Size of the U.S. mortgage market and stress capital for Freddie Mac, Fannie Mae, and private mortgage insurance

Outstanding U.S. residential (i.e., single-family and multifamily) mortgage balances were over $13 trillion as of March 31, 2021.1 Of this amount, approximately 50% of the credit risk is guaranteed by Freddie Mac and Fannie Mae, collectively, the government-sponsored enterprises (GSEs). According to figures obtained from the Federal Reserve Bank of St. Louis, the GSEs held $6.3 trillion of residential mortgage debt as of March 31, 2021. Assuming stress capital levels of 4%,2 the credit risk exposure for single-family mortgages is up to $252 billion.

How do Fannie Mae, Freddie Mac, and other mortgage market participants manage risk?

Mortgage guarantors (such as Freddie Mac and Fannie Mae), as well as depository institutions, engage in a variety of risk management activities to mitigate exposure to mortgage credit losses. Such activities include credit risk underwriting (i.e., evaluating a borrower’s ability to repay the debt), ensuring adequate collateral on the mortgages (i.e., evaluating the value of the underlying property), loss mitigation (e.g., forbearance or loan modification), and capital management (i.e., ensuring adequate loss-absorbing capital under a stress event). Capital management refers to the planning of adequate sources and amounts of loss-absorbing capital to cover stress losses—the losses that might occur during a stressful event. For example, in nine out of 10 years, a mortgage portfolio may result in only 0.20% of credit losses. However, in one out of 10 years, losses could exceed 2.00%. To ensure a company can operate as a going concern, the company needs to ensure it has enough resources to fund the one year where losses are large.

Capital management refers to the amount of equity capital a company holds, the amount of debt or leverage in the company, and the use of financial instruments (such as insurance) to mitigate risk. One common instrument for capital management used by mortgage guarantors and insurers is the use of risk transfer securities or the securitization of risk. In such securities, the primary holder of the risk pays investors or (re)insurers a recurring fee on a portfolio of loans in exchange for reimbursement for losses on the portfolio if the losses exceed a given threshold. Securitization is a common financial tool used to: manage risk for lenders, increase funding, and provide a mechanism to expand the capital base for securitized loans.3 Securitization has been the dominant source of funding for the U.S. mortgage market for several decades.

Figure 1 provides an illustration of mortgage securitization with the GSEs. In securitization, a mortgage is originated by a mortgage bank or other originator and is immediately sold to the GSEs. The GSEs then sell the cash flows of a collection of similar mortgages to investors through mortgage-backed securities (MBS). The GSEs guarantee the credit risk of the mortgages for investors. Separate from these transactions, the GSEs may also securitize a portion of their guarantee fees to Credit Risk Transfer (CRT) investors and reinsurers as a source of capital for potential stress credit losses.

Figure 1: Illustration of U.S. Mortgage Market

What is GSE CRT?

Starting in 2012 and introduced as a mechanism to limit exposure to potential mortgage credit losses, the Federal Housing Finance Agency (FHFA), which is currently serving as the conservator and regulator of the GSEs, set a strategic objective with the GSEs to share mortgage credit risk with private investors. Sharing credit risk with private investors was deemed the best option to minimize future risk for taxpayers, given the conservatorship of the entities. This is broadly referred to as Credit Risk Transfer (CRT). Freddie Mac and Fannie Mae subsequently created the GSE CRT market by issuing Structured Agency Credit Risk (STACR) and Connecticut Avenue Securities (CAS) bonds and purchasing reinsurance through the Agency Credit Insurance Structure (ACIS) and Credit Insurance Risk Transfer (CIRT) programs (STACR and ACIS are Freddie Mac’s programs and CAS and CIRT are Fannie Mae’s programs).

GSE CRT is a form of synthetic securitization. With GSE CRT, investors are not funding mortgages directly (that occurs via the pass-through certificates from Freddie Mac and Fannie Mae). Instead, CRT investors are participating alongside Freddie Mac and Fannie Mae through securitization of a portion of the mortgage credit risk retained by the GSEs. The table in Figure 2 provides a summary of the cash flows supporting CRT transactions for a single $300,000 loan for one monthly payment. In this example, the “CRT Cash Flow” would be aggregated across thousands of loans (most GSE CRT securities are supported by over 100,000 mortgages) to collateralize a CRT transaction.

Figure 2: Representative Example of Cash Flows

For this representative example, of the $1,250 monthly principal and interest payment from the borrower, approximately $100 would be paid to the mortgage servicer, $1,000 to pass-through certificate holders, and $150 to the GSE. Of the $150 paid to the GSE through the guarantee fee, approximately $37.50 would be passed to CRT investors. While there are costs to facilitate CRT, the majority of the $37.50 is not an additional cost assessed by the GSEs specifically to support CRT. Rather, the $37.50 is paid by the GSE for the transfer of risk to multiple investors who are providing capital to support the housing market. If a loan were in a CRT security, then the above simplification of cash flows provides an approximation of the amount of monthly payment that would go toward the CRT security. If a loan were not in a CRT security, the total cash flows would be the same, but the CRT cash flow would be $0 and the entire $150 would be retained by the GSE.

What are the cash flows of a GSE CRT?

GSE CRT bonds (i.e., STACR and CAS) are purchased at par at origination. Investors are repaid a combination of principal and interest over the life of the bond, and the amount and timing of repayments are dependent upon the performance of the reference collateral. Bond investors are paid a floating interest rate, which is priced at a spread to a benchmark interest rate. The spread to the benchmark interest rate is funded by the guarantee fee paid to the GSEs. Principal repayments are defined by the security structure. If credit losses exceed the attachment point of a given security (a predefined threshold upon which the investor or [re]insurer would be responsible for losses), the principal will be written down to account for credit losses. In such a scenario, the GSEs would collect par (e.g., $100) at issuance and repay an amount less than par (e.g., $70 assuming $30 of credit losses).

For reinsurance (i.e., ACIS and CIRT), reinsurers are paid a monthly premium for the insurance coverage and reimburse the GSEs for losses. The premium is like the spread paid to bond investors and is paid to the reinsurers from the guarantee fees collected by the GSEs. The reimbursement from the reinsurers is equivalent to the principal write-down for the bonds. Reinsurers do not “purchase” the risk in the same way a bond investor would purchase a bond. Instead, there is a reinsurance treaty with Freddie Mac and Fannie Mae where a premium is paid to the reinsurer in return for potential claim payments if losses exceed a certain threshold. To ensure adequate claims-paying ability, the GSEs require a collateral trust account with each counterparty. The required capital for the trust account varies based on the probability of attachment for the insured risks, the credit rating of the reinsurance company, and other factors.

The investor and reinsurer cash flows in CRT are summarized in the table in Figure 3.4

Figure 3: Cash Flows of CRT – From the GSEs’ Perspective

What are some of the structural features of a GSE CRT security?

The most significant structural features of GSE CRT are the attachment and detachment points of the security. The attachment point is the value, expressed as a percentage of the original unpaid principal balance (UPB) of the reference collateral, indicating the level at which the security begins to incur losses. The detachment point is the value indicating the level at which the security would experience a full principal write-down or the full limit loss for the reinsurance execution. For example, assume an attachment point of 0.50% and a detachment point of 1.00%. These values mean that, if cumulative credit losses are below 0.50% on the reference collateral, then the security would not incur a principal write-down—or there would be no reinsurance loss.

If the cumulative credit losses are between 0.50% and 1.00%, the security would absorb all principal write-downs exceeding 0.50%, and the reinsurance loss would be equal to the cumulative credit losses less than 0.50%. If cumulative credit losses exceeded 1.00%, the entire principal balance of the security would be lost, and the reinsurance loss would be equal to 0.50% irrespective of what the cumulative credit losses ultimately grow to.

The average GSE CRT issued from 2012 through 2021 has provided coverage from 0.20% to 4.00% of the original collateral balance for Freddie Mac and 0.40% to 3.50% for Fannie Mae. For the majority of CRT issuance, the GSEs retain the first-loss layer. This means that, if credit losses are at or below expected credit losses, then the CRT investors will not incur principal losses or pay claims to the GSEs. The initial attachment point varies by transaction and year of issuance. After the first-loss attachment, CRT issuance generally covers credit losses up to 300 to 400 basis points (the exact amount varies by transaction and transaction year). Losses greater than the CRT detachment point are retained by the GSEs. Historically, annual losses on collateral similar to those underlying recent CRT issuances have not exceeded more than 400 basis points;5 therefore, CRT structures are designed to cover unexpected losses in all historically observed stress scenarios. Please note that this comment only applies to large, geographically diversified pools. Subsets of mortgages certainly have experienced loss rates in excess of 400 basis points in historical data.

In general, losses to CRT securities are allocated to the most subordinate tranches first, then to the more senior tranches. Principal repayments, on the other hand, are allocated to the most senior tranches first, then to the more subordinate tranches.

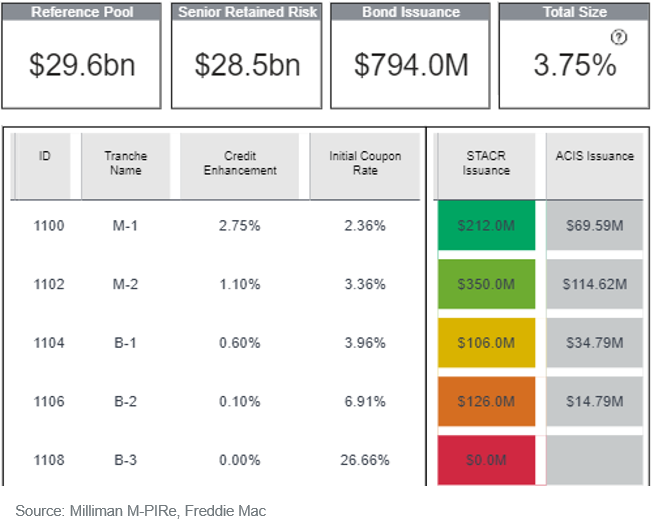

Figure 4 provides a summary of the security structure for STACR 2020-DNA1, a bond CRT with a low loan-to-value (LTV) ratio issued by Freddie Mac in 2020).

Figure 4: STACR 2020-DNA1 Structure

For this transaction, the reference pool of mortgages contained $29.6 billion at origination. Freddie Mac issued $794 million of CRT bonds to the market. Concurrently, ACIS reinsurance was also placed. The total size of the transaction (STACR + ACIS) totals 3.75% of the reference pool.6 The STACR issuance includes five tranches. The most subordinate tranche, B-3, was retained by Freddie Mac. The remaining tranches were issued to the market with credit enhancement (i.e., the attachment point) ranging from 0.10% to 2.75% and initial coupons (benchmark rate plus spread) ranging from 6.91% to 2.36% for the issued tranches.

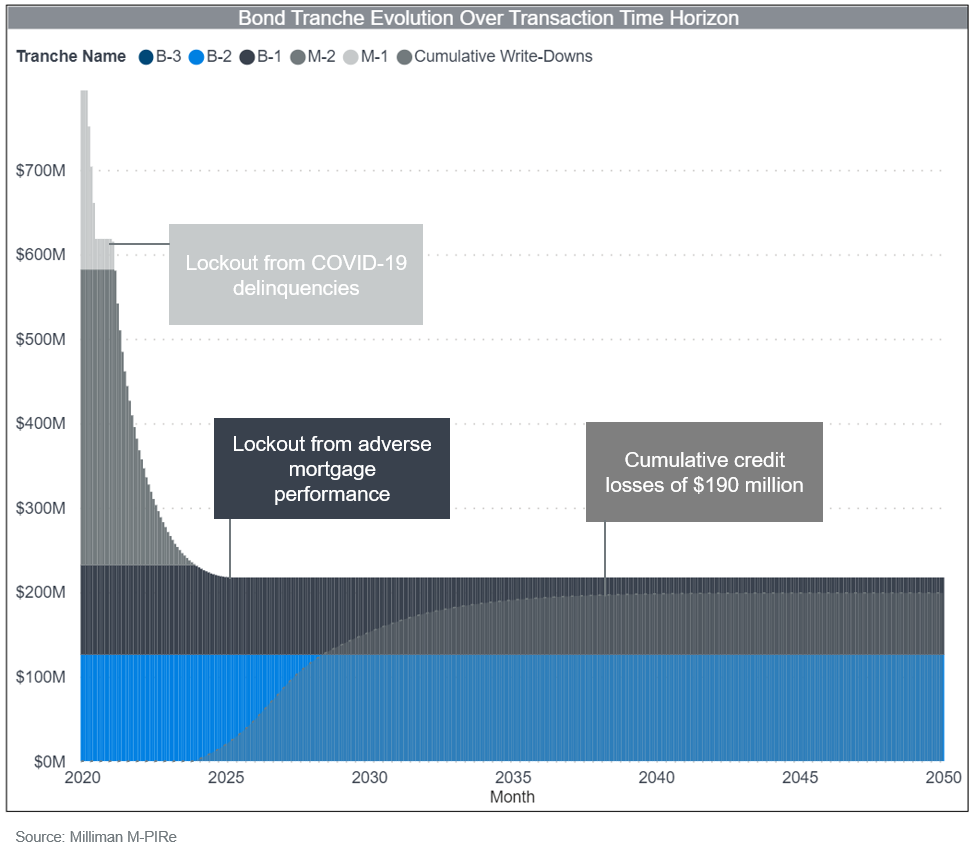

Figure 4 provides a snapshot of the transaction structure at origination. It is also important to understand how each tranche amortizes over time and how losses are allocated to each tranche. Figure 5 shows the amortization of the tranches for the transaction summarized in Figure 4 under a stress scenario. The bars on the chart represent the historical and forecast outstanding principal balance by calendar period for each tranche. The line on the chart represents cumulative credit losses. Figure 5 demonstrates two important features of the transaction. First, it demonstrates how the M-1 tranche is paid down before any amortization for the M-2 tranche, and then the M-2 tranche is paid down, etc., until the transaction is terminated. Second, Figure 5 highlights the impact that deal triggers have on tranche amortization. The structures are designed to “lock out” amortization during stress periods as defined by either the percentage of loans delinquent at a given time, required credit enhancement, or cumulative credit losses. If the performance of the collateral breaches certain delinquency, credit enhancement, or loss thresholds, the transaction stops amortizing, so the GSE CRT structure provides more credit protection against future losses. This is demonstrated in Figure 5 as a function of both the spike in delinquencies because of the COVID-19 pandemic (2020-2021) and as a function of the selected stress scenario (2025-2050). After 2025, the B-1 tranche stops amortization as losses begin to accrue to the B-2 tranche and the B-1 tranche starting in 2027.

Figure 5: STACR 2020-DNA1 Stress Amortization

There are additional structural features in GSE CRT transactions, and the above discussion highlights key features of the cash flow waterfalls. Milliman M-PIRe contains a detailed cash flow library for all public GSE CRT structures that includes all the structural features for a given transaction.

How are GSE CRTs priced?

The risk premium (i.e., spread or reinsurance premium) of a GSE CRT security varies with each transaction and tranche. The bond and reinsurance executions of CRT are priced independently, and the risk profile of the two transactions is different. Bond investors can buy and sell securities in reaction to changes in fundamentals, market prices, or as part of an overall strategic allocation of capital to different sectors. Reinsurers insure the risk from inception through the expiry of the contract. Reinsurers may take a longer-term view of the risk relative to the capital markets, often evaluating stochastic distributions of potential premium and loss.

For both bond and reinsurance executions, a securities broker or insurance broker assists Freddie Mac and Fannie Mae in bringing a transaction to market. There is an initial bid period where a loan tape and structure are presented to market participants. Market participants provide initial pricing guidance and general interest in the transaction. This feedback is evaluated by the GSE and its broker, and a final transaction is offered to the market, adjusting for feedback received. Market participants provide a final authorization to participate in the transaction, and the securities or reinsurance limit is placed among the market participants.

What has been the performance to date of GSE CRT?

Bond performance

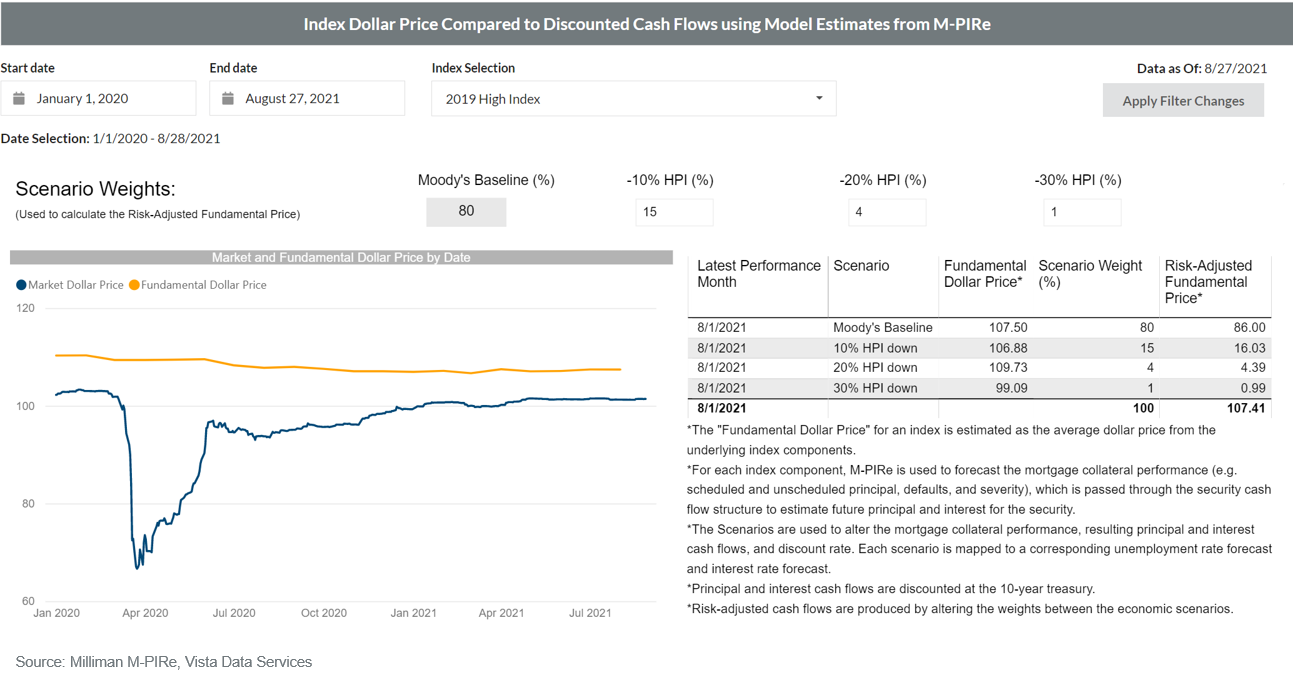

There are two ways to evaluate the performance of GSE CRT bonds from inception to date: historical market prices and fundamental price analysis. Market prices of GSE CRT securities have been more volatile relative to the fundamental price analysis of the securities. This is partially attributable to supply and demand dynamics in the market and the reaction of markets to global macroeconomic events. For example, during the COVID-19 pandemic, the market price of CRT securities declined by over 30%; however, fundamental analysis of the collateral and structures would have indicated a less severe outcome for future cash flows.

Figure 6 provides a comparison of historical market prices to fundamental estimates for a 2019 high-LTV index of GSE CRT. The figure demonstrates that market prices (the blue line on the chart) were relatively stable before March 2020, with average prices for the securities exceeding par. In March 2020, the market price of GSE CRT securities fell from above 100 to less than 70, given the uncertainty of the pandemic and other market forces, while a fundamental analysis indicated a more stable estimate of prices (yellow line on the chart).

Figure 6: Index Dollar Price Compared to Discounted Cash Flows Using Model Estimates From M-PIRe

From a fundamental view of the securities, GSE CRT securities to date have produced limited principal losses to investors. Mortgage credit losses since 2013, in general, have been low given tight underwriting guidelines and positive home price appreciation. Figure 7 provides a table of cumulative loss rates to date on reference collateral underlying GSE CRT and forecasts of future losses under a baseline economic scenario as of August 2021.

Figure 7: Collateral Loss Rate To-Date and Forecast Ultimate Loss Rate on GSE CRT Collateral

The rate of return on GSE CRT securities is dependent upon both the collateral performance and structure of the security. Subordinate tranches pay a higher spread relative to senior tranches. Figure 8 provides a summary of the spread, average credit enhancement, weighted average life (WAL), and internal rate of return (IRR) of STACR securities under a baseline economic scenario as of August 2021 for 2019 issuance transactions.7

Figure 8: Average Spread and Internal Rate of Return by Tranche

The average spread ranges from approximately 9% on B-2 (the most subordinate) tranches to less than 1% on M-1 (the most senior) tranches for 2019 issuances. The average credit enhancement of the B-2 tranches was 0.11% and covered up to 0.63% of the loss. This compares to expected credit losses of 0.13% for the reference collateral. Therefore, under a baseline scenario, investors in the B-2 tranche may incur some principal loss. However, the investors are compensated for this risk with a higher average spread, and the bond is expected to pay down over eight to nine years. The high coupon rate combined with the small level of principal loss results in an average internal rate of return of approximately 9.6%. Note that many market participants use leverage or purchase securities on margin to increase the above returns. Figure 8 assumes no leverage or margin.

Reinsurance performance

Like the bond execution, credit losses as of August 2021 have been limited on GSE CRT reinsurance treaties. For most issuance to date, the mortgage collateral underlying reinsurance transactions are identical for STACR and ACIS securities (in 2021, Freddie Mac started to separate the transactions to have different reference pools, and there have been a few other standalone STACR and ACIS transactions since 2013), and the collateral performance for reinsurance transactions is similar to the bond execution. The values shown in Figure 7 on collateral performance are representative of the same collateral performance for the collateral underlying reinsurance transactions.

For reinsurance, there are several ways to evaluate the return profile of a given treaty. Figure 9 provides a summary of select return metrics for ACIS treaties under a baseline economic scenario as of August 2021 for 2019 issuance transactions.8 Figure 9 assumes a varying collateral requirement across the tranches.

Figure 9: Average Premium Rate and Internal Rate of Return by Tranche

Under a baseline scenario, the loss ratio across all tranches is 0%, meaning it is not expected the treaties will have claims payments if the covered loans perform as expected under the baseline economic forecast. The average premium rates range from approximately 11% to just under 1%. It is expected the transactions will be subject to early redemption, and the weighted average life of those transactions is estimated to be less than four years across all tranches. With the assumed collateral requirements, these transactions generate an average return on collateral that ranges from just under 5% to approximately 20%. The return on collateral calculations in this example do not account for investment income generated on the collateral.

What are the risks to GSE CRT investors?

To-date performance has resulted in attractive return profiles for GSE CRT; however, there are risks in GSE CRT transactions. To-date, GSE CRT securities have only been issued during periods with positive home price appreciation and limited mortgage credit losses. As observed during the global financial crisis of 2007 to 2010, mortgage credit losses fluctuate with different economic cycles, and the type of loans referenced in CRT transactions had considerable credit events during the global financial crisis.

During the COVID-19 pandemic, mortgage delinquencies increased sharply within a short period (a few months) and remained elevated for over 18 months. However, strong home price growth during the same period, combined with favorable loss mitigation efforts, resulted in limited losses from the pandemic.

In Milliman M-PIRe, alternative scenarios and stochastic distributions are leveraged to evaluate the risk of transactions outside of a baseline economic scenario. Figure 10 provides a summary of possible results using forecasts from M-PIRe for a 2021 CRT reference pool. In the table, ultimate credit losses are defined as the sum of future credit losses under each scenario or trial divided by the original UPB.

Figure 10: Ultimate Credit Losses for a 2021 CRT Reference Pool

For this reference pool, ultimate credit losses are estimated to be 0.26% in the baseline scenario and up to 1.25% if home prices decline by 20%. A 20% home price decline is approximately equivalent to a 95th percentile scenario, which has an ultimate loss rate of 1.28%.

For an investor in the B-2 layer, which may have an attachment point of 0.25% and a detachment point of 0.50%, Milliman M-PIRe estimates full principal losses in scenarios where home prices decline by 10% or greater. Investors in more senior tranches would incur principal losses only in scenarios with greater home price declines and/or adverse economic conditions.

The risk profile for all tranches of CRT transactions along with the above output can be viewed for the entire CRT universe in M-PIRe as well as in an integrated portfolio view of securities or reinsurance treaties.

Summary

Results in lower capital requirements for the GSEs and increases their return on capital. Participants in CRT (both capital markets and reinsurers) gain exposure to mortgage credit risk, and the participants can manage the risk profile of the exposure by selectively allocating capital to higher or lower risk tranches. Evaluating a CRT transaction requires the ability to process large loan pools, the structure of the transaction, and outcomes over a range of possible outcomes. This paper provides an overview of GSE CRT and how these components work together. Milliman M-PIRe is a software solution that facilitates analysis on these complex structures and contains a complete library for GSE CRT.

Evaluating GSE CRT and Other CRT Transactions in M-PIRe

The above discussion has focused on GSE CRT securities as GSE CRT securities are the largest market for mortgage credit risk. In addition to GSE CRT, other mortgage credit investors similarly issue CRT securities and reinsurance transactions.

Private mortgage insurance CRT

All the private mortgage insurance companies in the United States have issued insurance-linked notes (ILNs) and reinsurance treaties to the capital and reinsurance markets. These transactions are structured like GSE CRT securities, but the transactions reference mortgage insurance premiums and losses on insured mortgages. In addition, some transactions are structured and amortize with the Private Mortgage Insurer Eligibility Requirements (PMIERs) capital requirements.

Milliman M-PIRe includes mortgage performance models and assumptions specific to mortgage insurance, and Milliman M-PIRe contains a cash flow library with structures for each of the private mortgage insurance companies in the United States.

Multifamily CRT

Freddie Mac and Fannie Mae also issue CRT transactions referencing multifamily mortgages. The amortization schedules for multifamily loans, risk attributes, and cash flow waterfall structures for multifamily all differ from single-family GSE CRT. Multifamily provides a different exposure base relative to single-family CRT and different risk profiles.

Milliman M-PIRe includes mortgage performance models and assumptions specific to multifamily mortgages, and Milliman M-PIRe contains a cash flow library with structures for multifamily transactions issued by both Freddie Mac and Fannie Mae.

Australian lender mortgage insurance

Like the United States, mortgage insurance is often purchased on high-LTV mortgages in Australia. The Australian mortgage insurance companies similarly engage in CRT activities, and many U.S. participants in the market also participate in Australian mortgage CRT. The motivation for Australian CRT is largely driven by capital relief, and the probability of loss is more remote relative to United States mortgages. However, historical data sets are not available to perform a deep analysis of the market, and transparency on underwriting requirements and criteria is not on the same level as it is with GSE CRT.

Milliman M-PIRe includes mortgage performance assumptions specific to Australian mortgages, and Milliman M-PIRe contains a cash flow library with structures for Australian CRT for all four issuers.

1https://fred.stlouisfed.org/release/tables?rid=52&eid=1192326.

2https://www.fhfa.gov/SupervisionRegulation/Rules/RuleDocuments/Fact-Sheet-Capital-NPR.pdf.

3 Securitization is the process of originating a pool of similar loans (e.g., 100,000 30-year fixed-rate mortgages), aggregating the cash flows produced from the loans, and selling the aggregated cash flows to investors. Securitization (1) increases the amount of capital available to fund loans, thereby providing access to credit, (2) disperses risk among various investors with varying risk appetites to estimate a more reliable stream of cash flow and proportionality share in the credit risk of the entire pool, and (3) results in market feedback and increased transparency for the industry

4The GSEs may also earn investment income on the principal paid by investors to purchase CRT bonds. Such investment income is assumed to offset the floating benchmark interest rate liability of the CRT bonds in this analysis.

5https://capitalmarkets.fanniemae.com/media/20926/display.

6The 3.75% is inclusive of a 5% risk retention by Freddie Mac, which aligns the interests of Freddie Mac with the investor pool.

9Assumes a 20%, 30%, 40%, and 60% collateral requirement for tranches M-1H, M-2H, B-1H, and B-2H, respectively. This calculation does not account for investment income on collateral.