Artificial intelligence (AI) and machine learning (ML) are used in many industries to help solve complex problems in simplified ways. The insurance industry is no exception. This article discusses how AI and ML are used in gathering comprehensive claim data from both structured and unstructured data fields found in a claim system. This helps risk management professionals make more informed decisions to reduce their loss experience, thereby reducing their total cost of risk (TCOR).

Total cost of risk can include casualty risks (e.g., workers’ compensation, general liability, auto liability), financial lines (e.g., errors and omissions, directors and officers, cyber), and employee benefits. This paper will focus on workers’ compensation (WC) as those costs tend to be conducive to controllability, given the nature of the line of business; however, the concepts regarding AI and ML discussed in this paper can be extrapolated to other lines of business. We will outline each of the costs associated with WC and discuss how AI and ML may help with a reduction of TCOR.

What is total cost of risk?

Total cost of risk (TCOR) is the sum of all aspects of an organization's operations that relate to risk, including retained (uninsured) losses and related loss adjustment expenses, risk control costs, transfer costs, and administrative costs.1

Risk management professionals at organizations that self-insure some or all their losses use TCOR as a key metric to measure the success of risk management initiatives, such as determining a return on investment (ROI) for loss control, safety, and claim management efforts. Controlling, and ultimately reducing, TCOR is a priority for risk managers, and AI has become an accessible tool to quantify their success.

TCOR can consist of a variety of elements, but generally falls into three main categories:

- Variable costs: Retained losses and related loss adjustment expenses, as well as other tangential costs such as collateral (e.g., borrowing costs, volatility charges, and buy-down charges) and claim handling. Variable costs are subject to change depending on the claim experience within a given policy year.

- Fixed costs: Transfer costs (i.e., policy premium). Fixed costs do not change over the policy year and are not directly impacted by claim experience.

- Administrative and risk control costs: Risk control costs may include the expenses associated with safety initiatives, onboarding, and training. Administrative costs may include risk management information system (RMIS) expenses, broker fees, salaries of risk management professionals, and facility costs. These are expenses that are not directly tied to the insurance program, but their value may be impacted depending on the performance of the policy year.

This is not a comprehensive list of the elements that can be considered in the TCOR calculation, but these items will be discussed in this paper.

Figure 1: Sample TCOR pie chart and table for WC, by cost category

To allow for comparisons across years, a TCOR rate can be calculated as TCOR normalized by an exposure basis, such as payroll or revenue. For example, if a company’s WC insurance cost spend in 20X1 is $20 million and the payroll is $1.1 billion, then the TCOR rate for that year would be $18.18 per $1,000 payroll. If the TCOR in 20X2 is $18.00, the company can identify that there has been an improvement in the TCOR.

Variable costs

Of the three categories of TCOR elements, the variable costs are the most controllable. If a company retains losses, either with a deductible or a self-insured retention, they are motivated to minimize this spend through safety/loss control and claim management. Depending on the size of a company’s retention, the variable costs can make up a sizable percentage of the total insurance spend, which can have a considerable impact on the TCOR. For large self-insureds, it is prudent to explore cost mitigation opportunities, such as return-to-work programs, nurse triaging, and alternative work assignments, given that approximately 65% to 80% of TCOR is variable costs and potentially controllable.

A leap forward in risk management with AI

Advancements in technology have democratized AI, presenting an opportunity for risk management departments to control the largest component of TCOR: claim costs.2 In the past, claim management was largely a manual process, rife with inefficiency and inconsistency. AI helps self-insureds to establish a more consistent set of best practices related to claim outcomes.

The cost of claims can be reduced by lowering frequency (i.e., total claim counts normalized by payroll), or by lowering severity (i.e., the average cost per claim). Safety and loss control professionals may focus on lowering frequency; however, equal focus should be given to lowering severity. If only small-dollar claims are eliminated or mitigated, it may not have a sizable impact on the retained losses.

The top 10% of claims often represent 80% of claim costs, meaning high-severity claims drive the variable cost component of TCOR. Early intervention and cost containment on these costly claims can lead to material reductions in overall claim costs while maximizing the efficiency of the claims department.

The legacy approach to claim analytics relied on structured data from the claim system. Structured data is rows and columns of data, such as a loss run. It is naturally limited, given that the user of the claim system (i.e., the adjuster) must enter data into a predefined dropdown based on incomplete information at First Report of Injury (FROI). Structured data lacks context and generally fails to evolve as a given claim matures and the circumstances of the claim become known. Another source of data in the claim system, unstructured data, provides more context and depth. Unstructured data is any sort of messy, unorganized data, such as an open-text field, found in the claim system. Claim systems are rich with text data such as loss descriptions, adjuster notes, and other correspondence. The primary challenge with unstructured data is the difficulty in extracting data to support analysis.

Figure 2: Sample structured data fields

Figure 2 includes multiple structured data fields and demonstrates the “cleanness” of the data; however, it also displays the lack of additional context and non-specificity. For example, why is a contusion claim considered an indemnity claim (likely because the preliminary diagnosis was a contusion that ultimately was a fracture or tear resulting in surgery)? There aren’t enough clues here to help a risk management professional identify problematic claims for mitigation.

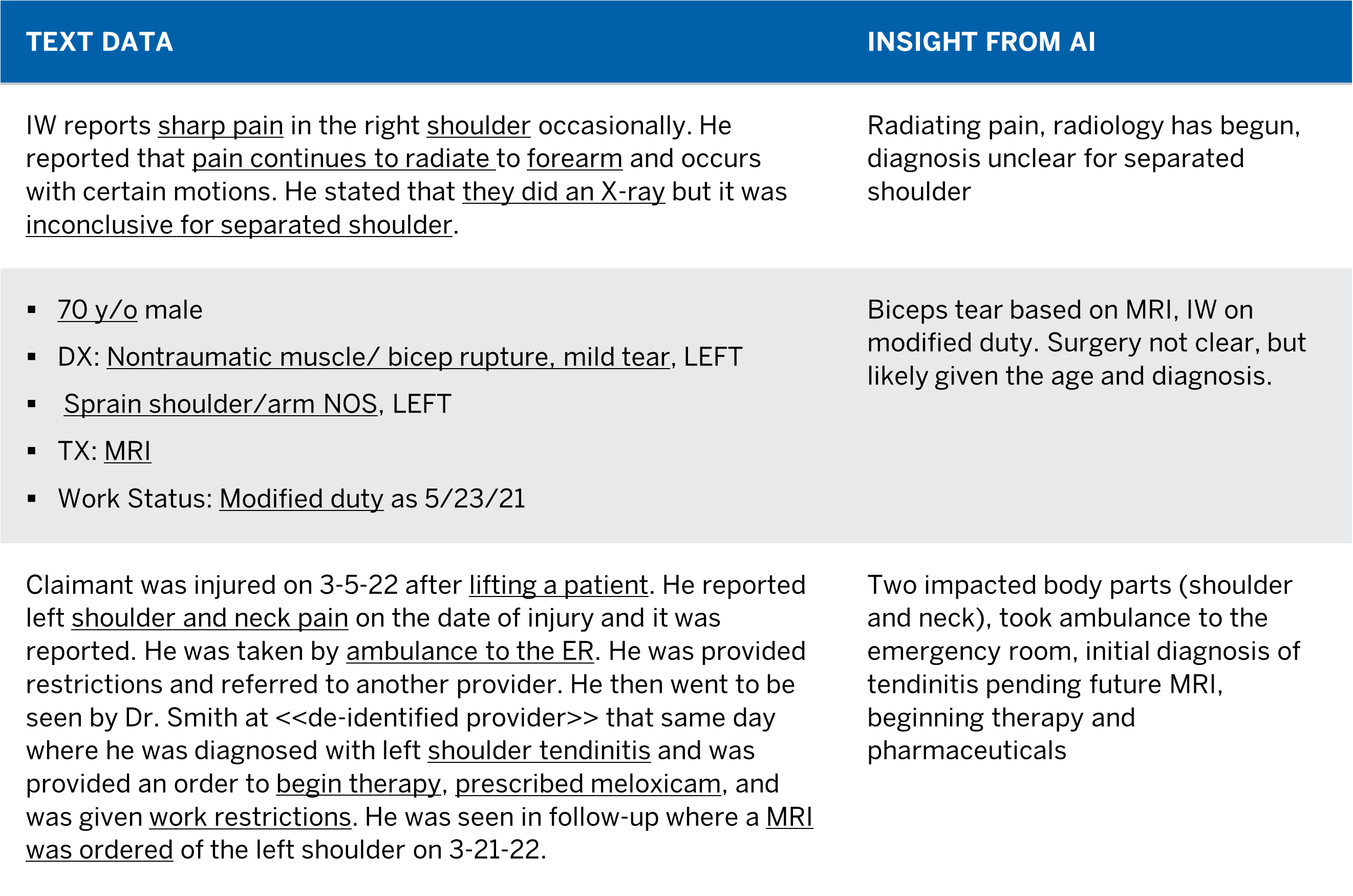

Figure 3: Sample unstructured data fields

Figure 3 shows a few sample claim descriptions, which is an unstructured open-text field. There are misspellings and abbreviations, but it does a better job at explaining the circumstances of the claim. It allows the user to identify additional details. For example, in the third description above, the structured data field for part of body may have described it as a shoulder claim and is completely silent on the neck injury.

Modern AI allows the user to mine unstructured data for critical information before it becomes known in the structured data (such as future surgeries, attorney involvement, comorbidities, etc.). AI looks for nonobvious associations in the unstructured data, such as relationships between the age of the injured worker, medical procedures, and comorbidities, and this is before the overlay of attorney involvement and state regulations (such as ability to direct care). ML provides advanced analytical techniques that go beyond the traditional linear and well-behaved nonlinear techniques.

The information from the mined unstructured data, combined with elements of the structured data, can then feed into a predictive model to identify high-risk claims as candidates for triage and early claim intervention. This leads to more efficient allocation of claim resources, ultimately resulting in a reduction of 3% to 10% in claim costs. Often, inconspicuous injuries, such as soft tissue injuries, can linger and deteriorate. AI enables a consistent approach to evaluating the entire claim inventory every day to draw focus to the important claims.

As a byproduct of loss elimination and reduction, the other variable costs may also experience a savings, albeit not as immediate. With the early intervention of high-cost claims from the use of AI and ML, there may be reductions in collateral and claim handling costs.

The collateral requirement represents the carrier’s view of remaining liability. As policies renew, the collateral ramps up until it hits a steady state.3 If there is improvement in loss experience, resulting in a reduction in retained losses, the carrier may release collateral. It will likely take multiple years of improved experience for a reduction in collateral, and an organization’s actuary can assist in conversations with the carrier’s actuary to provide support for why a collateral decrease is warranted. Explaining how AI and ML have been used to eliminate and reduce losses to a carrier’s actuary will help them gain comfort that any improvements are not artificial and will continue to persist.

If there are fewer claims or if lower cost claims can be auto-adjudicated, this may lead to a reduction in claim handling expenses. Like the impact to future collateral costs, a reduction in claim handling won’t move the needle much in terms of recognizing a decrease in the overall variable costs.

Fixed costs

Fixed costs, which are primarily premium, do not change quickly, even in cases of lower claim costs. For WC, the premium is based on experience rating, which applies industry rates to the company’s payroll with an adjustment for the company’s loss experience. The industry rates are based on the state of operation and job code where the payroll belongs and are subsequently adjusted to account for the deductible.

The company’s loss experience is calculated using the experience modification factor. Typically the experience modification factor uses the most recent three complete policy years’ loss data to calculate. Because of this, if there are improvements to loss experience, they will eventually flow through to the experience modification factor. However, it may take a few years to gain this advantage.

Administrative and risk control costs

Administrative costs are unlikely to be impacted by AI at this time. The facility costs and RMIS expenses will remain constant regardless of loss control or claim management.

There may be a change in the broker fees if the broker is paid on commission. Otherwise, this cost will also remain flat.

If losses improve to the point where there is a reduction in risk management professional staff, there may be some savings there. However, a bigger savings may be in the time and energy saved by narrowing the focus to only the claims that need increased attention. This is more difficult to quantify and may take a few years to realize, but it may improve long-term risk management strategy.

The risk control costs may also shift depending on what the data highlights as opportunities for improvement, but they will likely stay consistent in total.

Conclusion

When trying to find ways to improve the TCOR rate, AI and ML can help risk management professionals control the largest portion of TCOR, variable costs, which is the largest beneficiary of these emerging technologies.

Using a combination of structured and unstructured data fields, AI and ML allow risk management professionals to gain more comprehensive pictures of their losses, shifting the focus to the problematic claims as opposed to relying on a more generalized approach. This will aid an organization in prioritizing risk management strategies, leading to a reduction in TCOR.

1 IRMI. Glossary: Cost of Risk. Retrieved July 13, 2022, from https://www.irmi.com/term/insurance-definitions/cost-of-risk.

2 Paczolt, M. (March 15, 2022). The Complete Guide to Claims Triage: Lowering Workers’ Compensation Costs With Predictive Analytics. Milliman Insight. Retrieved July 13, 2022, from https://www.milliman.com/en/insight/The-complete-guide-to-claims-triage-Lowering-workers-compensation-costs-with-predictive-analytics.

3 Huenefeldt, M. (October 22, 2021). Large Deductible Programs: Demystifying Collateral. Milliman Insight. Retrieved July 13, 2022, from https://www.milliman.com/en/insight/large-deductible-programs-demystifying-collateral..