In 2009, the Tampa Bay Regional Planning Council released a report detailing the potential impacts of a major hurricane on the Tampa Bay area. The fictional storm they created, “Hurricane Phoenix,”1 was designed to simulate a worst-case landfall for Tampa, which is rated the most vulnerable U.S. city to storm surge.2 The report, drawing on expertise from across the public and private sectors, predicted a scenario that would “devastate the entire Tampa Bay region” and result in the most expensive insurance loss from a natural disaster in world history.

Last week, that scenario nearly came to fruition.

Late on Wednesday, October 9, Hurricane Milton made landfall near Sarasota, Florida, as a Category 3 hurricane with estimated winds of 120 miles per hour (mph). The storm then tracked across peninsular Florida, exiting the Atlantic coast as a Category 1 hurricane. As of midday on October 10, it was estimated that more than 3 million customers were without power in Florida.3 For these people and many others, particularly those who were closest to where the storm made landfall or who were affected by one of the many tornadoes Milton generated, the rebuilding process will be long and painful.

However, Milton’s impacts could have been much worse. In the final day before landfall, high southwesterly wind shear exceeding speeds of 30 knots (35 mph) began to significantly degrade what had been a Category 5 hurricane.4 Additionally, a final shift in the storm’s path rerouted it from a Tampa Bay landfall to Sarasota. Without these factors, Milton might have closely resembled its hypothetical counterpart, Phoenix.

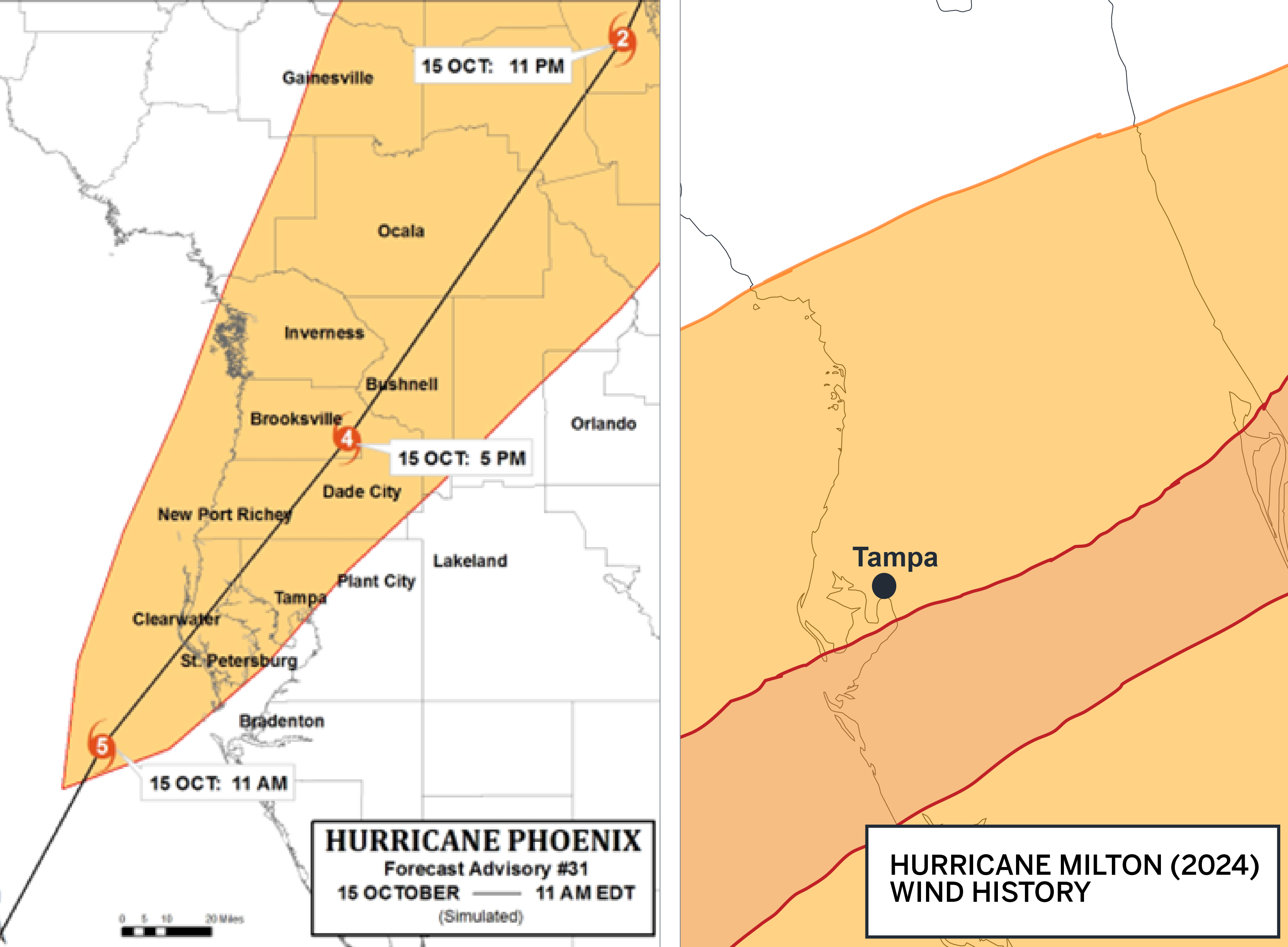

Figure 1: Hypothetical Hurricane Phoenix track versus actual Hurricane Milton (2024) track5

In the aftermath of an event that will likely be the most expensive disaster of 2024, but thankfully avoided becoming the highest insured loss event of all time…what’s next? This paper reviews the expected insurance impacts of Milton and the anticipated future responses of the (re)insurance markets in Florida.

Expected Milton impacts on insurance industry

Like Irma (2017) and Ian (2022) before it, Milton will likely result in an insurance industry loss exceeding $20 billion. The exact quantum of loss will not be determined for years, as the process of identifying, adjusting, and settling claims on the enormous scale a hurricane produces takes significant time. However, compared to the ranges of potential loss being discussed prior to the event (varying all the way from $15 billion of industry loss to $150 billion),6 an updated post-event range will be significantly narrower. Based on a review of past events, the physical characteristics of Milton, and various industry information, our initial post-event range is from $20 billion to $40 billion of insured loss.

At this level, we expect Milton to be:

A major event for Florida insurance carriers

The Florida property insurance market has recently begun to rebuild itself after nine insolvencies over the past five years, with at least eight new startup companies beginning to write business in the market in 2024. Accordingly, the total number of policies insured by the insurer of last resort, Citizens Property Insurance Corporation, peaked at 1.41 million as of September 30, 2023, and has since fallen somewhat to 1.26 million as of September 30, 2024.7

For these newer carriers, and for any Florida insurer with significant exposure in Hillsborough, Manatee, Pinellas, and Sarasota counties, Milton might represent the largest event in their company’s history. We expect that several companies will incur a full retention of losses up to the beginning of their reinsurance towers, and additional losses for any portions of the reinsurance layers that they opted to retain. Milton might put some companies under surplus pressure, although this pressure would have been significantly greater with a worst-case Milton path or if another similar event were to hit Florida later in this hurricane season.

A manageable event for the reinsurance industry

Milton is expected to impact several of the lowest layers of Florida reinsurance towers, passing losses to the reinsurers participating on those layers. These layers typically carry a high price (or “rate on line”) and are expected to be hit with some frequency. However, the repeated occurrence of events (Irma, Ian, Milton, and 2018’s Michael) tapping these lower-lying layers over the past decade raises questions about the sustainability of current prices for this coverage.

In 2022 and 2023, Florida offered state-backed reinsurance for these working layers via the Reinsurance to Assist Policyholders and the Florida Optional Reinsurance Assistance Program; Milton is likely to squeeze the rates of such working layers even further.

We do not expect material impacts to more remote layers (for the 1-in-50 year storm or higher) across most reinsurance programs.

A minor event for the insurance-linked securities (ILS) industry

Over the past five years, the ILS industry has gradually retreated from lower layers of Florida reinsurance towers, opting to write fewer of the types of deals most often exposed to a hurricane of Milton’s size (e.g., collateralized reinsurance, particularly on a retrocessional and/or aggregated event basis) and more of the types of deals that are more risk-remote (e.g., catastrophe bonds). On average, wind-exposed catastrophe bonds over the past two years attach at approximately the 1-in-60 event,8 a level that should generally be safe from Milton losses. Initial industry sentiment around the catastrophe bond market suggests an expected loss impact of only a few percentage points of total value,9 and in the absence of further events, many catastrophe bond funds should still finish with an overall net gain for the year.

We do expect some pockets of the ILS industry, particularly those participating on lower-lying reinsurance layers, are likely to face more tangible challenges when reserving for Milton. These funds may also encounter constraints from locked collateral as the January renewal cycle approaches.

A prominent hedging tool for the ILS space is the industry loss warranty, a derivative that pays out based on the sum total of insured industry losses. Interestingly, as we generally expect these instruments to be set at industry loss thresholds between $30 billion and $80 billion (either on an occurrence or aggregate basis), it is possible that funds hedging against the predicted active hurricane season in this manner might see Milton’s ultimate loss slip under the attachment points of some of their hedges, whereas these hedges might have paid off at a significantly higher level had Milton entered Tampa Bay.

Milton insurance and actuarial impacts to watch going forward

After a significant hardening of property reinsurance rates over the last three years, there has been some market sentiment that reinsurance rates might stabilize or potentially even decrease at the upcoming January renewals.10 While the recent Hurricane Helene might not have moved the needle on this prediction, we expect that Milton will, at least on lower layers of reinsurance towers. This makes rate increases the most likely scenario in 2025. Increases in reinsurance rates then invariably lead to knock-on increases on Florida primary homeowners insurance pricing. 2024 had been a relatively benign year for homeowners rate increases, with rates increasing only +1.7% on average.11 Milton may herald a shift in 2025 back to the higher yearly increases witnessed earlier in the 2020s.

From an actuarial perspective, we are keeping a close eye on the rate at which claims are reported and developed compared to Irma and Ian. Like Milton, these storms both impacted the western coast of Florida as major hurricanes before crossing the peninsula. Like Milton, Irma and Ian also spread winds with the force of a low-grade hurricane or tropical storm across a broad swath of the state.

However, Irma and Ian have had starkly dissimilar loss emergence patterns, which highlights the particularly fraught litigation climate insurers faced in Florida from 2017 through 2022. The impacts of assignment of benefits and one-way attorney’s fees have been previously documented as key drivers of late loss development activity on Irma12. In contrast, Ian was expected to benefit from the market reforms introduced by Florida Senate Bills 2D and 4D in May 2022.

While indeed there have been some pockets of adverse development as those claims reach their two-year anniversary,13 the loss creep has been far less pronounced than Irma’s. This may be partly attributed to the fact that initial Ian loss estimates were generally significantly more conservative than the comparable Irma ones, but there is also evidence that legislative reforms have tamped down on litigation rates, reducing the explosive growth of Irma loss development in 2019 and 2020.14

As Milton now begins its own loss development cycle, we highlight four things of note:

- Florida’s recent insurance reforms are now fully in place. Some of Florida’s recent insurance reform bills came into effect after Ian (for example, Florida Senate Bill 2A in December 2022), meaning that Milton’s loss development is likely to more fully represent the efforts that the legislature has put in to stabilize loss development.

- The state has issued new claims-handling directives to the insurance industry. Florida insurers have drawn recent scrutiny from consumer groups and the government with regard to their claims-handling practices. In response, state officials issued an emergency rule15 limiting desk adjusters’ ability to modify initial loss estimates (most notably, to lower them) without further itemization and support for those changes.

Effective implementation of these rules might lead to an increase in the average cost of claim as well as an added increase in expense costs to provide this additional documentation. However, to the extent that the emergency rule forces insurers to hold higher reserves soon after the event, it may help limit the development tail on the event; virtually all Florida insurers have historically seen their case incurred reserves increase (and sometimes significantly) over time following past hurricanes. - Milton might impact a generally older housing stock. The Tampa Bay area, which had not seen a major hurricane make landfall since 1921, has a disproportionately high percentage of houses built prior to the post-Hurricane Andrew (1992) building codes, particularly in Pinellas County.16 While these houses dodged the worst of Milton, many were still subjected to hurricane-force winds. The age of the building stock may complicate the loss adjustment and rebuilding process.

- Milton follows closely on the heels of Helene. Despite passing 100 miles to the west of Tampa, Hurricane Helene nonetheless caused a storm surge event in the Bay Area that exceeded Milton’s, leaving debris on coastal streets that had not been fully collected by the time Milton arrived. Even setting aside the coverage complexities arising from water losses, having these two events in sequence may complicate the loss adjustment and assignment process.

Overall, the damage from Milton will be widespread but generally not out of proportion to past events. Both the wind and surge components will come in lower than was feared, and the total volume of claims should be almost familiar at this point to companies that weathered prior major Florida disasters.

Given the complexities of hurricane reserving, we rate Milton to have a reasonably elevated level of future reserve uncertainty, but not disproportionately high compared to other events of comparable size.

What is certain is that once again, the State of Florida and its insurance industry are settling in to pick up the pieces from yet another major, year-defining loss. As anomaly begins to resemble trend in the Sunshine State, there appears to be no immediate relief on the horizon for major insurers or beleaguered homeowners. While Milton is unlikely to cause complete market failure, steadier footing still seems a long distance away.

1 Tampa Bay Regional Planning Council. (January 2010). The Tampa Bay catastrophic plan: Scenario information and consequence report. Retrieved October 11, 2024, from https://tbrpc.org/tb-cat-plan/.

2 Karen Clark & Company. (August 2015). Most vulnerable US cities to storm surge flooding. Retrieved October 11, 2024, from https://research.fit.edu/media/site-specific/researchfitedu/coast-climate-adaptation-library/united-states/national/us---other-national-reports/KC--Co.--2015.--Most-Vulnerable-US-Cities-to-Storm-Surge-Flooding.pdf.

3 As per https://poweroutage.us/area/state/florida at 2 p.m. on October 10, 2024.

4 National Oceanic and Atmospheric Administration, National Hurricane Center and Central Pacific Hurricane Center. (October 9, 2024). Hurricane Milton advisory. Retrieved October 11, 2024, from https://www.nhc.noaa.gov/archive/2024/al14/al142024.discus.018.shtml.

5 Left: Tampa Bay Regional Planning Council. (January 2009). The Tampa Bay catastrophic plan: Scenario information and consequence report, forecast map 4. Right: Based on data from the National Oceanic and Atmospheric Administration, National Hurricane Center. Post-tropical Cyclone Milton: Cumulative wind history. Retrieved October 14, 2024, from https://www.nhc.noaa.gov/refresh/graphics_at4+shtml/203803.shtml?swath#contents.

6 Evans, S. (October 9, 2024). Hurricane Milton cat bond loss potential still in wide range: Icosa Investments. Artemis. Retrieved October 11, 2024, from https://www.artemis.bm/news/hurricane-milton-cat-bond-loss-potential-still-in-wide-range-icosa-investments/.

7 Citizens Property Insurance Corporation. (2024). Policies in force. Retrieved October 11, 2024, from https://www.citizensfla.com/policies-in-force.

8 As per Milliman internal study of publicly available catastrophe bond information.

9 See Evans, S. (October 10, 2024). Cat bond funds can still finish the year positively: Twelve Capital’s Wrosch. Artemis. Retrieved October 11, 2024, from https://www.artemis.bm/news/cat-bond-funds-can-still-finish-the-year-positively-twelve-capitals-wrosch/ and Evans, S. (October 10, 2024). Hurricane Milton losses likely below a 5% cat bond market impact: Icosa Investments. Artemis. Retrieved October 11, 2024, from https://www.artemis.bm/news/hurricane-milton-losses-likely-below-a-5-cat-bond-market-impact-icosa-investments/.

10 Gallin, L. (September 25, 2024). Reinsurance market participants divided on price movements at Jan ’25 renewals: Fitch. Reinsurance News. Retrieved October 11, 2024, from https://www.reinsurancene.ws/reinsurance-market-participants-divided-on-price-movements-at-jan-25-renewals-fitch/.

11 Based on rate filing data from S&P Global Market Intelligence.

12 Koch, A. C. & Blake, D. (July 19, 2023). The Florida property insurance market ran aground. Can the ship be righted? Milliman Insight. Retrieved October 11, 2024, from https://www.milliman.com/en/insight/florida-property-insurance-market-ran-aground.

13

Evans, S. (February 13, 2023). United (UPC) hikes Hurricane Ian loss 54%, with ramifications for reinsurance partners. Artemis. Retrieved October 11, 2024, from https://www.artemis.bm/news/united-upc-hikes-hurricane-ian-loss-54-with-ramifications-for-reinsurance-partners/.

Evans, S. (September 16, 2024). Recent cat bond losses highlight loss creep potential: Icosa Investments. Artemis. Retrieved October 11, 2024, from https://www.artemis.bm/news/recent-cat-bond-losses-highlight-loss-creep-potential-icosa-investments/.

Evans, S. (September 17, 2024). American integrity cat bonds market down further as Hurricane Ian loss rises again. Artemis. Retrieved October 11, 2024, from

https://www.artemis.bm/news/american-integrity-cat-bonds-marked-down-further-as-hurricane-ian-loss-rises-again/.

14 Florida Office of Insurance Regulation. (August 1, 2024). Public Rate Hearing: Citizens Property Insurance Corporation, slide 17. Retrieved October 11, 2024, from https://www.floir.com/docs-sf/default-source/public-hearings/citizens-hearing-2024/august-2024-citizens-rate-hearing-slides_final.pdf?sfvrsn=2b408b5c_4.

15 Florida Department of State. (October 9, 2024). Emergency Rule 69BER24-4. Retrieved October 11, 2024, from https://myfloridacfo.com/docs-sf/cfo-news-libraries/news-documents/2024/emergency-rule-69ber24-4.pdf.

16 https://bsky.app/profile/kellyhereid.bsky.social/post/3l5xcphzxc62h, posted October 7, 2024.