The Prescription Drug Pricing Reduction Act (PDPRA) of 2019 proposes changes to the Medicare Part D program that could impact all stakeholders beginning as early as 2021. The Senate Finance Committee approved a draft of this Act on July 25, 2019. The key provisions affecting Part D include:

1. Redesigning the Part D benefit, including eliminating the current coverage gap phase, establishing an out-of-pocket maximum for beneficiary cost sharing, and splitting the cost of catastrophic phase claims between plan sponsors, the federal government, and drug manufacturers.

2. Requiring drug manufacturers to pay a rebate directly to the federal government if prices for certain Part D drugs increase faster than inflation.

3. Mandating public disclosure of aggregate rebates, discounts, and other pharmacy benefit manager (PBM) contract provisions.

This article provides an overview of these provisions and the impacts to Part D stakeholders. The PDPRA also proposes changes to the Medicare Part B and Medicaid programs; however, this article is focused on the proposed changes relating to Medicare Part D.

Section 121: Medicare Part D benefit redesign

The Medicare Part D program is funded by three stakeholders:

1. Beneficiaries, through member premiums and cost sharing. Low-income beneficiaries have some or all of these costs covered by the federal government.

2. The federal government, through risk-adjusted direct subsidy payments, reinsurance for catastrophic claims, and cost-sharing and premium subsidies for low-income beneficiaries.

3. Pharmaceutical manufacturers cover 70% of applicable drugs for non-low-income beneficiaries in the coverage gap phase through the Coverage Gap Discount Program (CGDP). The “applicable” drug definition includes most brand and biosimilar medications.1 Plan sponsors do not receive the CGDP payments for low-income beneficiaries eligible for cost-sharing subsidies.

Plan sponsors are risk-bearing intermediaries that sell and administer subsidized plans to Medicare beneficiaries; they are not a key source of funding for the program. However, plan sponsors are at risk for variances in projected costs in the bids they submit each year.

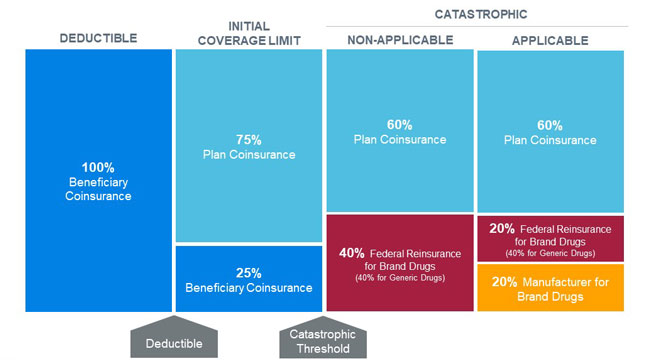

Each stakeholder’s liability changes throughout the benefit year as the beneficiary moves through the four distinct cost-sharing phases of the defined standard benefit. Figure 1 illustrates the 2020 defined standard benefit for a non-low-income beneficiary.

Provision 121 of the PDPRA proposes restructuring the standard benefit design in order to cap beneficiary out-of-pocket costs and realign stakeholder incentives to encourage more efficient management of drug spending.

Under the proposed benefit redesign, beneficiaries would move from the initial coverage limit (ICL) phase directly to the catastrophic phase once their total out-of-pocket costs reach the catastrophic threshold (proposed to be $3,100 in 2022). Catastrophic claim liability would be split between plan sponsors, the federal government, and pharmaceutical manufacturers via a new manufacturer discount program that applies to both non-low-income and low-income beneficiaries. Beneficiaries would not be responsible for any cost sharing in the catastrophic phase after they reach the new out-of-pocket maximum. The changes to the catastrophic phase would be phased in beginning in 2022 and established by 2024. Figure 2 illustrates the redesigned Medicare Part D defined standard benefit in 2024.

What can plan sponsors expect?

While plan sponsors themselves are not a key source of funding for the Part D program, their responses to the proposed provisions will set the course on whether the PDPRA will lower the cost of the Part D program. The proposed benefit design would increase plan liability, and as a result plan sponsors may revise alternative benefit designs, implement tighter formulary controls, or employ new strategies to manage catastrophic claim costs and address increased liability and risk exposure. Further, a potential recalibration of the Centers for Medicare and Medicaid Services (CMS) prescription drug hierarchical condition categories (RxHCC) risk score model may impact plan revenue. Both the benefit redesign and potential risk score model changes may incentivize plans to target new member types. Plan sponsors may increase the risk margin included in premiums or purchase private reinsurance to help mitigate the additional risk, both of which could increase the total cost of the program.

Impact on key funding sources

All program stakeholders would be impacted by the restructured benefit. Figure 3 outlines the anticipated directional impact to the various components of stakeholder spending with no additional changes in stakeholder behavior or changes in the risk score model from the current environment.

Figure 3: Stakeholder impact Part D benefit redesign

Beneficiaries

The impact of the benefit redesign would vary depending on the income status of the beneficiary, the plan in which the beneficiary is enrolled, and the level of drug spend. Low-income beneficiaries eligible for premium and cost-sharing subsidies would experience little impact from the benefit redesign because the federal government already covers most of their premium and cost sharing. These beneficiaries may be most affected by changes such as formulary redesign or increased catastrophic claim management activities.

The proposed benefit redesign may increase premiums for most beneficiaries. The magnitude of the increase would vary by plan and depend on the characteristics of each plan’s enrolled beneficiaries. Plans with higher catastrophic costs, particularly plans with a high percentage of low-income members, may have higher premium increases. Plans with lower-cost populations may see premium decreases, as the increased plan liability may be more than offset by higher direct subsidy payments from the federal government. A recalibration of the CMS RxHCC risk score model may minimize the variation of the impact among plans.

On average, the benefit redesign would decrease member cost sharing. Non-low-income beneficiaries with high drug spend would benefit most from the introduction of an out-of-pocket maximum. Non-low-income beneficiaries with drug spend below the proposed catastrophic threshold may see slight or no cost-sharing changes because member cost sharing in the deductible and ICL phases would remain similar to the current benefit design. Non-low-income beneficiaries enrolled in plans with alternative benefit designs may see varying impacts from the proposed benefit redesign due to the complex nature of actuarial equivalence tests and potential plan sponsor responses.

Federal government

The cost of standard benefit coverage is defined as the sum of the national average bid amount (NABA) and the estimated federal reinsurance. The national average direct subsidy (NADS) is set annually to target nonsubsidized base beneficiary premiums at 25.5% of the cost of standard benefit coverage. Using projections from individual market plan sponsors, CMS establishes the NADS such that the NADS and the estimated federal reinsurance fund 74.5% of the projected cost of standard coverage. Therefore, reducing the level of federal reinsurance, as proposed in the benefit redesign, may have an offsetting effect of increasing plan liability, translating to an increased NADS.

Under the proposed benefit redesign, the low-income premium subsidy (LIPS) may increase to cover the increased premiums for low-income beneficiaries. The low-income cost-sharing subsidy (LICS) is expected to decrease due to the elimination of member cost sharing in the catastrophic phase. Member cost sharing in the initial coverage phase remains at 25% under the redesigned benefit. This represents no change in cost sharing for non-low-income beneficiaries in the current coverage gap phase, but would be a reduction in the cost-sharing liability for low-income members (for which the federal government is responsible via cost-sharing subsidies).

Section 128: Inflation-based Medicare Part D rebates

Section 128 of the PDPRA proposes a means of limiting drug manufacturer incentives to increase Part D drug prices. Specifically, it introduces a new rebate that drug manufacturers would pay to the Medicare Supplementary Medical Insurance Trust Fund, based on the magnitude of a drug’s price increase compared to inflation. The U.S. Department of Health and Human Services (HHS) would calculate a benchmark price—adjusted by the Consumer Price Index for All Urban Consumers (CPI-U)—as the list price on July 1, 2019, at the National Drug Code (NDC) level, increased by the change in the CPI-U from July 1, 2019, to a given six-month reporting period. The rebate would then be calculated based on the quantity of each drug dispensed to Part D beneficiaries, and the amount by which the actual average daily price exceeds the CPI-U-adjusted price in the reporting period.

This provision would apply to Part D-covered drugs that are branded or are licensed as a biologic (and not a biosimilar). It should be noted that the draft bill does not clarify whether authorized generics would be defined as brand or generic drugs for this provision, which could have strategic implications for multiple stakeholders. If authorized generics are not considered brand drugs under this provision, manufacturers may be incentivized to introduce authorized generics for use in the Medicare Part D market to allow for price increases on the branded counterpart in the commercial market.

These rebates would not explicitly be shared with utilizers of rebated drugs, nor with other beneficiaries through premium reductions, because payments made to the Trust Fund fall outside of the current Part D funding structure. Further, this provision could substantially impact current price protections and other rebate agreements between manufacturers, PBMs, and plan sponsors. If, for example, manufacturers were to restructure rebate agreements with plans to reduce rebates on a portion of a drug’s price that is subject to this provision, any resulting reduction in plan rebates could increase plan liability, direct subsidy payments, and potentially premiums.

According to the Congressional Budget Office (CBO) scoring2 of the draft bill, this provision accounts for $57 billion of the $92 billion of projected savings over 10 years. Further, the CBO anticipates a downstream reduction in costs for commercial insurance plans if this provision successfully limits drug price increases. However, manufacturers may consider alternative strategies such as introducing an authorized generic version of a given drug for the Part D market and a brand version for the commercial market. This would establish separate NDCs for each market and theoretically allow manufacturers to avoid impact in the commercial market from this provision. As the CBO has not yet released the details behind its score, it is unclear whether this or other potential industry reactions were considered in the projected savings.

The pharmaceutical industry has spoken out against this proposed provision, stating it does not pass savings to utilizers of the drugs and would limit future research,3 while those in favor of direct government negotiation of prices or setting of reference prices for Part D drugs have criticized this proposal as not strong enough.4 America’s Health Insurance Plans (AHIP) has spoken in favor of the legislation.5

Public disclosure of pricing and rebates information

Sections 123 and 124 of the PDPRA relate to increased disclosure of prescription drug price concessions and new plan audit requirements for PBM contracts. Plan sponsors negotiate prescription drug price concessions at both the point of sale (POS) and post-POS. POS price concessions often come in the form of percentage discounts on list prices while post-POS price concessions tend to come in the form of rebates.

Plan sponsors (or their contracted PBMs) are currently subject to prescription drug price transparency reporting requirements under 42 U.S. Code § 1320b–23. Information disclosed by plan sponsors or PBMs under these requirements are considered confidential and may only be disclosed by HHS to limited governmental parties, under limited circumstances, and in such a way that the disclosure does not reveal the identity of specific PBMs, plan sponsors, or prices charged for specific drugs.6

The PDPRA would require HHS, beginning on July 1, 2022, to make public on its website the data that is reported under existing requirements. This section would require HHS to ensure that publicized information is displayed in a manner that prevents the disclosure of price concessions with respect to individual plans or individual drugs.

Part D plans are also currently subject to additional reporting requirements relating to price concessions not passed onto enrollees at the POS.7 Such price concessions are reported to HHS as Direct and Indirect Remuneration (DIR).8,9 Part D plan sponsors must provide detailed DIR reports to HHS after each plan year and additionally must include actual and projected DIR in their bid submissions each year.

The PDPRA would require HHS to publicly report on discrepancies related to DIR information submitted by plans, with the stated purpose of demonstrating the accuracy with which plans report DIR to HHS. Section 123 of the PDPRA would require Part D plans, beginning in plan year 2022, to report the actual and projected DIR amounts in their bid submissions, including those related to pharmacy price concessions. Because plans already report actual and projected DIR in their bid submissions to HHS we assume that this reporting requirement relates to public disclosure of these amounts.

Furthermore, the PDPRA would require plans, beginning in plan year 2022, to report to pharmacies at least annually any post-POS price concessions or incentive payments for covered Part D drugs, including those made by PBMs.

Lastly, the PDPRA would require Part D plans, beginning January 1, 2022, to conduct financial audits of data related to their PBM contracts. The stated purpose of this requirement is to ensure that plans monitor PBM compliance with contract terms, including with respect to accounting for the net price of Part D-covered drugs. The audits would be required to be conducted at least every two years by an independent third party.

Unlike many other provisions of the PDPRA, sections 123 and 124 would have limited direct effects on most Part D stakeholders. While plans and PBMs would face increased administrative requirements relating to reporting and auditing provisions, other stakeholders may only be indirectly affected. It is possible that the increased disclosure of prescription drug pricing information, including aggregate POS and post-POS price concessions, would lead to more transparency and possibly put downward pressure on prescription drug costs.

Other sections

The PDRPA contains a number of other provisions that will have less direct impact on the Part D program, which include the following:

- Section 122 would allow the HHS Secretary to share the drug pricing and rebate data from Part D and Medicaid with the Medicare Payment Advisory Commission (MedPAC) and the Medicaid and CHIP Payment and Access Commission (MACPAC) for the purposes of monitoring and analysis.

- Section 125 would require Part D plan sponsors to provide for a “real time benefit tool (RTBT)” with the stated goal of delivering formulary and benefit information to prescribing providers. The required RTBT should integrate with electronic prescribing and electronic health record (EHR) systems and enable better information flow to help physicians implement more efficient and effective prescribing behavior in sync with a patient’s benefits. This provision also gives credit to physicians using RTBT for the Merit-based Incentive Payment System (MIPS). The implementation of RTBT systems could result in increased administrative costs for Part D plan sponsors and their overall effectiveness will largely depend on prescriber uptake of the new tools.

- Section 126 allows for exceptions to be made for standalone Part D plans (PDPs) to use fee-for-service claim data for Part D coverage determinations to improve outcomes. The use of this data for this purpose was previously prohibited.

- Section 127 would permanently authorize the Limited Income Newly Eligible Transition (LI NET) program that helps beneficiaries with any gaps in coverage between the time they are eligible for the low-income subsidies and enrolled in a Part D plan. This pilot program has been in effect since 2010.

These provisions may minimally impact behavior for the key stakeholders and have minor direct financial impact, unlike provisions contained in sections 121, 123, 124, and 128.

1The full text of 42 U.S. Code § 1395w–114a, Medicare coverage gap discount program, includes definitions of applicable and non-applicable drugs. See https://www.law.cornell.edu/uscode/text/42/1395w-114a.

2CBO (July 24, 2019). The Prescription Drug Pricing Reduction Act (PDPRA) of 2019. Retrieved August 6, 2019, from https://www.cbo.gov/system/files/2019-07/PDPRA_preliminary_estimate.pdf.

3PhRMA (July 25, 2019). PhRMA statement opposing Senate Finance Committee drug pricing legislation. Press release. Retrieved August 6, 2019, from https://www.phrma.org/press-release/phrma-statement-opposing-senate-finance-committee-drug-pricing-legislation.

4Luthi, S. (July 25, 2019). Senate drug-pricing legislation passes committee unscathed. Modern Healthcare. Retrieved August 6, 2019, from https://www.modernhealthcare.com/politics-policy/senate-drug-pricing-legislation-passes-committee-unscathed.

5AHIP (July 23, 2019). AHIP issues statement on Senate Finance Committee drug pricing and coverage proposals. Retrieved August 6, 2019, from https://www.ahip.org/ahip-issues-statement-on-senate-finance-committee-drug-pricing-and-coverage-proposals/.

6The full text of this provision is available at https://www.law.cornell.edu/uscode/text/42/1320b-23.

7CMS. 2017 DIR Reporting Reqs. Retrieved August 6, 2019, from https://www.cms.gov/Research-Statistics-Data-and-Systems/Computer-Data-and-Systems/HPMS/Downloads/HPMS-Memos/Weekly/SysHPMS-Memo-2018-Apr-17.zip (zip file download).

8CMS (April 30, 2019). Revised Final Medicare Part D DIR Reporting Requirements for 2018. Retrieved August 6, 2019, from https://www.npaonline.org/sites/default/files/PDFs/Final%202018%20DIR%20Reporting%20Requirements.pdf.

9Bell, D. & Margiott, T. (January 2018). Medicare Part D DIR. Milliman White Paper. Retrieved August 6, 2019, from /-/media/Milliman/importedfiles/uploadedFiles/insight/2018/medicare-part-d-dir.ashx.