Evolution of the individual marketplace

In March 2010, the Affordable Care Act (ACA) was implemented by the Obama administration. A number of new regulations emerged from the direction of this policy, including a mandate requiring all individuals to obtain health insurance coverage by January 1, 2014. Three years following the implementation of ACA, the individual marketplace, or federal exchange, was opened in an effort to supply individuals with a means to purchase health insurance. When individual marketplace open enrollment began1, it was perceived to be overrun with everchanging and high deductible plans2, unaffordable premiums3, and subsidy requirements that were hard to qualify for. This marketplace was comprised of roughly 144 participating carriers nationwide4 and attracted approximately 8 million individuals to purchase coverage5. While participation figures bounced up and down throughout the later years of the 2010s, the number of enrollees on the individual marketplace remained close to 8.3 million6.

Jumping ahead to January 2020, individual coverage health reimbursement arrangements (ICHRAs) became permissible under the Trump administration5, and the breadth of options in the individual marketplace became functionally available to employer groups of all sizes. ICHRAs are health reimbursement arrangements that allow employers to make tax-free reimbursements for some or all of an employee’s individual health insurance premium. These individual policies are ones that employees purchase on their own, typically through the federal exchange or some other marketplace. Since 2020, the individual marketplace has continued to expand to its current statistics suggesting nearly 14.5 million7 enrolled individuals, across 38 states and 213 participating carriers6. This is estimated to result in a typical enrollee having an average of six to seven issuers available to them8. Enrollment in ICHRAs is one contributing factor to this expansion. The U.S. Departments of Treasury, Labor and Health and Human Services estimate 800,000 employers will offer an ICHRA by the end of the year 2025 insuring 11 million individuals, which indicates total enrollment in the individual marketplace will likely increase9.

Figure 1: Individual market trends

Advantages of ICHRA

Due to the expansion of the individual market and the shift in workplace culture from traditional brick and mortar to “work from home” and/or remote arrangements in the last few years, employers have begun revisiting their entire benefits package in an effort to advance recruitment and retention of their workforce. Because of this, there has been an increase in ICHRAs for both small and large group employers10. ICHRA arrangements usually allow employees greater freedom of choice, while giving employers a higher degree of cost control and a greater opportunity to create a customized benefit offering through classing options. Additional note-worthy benefits of ICHRAs are no participation requirements and tax-free employer contributions, much like traditional employer sponsored health reimbursement arrangement (HRA) and health saving account (HSA) contributions.

Greater freedom of choice for employees

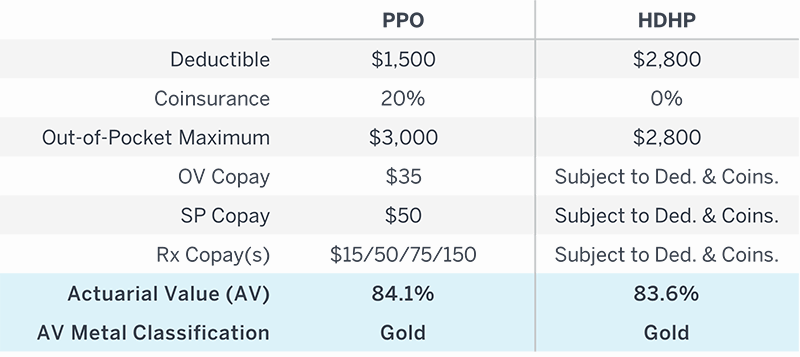

Compared to traditional group health plans, the individual market can offer greater freedom of choice for employees for a variety of reasons. Under a traditional group plan, an employer typically offers a finite number of plans – usually ranging from one to four options. This can result in employer-sponsored benefit packages that do not align with an employee’s individual or family benefit and financial needs. For example, in a group health plan arrangement, an employer may offer two plan designs: a $1,500 deductible preferred provider organization (PPO) and a high-deductible health plan (HDHP) with a $2,800 deductible. While the network offerings and basic mechanisms that make up plan design may vary in nature, both of these plan designs could equal an ACA “gold” metallic valuation (metallic classifications were introduced in ACA and are defined based on actuarial value), suggesting the variety of benefit offerings is generally limited to fairly rich options.

Figure 2: Actuarial value comparison of plans

While these benefit levels may align with the needs of certain employees, other employees may prefer bronze level plans with lower premiums and less robust coverage. This is most prevalent with younger employees generally who do not access healthcare as frequently in any given year. Conversely, an ICHRA offers a wider choice of networks, carriers, and plan designs catering to an employee’s preference of provider selection and costs. This is especially true for employers with a national footprint who want to ensure employees in niche markets have access to networks and providers of choice, like Kaiser (West Coast) or Mayo Clinic (Center of Excellence).

Greater cost control for employers

In addition to freedom of choice for employees, employers have a greater potential to control costs when utilizing ICHRA. Regardless of the size of the group and funding arrangement, many employers struggle to control annual renewal increases. For small fully-insured groups, this can be due to limited or no access to their own claims experience and renewals driven largely by community rating. Similarly, large self-insured groups may experience growing stop-loss premium increases due to high or ongoing large claims. Conversely, an ICHRA allows an employer to set a predefined budget for all employees (at various age levels) and will often negate claims risk allowing for greater financial stability. This can increase cash flow for other benefits, such as life insurance, retirement planning, or salary and compensation packages that would better enable an employer to compete for highly sought-after talent nationwide.

In group health plans, a primary focus centers around managing claims and employer spend. This can be achieved through a variety of mechanisms, such as plan design, premium cost sharing, employee education regarding health management, participation in wellness programs, and early detection of chronic conditions. Thus, much of the employer’s claims liability hinges on employee engagement. In an ICHRA, however, employees’ healthcare decisions only impact themselves. The employer’s focus then shifts to setting contributions at a level that meets ACA affordability in order to avoid penalties.

Customization through classing options: Full replacement, partial replacement, or new benefit?

ICHRAs allow an employer to differ benefit contributions by class (separating employees into groups based on various criteria) which can provide additional opportunities for savings, especially for employers with employees in multiple states. It is important to note that minimum classing sizes required by law vary by employer group size.

Figure 3: Minimum classing size requirements

A full list of classing options is displayed below.

- Full-time employees

- Part-time employees

- Seasonal employees

- Employees covered under a collective bargaining agreement

- Employees in a waiting period

- Foreign employees who work abroad

- Employees working in the same geographic location (same insurance rating area, state, or multi-state region)

- Salaried workers

- Non-salaried workers (such as hourly workers)

- Temporary employees of staffing firms

- A combination of two or more of the above

Classing of employees can be used in a full ICHRA replacement scenario or can be used to carve out a subset of a population. A full ICHRA replacement is, typically, most successful for groups with continual high renewal increases, ongoing large claims, a large Medicare-eligible population, or for companies with high growth rates struggling to find or maintain nationwide plan offerings for their employees. However, in a carveout scenario, a portion of the population retains group coverage, and the remainder of the population is offered an ICHRA. A carveout scenario allows an employer to capitalize on additional savings where the ICHRA market is robust with many plan offerings and lower premiums. It also offers the potential to remove high risk locations or classes from the group plan, in effect eliminating adverse selection and reducing the risk of the remaining pool. Lastly, ICHRAs can serve as a viable solution for employers who are interested in expanding their benefit offerings for part-time employees. Because part-time employees are not subject to affordability rules under ICHRA, employer contributions can be set at any level. This gives the employer an advantage over competitors’ benefit offerings without concern of conditions or potential claims liabilities to their plan(s).

Challenges of ICHRAs

While there are a number of advantages regarding ICHRAs, employers considering this arrangement should be aware of various potential limitations and complexities for both employers and employees. To begin with, employer groups with 50 full-time equivalents (FTEs) or more are subject to affordability rules. These requirements should be given careful consideration when setting annual employer subsidy levels. Concerning affordability, an employer should consider the 3:1 rule, which limits the spread in contribution given for the oldest employee compared to the youngest. An employer will also need to decide if it will set contributions based on an applicable large employer (ALE) safe harbor, such as an employee’s rate of pay, W-2 wages, or the federal poverty level. Furthermore, employers should understand they are no longer allowed to advise and direct employees regarding plan selection on the individual market. This presents the potential for an employee to be tasked with evaluating and comparing a much larger number of plan offerings than is typically offered under a group plan, but without a designated human resources (HR) professional. In general, ICHRAs require employees to have greater ownership regarding the selection and maintenance of their health coverage.

Employees commonly will experience a greater level of responsibility when tasked with comprehending how plan designs are administered and how reimbursement from the employer will be processed. Both of these items have the potential to impact an employee from a cash flow perspective. Understanding the differences in basic plan components, such as deductibles, out-of-pocket maximums, copays, and coinsurance, is important when estimating the employee’s own portion of the cost share. In addition, because ICHRAs are typically administered similarly to traditional reimbursement arrangements, employees may be expected to front the entire cost of the premium associated with plan coverage and wait for employer reimbursement. Lastly, because a large majority of individual market plans are administered as exclusive provider organization (EPO) or health maintenance organization (HMO) arrangements, with no out-of-network coverage, it is imperative an employee understands whether their provider(s) will be covered under their individual market plan.

Summary

The individual marketplace has expanded and matured since its inception in 2013. Due to the robust number of participating carriers and networks, the individual marketplace has become a viable solution for employer health plans, especially when coupled with an ICHRA. While they can bring light to new complexities regarding affordability requirements for employers and increased employee responsibility to understand their plan options and make good choices about their benefits, ICHRAs can also provide greater freedom of choice for employees, greater cost control for employers, and a unique opportunity for customization of benefits through classing options. Classing options can be leveraged in a full or partial replacement of a group health plan, or as a supplemental benefit for part time employees.

1 Open enrollment began October 1, 2013, with first effective date of January 1, 2014.

2 Kaiser Health News (December 2017). Churning, Confusion, and Disruption – The Dark Side of Marketplace Coverage. khn.org.

3 Kaiser Health News (November 2017). Brokers Are Reluctant Players in a Most Challenging ACA Open-Enrollment Season. khn.org.

4 Healthcare.gov. 2014 FFM QHP data sets for researchers. Note: data was manipulated by the author of this article.

5 U.S. Department of Treasury (June 2019). Health Reimbursement Arrangements and Other Account-Based Group Health Plans. Federal Register, 84: 119.

6 Robert King (January 2020). Nearly 8.3M pick ACA plans on HealthCare.gov for 2020… FierceHealthcare.com.

7 Centers for Medicare and Medicaid Services (January 2022). Biden-Harris Administration Announces 14.5 Million Americans Signed Up for Affordable Health Care During Historic Open Enrollment Period.

8 Centers for Medicare and Medicaid Services (December 2021). All-Time High: 13.6 Million People Signed Up for Health Coverage on the ACA Insurance Marketplaces With a Month of Open Enrollment Left to GO.

9 U.S. Departments of Treasury, Health and Human Services, and Labor (June 2019). U.S. Departments of Treasury, Health and Human Services and Labor Expand Access to Quality, Affordable Health Coverage Through Health Reimbursement Arrangements. Treasury.gov.

10 W3LL.com (August 2021). 3 Reasons Why 2021 Is the Perfect Time to Switch to an ICHRA.