in the mortgage-backed securities. This cost is strongly correlated to the 10-year Treasury rate. The spread to the cost of funds represents operating expenses, the guarantee fee charged by Freddie Mac and Fannie Mae for assuming credit risk, and a profit margin for the parties involved.

Freddie Mac and Fannie Mae maintain pricing sheets informing lenders at what price they will pay to purchase loans. The prices are indexed to 100 and represent a percentage of the loan amount. For example, a price of 101 means Freddie Mac or Fannie Mae would pay $202,000 for a $200,000 mortgage. The price paid for a mortgage may be above or below 100. The pricing sheets vary by the interest rate of the mortgage (the higher the rate, generally the higher the price) and the various risk attributes of the mortgage (the greater the risk, the lower the price). Mortgage originators take the price at which they can sell a mortgage to the Enterprises, and they calculate the mortgage rate at which they can originate the mortgage. In the above example, the originator would create an immediate gain of $2,000 on the sale ($202,000 - $200,000).

The 0.5% refinance fee is an adjustment to the price paid by the Enterprises for refinance mortgages. If the price before the fee was 101, then the new price would be 100.5 (100.5 = 101 – 0.5). This reduces the amount paid in the above example by $1,000, to $201,000.

How does this impact you?

It is important to remember that this is not an additive fee. The fee will not increase the mortgage rate from 3.0% to 3.5%. Rather, it is an adjustment to the price.3 The way mortgage originators pass this cost through to borrowers will vary by originator.

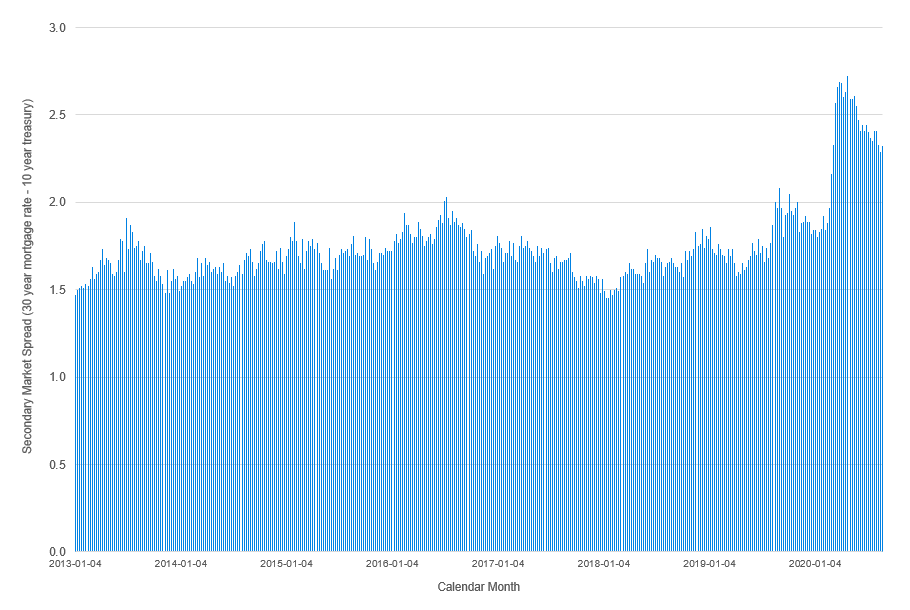

There are two ways mortgage originators can treat the adjustment. They can absorb the fee to offer more competitive rates, or they can pass the fee onto borrowers. The decision between the two is determined by several factors specific to the originator including competitive position, market share objectives, and operational structure. One way to gauge the ability of originators to absorb the fee is to look at the difference between the average 30-year U.S. mortgage rate and the 10-year U.S. Treasury. Between 2013 and 2019, the difference between these two rates (known as the primary market spread) has averaged about 1.7 percentage points.4 This means that, if the 10-year Treasury was 3.0%, the average mortgage rate was 4.7%.

In 2020, this spread started increasing and has averaged 2.3 percentage points since January. Therefore, mortgage originators are originating loans at higher interest rates relative to the cost of funds and selling the loans to the Enterprises at a higher price. In fact, in the second quarter (Q2) of 2020, mortgage originators posted record profits given the heavy refinance volume and favorable economics.5 Remember, the price received for a mortgage varies by the interest rate. Figure 1 provides a chart of the primary market spread from 2013 to today. The chart highlights the large increase in spread starting in March 2020 as a response to the pandemic. To maintain competitive rates in the market, mortgage originators could absorb the cost of the refinance fee by lowering the mortgage rate offered to borrowers who refinance. The impact to borrowers might be relatively muted or have no impact at all. Under this scenario, the primary market spread should return to historical averages.

Figure 1: Primary Market Spread, January 2013 Through August 2020

If mortgage originators pass the impact of the fee to borrowers, the fee becomes a one-time adjustment to the price. This translates into an annual increase in the mortgage rate. Even though most mortgages are originated with a 30-year term, the average duration of a mortgage is not 30 years. It is closer to five to seven years, depending on the interest rate and economic environment. This duration of five to seven years takes into consideration borrower mobility (e.g., moving, or downsizing or upsizing the home) and the decision to refinance (e.g., rate or term refinancing, or cash-out refinancing to extract equity from the property). To approximate the cost to borrowers under this approach, the fee is divided by the expected duration of the mortgage. A 0.5% fee divided by five or seven years equates to an increase in the interest rate of between 0.07 and 0.10 percentage points, after being passed on by the lender. If the average interest rate for a refinance is 3.0%, then the interest rate after the fee would be between 3.07% and 3.10%. This adds an expected cost to the borrowers of between $175 and $250 per year over the life of the mortgage, assuming an average mortgage rate of $250,000.6 At the high end (3.1%), this is $1,250 if the borrower repays the mortgage in five years ($1,250 = 250 * 5) and $1,750 ($1,750 = 250 * 7) if the borrower repays the mortgage in seven years.

The 0.50% refinance fee will likely have a limited impact on a borrower’s decision to refinance a mortgage. A larger impact is what future interest rates will be, and the Federal Reserve has indicated they are likely to remain low for the foreseeable future. Therefore, mortgage rates are likely to remain low when the refinance fee goes into effect.

Borrowers are incentivized to refinance their mortgage if they can lower their monthly payment and save money over the remaining life of the mortgage after consideration of mortgage origination costs and fees. With a 30-year $250,000 mortgage, each 0.25 percentage point reduction in the interest rate from 4.5% to 3.0% results in an approximate $35 reduction in the monthly payment. For example, the monthly mortgage payment for a 4.50% mortgage rate would be $1,267; the monthly mortgage payment for a 4.25% mortgage rate would be $1,230 (a reduction of $37 from a 4.50% rate payment); and the monthly mortgage payment for a 4.00% mortgage rate would be $1,194 (a reduction of $36 from a 4.25% rate payment). Assuming refinance costs and fees of $5,0007, the savings for a borrower reducing their mortgage rate by 0.25 percentage points would exceed refinance costs after 12 years (12 = $5,000 costs and fees/$35 monthly savings/12). The savings for a borrower reducing their mortgage rate by 0.50 percentage points would exceed refinance costs after six years (6 = $5,000/$75 monthly savings/12 ), and the savings for a borrower reducing their mortgage rate by 0.75 percentage points would exceed refinance costs after four years (4 = $5,000/$105 monthly savings/12).

To evaluate the population that would benefit from a refinance before and after implementation of the fee, we created an interactive business intelligence (BI) tool that breaks down the potential refinance population by state, origination year, and estimated loan-to-value ratio (LTV) in December 2020. For this dashboard, we assume a borrower would benefit from a refinance if they can reduce their mortgage rate by 0.50 percentage points or greater. On the dashboard, the refinance population is labeled “eligible.” The dashboard8 shows that 97.54% of the active loan population in the data would benefit from a refinance today. When 0.10 percentage points are added to the interest rate (assuming a borrower would benefit from a refinance if they can reduce their mortgage rate by 0.60 percentage points or greater) 95.84% of the population would still benefit from a refinance. Please note that this analysis looks only at the interest rate differential to evaluate the refinance population. Certain borrowers may be unable to refinance due to low credit quality, changes in income, amount of equity in the home, or other reasons.

The data in this report represents active and current loans that collateralize credit risk transfer securities issued by Freddie Mac, as this is the most granular and current data available for the mortgage market. For a loan to be included in the refinance population, the loan must be current (nondelinquent and not in forbearance) as of August 2020, have a positive unpaid principal amount by December 2020, and have a current interest rate spread to the average 30-year fixed rate mortgage of more than 0.50 percentage points. When the fee is applied, this spread becomes 0.60 percentage points—unless the unpaid principal amount is less than $125,000.

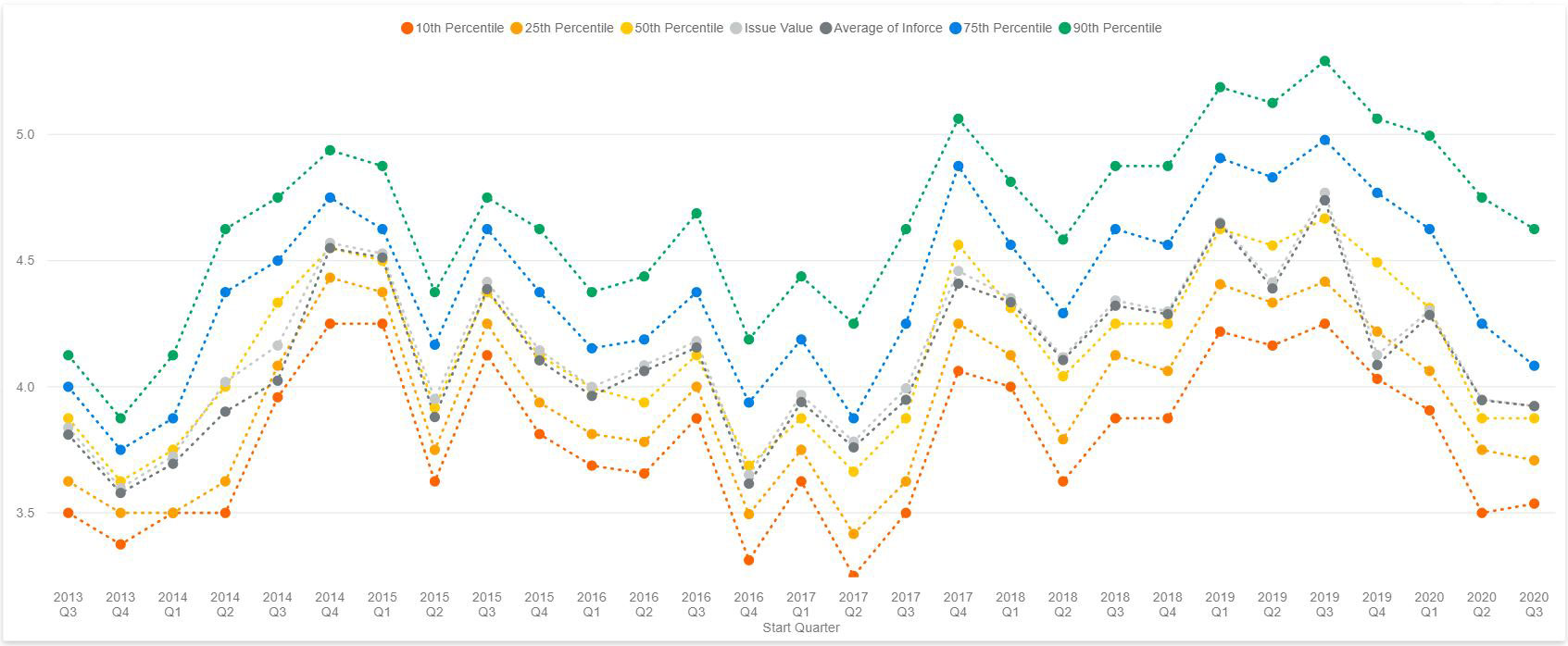

Figure 2 shows interest rates from the same population of loans grouped by the start quarter of the mortgage underlying a given transaction. The interest rate is broken down into average and various quantiles. Figure 2 shows that all loans from 2013 onward have interest rates well in excess of the current 30-year mortgage rate, which is approximately 3.0%. In other words, adding 0.10 percentage points to the current mortgage rate would not result in borrowers being “out-of-the-money” with respect to refinancing their mortgages.

Figure 2: Interest Rates (in %) Distribution of Origination Volume, Segmented by Deal Start Quarter

Sizing the impact

The largest issuers and guarantors of mortgage-backed securities are Freddie Mac, Fannie Mae, and Ginnie Mae. Combined, these three entities purchase or guarantee approximately 70% to 80% of mortgage originations each year. Two-thirds of those are acquired by Freddie Mac and Fannie Mae alone, which is approximately 50% of the total mortgage market.

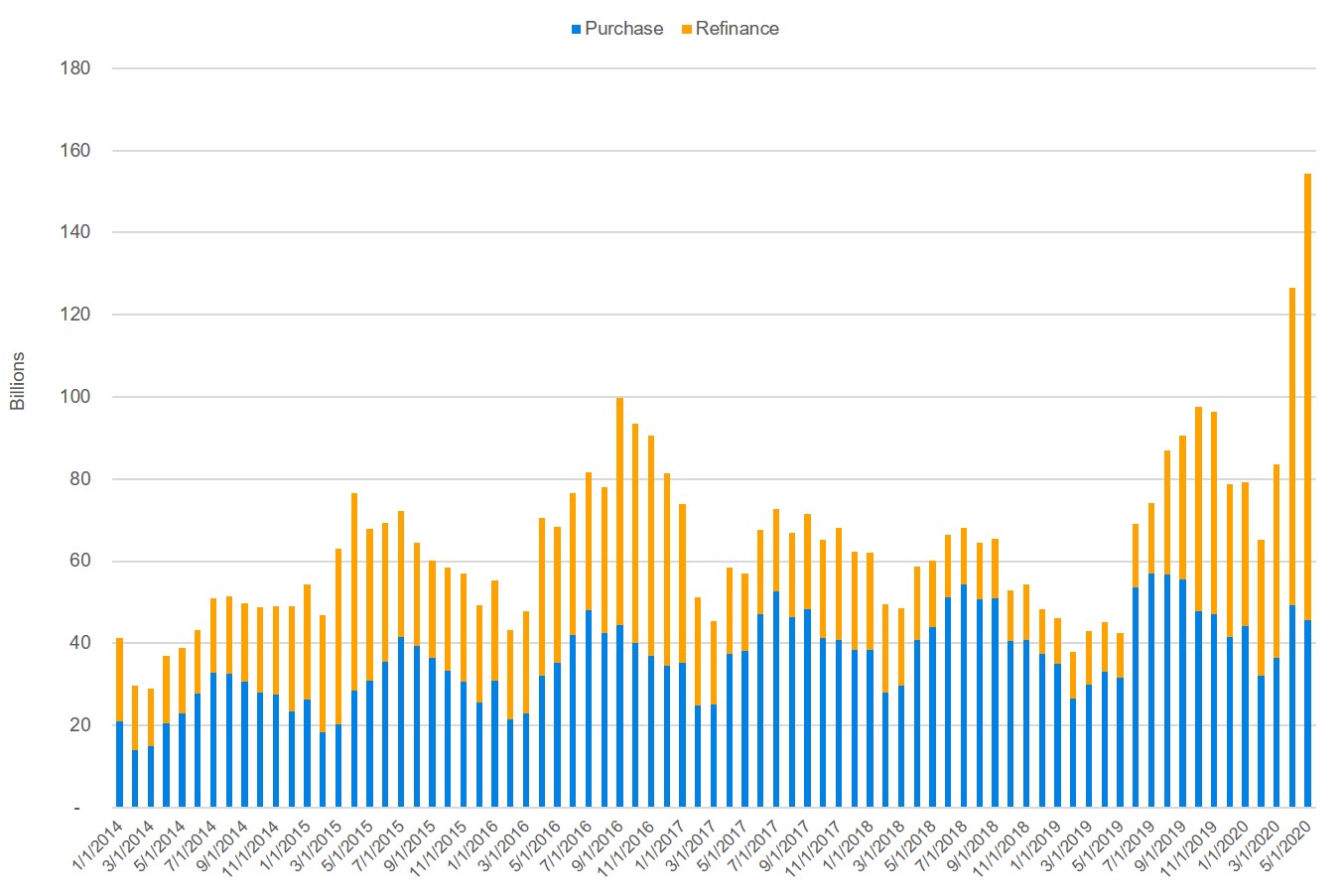

Mortgage originations are typically segmented into two types for analysis and forecasting: purchase loans and refinance loans. Purchase loan volume is highly seasonal and has been steadily increasing since the global financial crisis of 2007 to 2010. Refinance loan volume is mostly dependent upon an inverse relationship with interest rate movements. Figure 3 shows purchase and refinance volumes for loans acquired by Freddie Mac and Fannie Mae from 2014 through 2020.

Figure 3: Freddie Mac and Fannie Mae Acquisition Volume, by Month

Source: Freddie Mac, Fannie Mae, Milliman M-PIRe

Figure 3 shows a significant increase in refinance volume when interest rates declined in 2020. Refinance volume was approximately 30% of total acquisitions for Fannie Mae and Freddie Mac in 2019. This increased to approximately 60% of total acquisitions for both Enterprises in 2020. Most recently, there have been two refinance loans for every purchase loan.

The refinance fee will apply to approximately 30% of total new mortgage originations (30% = 50% [market share for the Enterprises] * 60% [percentage of acquisitions that are refinance loans]) if the current refinance loan market continues. This equates to approximately $750 billion of original loan amount (750 = 2,500 * 30%), assuming a $2.5 trillion origination market over the next 12 months.9 Multiplying this by the 0.5% fee results in $3.75 billion in fees, with a wide margin of error around this estimate. Another way to look at this is to convert the $750 billion into individual mortgages. Assuming an average loan amount of $250,000, the fee would apply to approximately 3 million borrowers.10

The press release discussing the refinance fee states that its intent is to increase capital for the Enterprises to cover pandemic-related expenses incurred. Specifically, Freddie Mac and Fannie Mae are offering special forbearance policies and foreclosure moratoriums that help borrowers stay in their homes, and the fee will raise funds to support these initiatives. Further, FHFA recently announced proposed capital rules that will raise the amount of capital holdings required for the Enterprises to operate.

The impacts to most borrowers will be limited and will not affect the decision to refinance. Many borrowers will still benefit from refinancing given the decline in interest rates. Nearly 98% of borrowers would benefit from refinancing in December before the fee is applied. The interactive BI tool from this article shows just how small of an impact the fee will likely have on the percentage of borrowers who would benefit from refinance even after the fee is priced into the mortgage. The refinance population is expected to fall by 1.70 percentage points to 95.84% when the fee takes effect. This means future refinance volume will likely remain elevated, and the refinance fee is an efficient mechanism for the Enterprises to raise capital. We have written before that the housing market is proving to be a bright spot of the pandemic recession.11

Conclusion

Most borrowers will likely not notice a large change in mortgage interest rates as the fee becomes effective. Mortgage originators have time to implement and adjust their internal pricing to account for the fee, and they may have room to absorb the fee and not pass it to borrowers. They could pass the rate through to borrowers, but the effect would likely be muted—approximately a 0.10 percentage point increase in the mortgage rate.

The greatest effect will be in line with the fee’s intent. It will increase capital for the Enterprises, and it will help buffer their finances from both the pandemic and a release from conservatorship.

1FHFA (August 25, 2020). Adverse Market Refinance Fee implementation now December 1. News release. Retrieved September 11, 2020, from https://www.fhfa.gov/Media/PublicAffairs/Pages/Adverse-Market-Refinance-Fee-Implementation-Now-December-1.aspx.

2In addition to the interest rate, borrowers are also charged an origination fee for the mortgage. It is common for borrowers to finance this fee through a slightly higher mortgage amount on the refinance mortgage.

3Fannie Mae (August 27, 2020). Lender Letter LL-2020-12: New Adverse Market Refinance Fee. Retrieved September 11, 2020, from https://singlefamily.fanniemae.com/media/23726/display.

4FRED Economic Research. 30-Year Fixed Rate Mortgage Average in the United States: 10-Year Treasury Constant Maturity Rate. Retrieved September 11, 2020, from https://fred.stlouisfed.org/graph/?g=i8HL.

5Swanson, J. (September 9, 2020). Loan originators posted record profits in Q2. Mortgage News Daily. Retrieved September 11, 2020, from http://www.mortgagenewsdaily.com/09092020_mortgage_industry.asp.

6$175=$250,000∙0.0007 and $250=$250,000∙0.001.

7Ponder, C. (August 19, 2020). Understanding Mortgage Refinance Closing Costs. Lendingtree.com. Retrieved September 15, 2020, from https://www.lendingtree.com/home/refinance/mortgage-refinance-closing-costs/

8Also available at http://milliman-milwaukee-reports.azurewebsites.net/Reports/RefinanceImpact.

9Mortgage Bankers Association. Forecasts and Commentary. Retrieved September 11, 2020, from https://www.mba.org/news-research-and-resources/research-and-economics/forecasts-and-commentary.

10These numbers ignore the loan size limit and are general approximations.

11"The pandemic hits the mortgage market: Assessing the impact in 2020 and beyond"