As we enter a new year, individuals usually establish personal goals. Whether it be to work out more often, eat healthier, or plan a family vacation, the new year triggers a mindset for new beginnings. Trustees of retirement plans can also take this time to review goals for their plan participants and consider improving plan benefits in the future. With rising healthcare costs and people living longer, trustees of multiemployer plans may want to ask themselves: How can we better support our members in retirement when addressing healthcare costs?

Rising healthcare costs in retirement

Healthcare costs will likely be the number one expense that individuals face in retirement. For the building and construction trades industry, this is almost a certainty. According to a recent Milliman study1, a 45-year-old couple in average health is projected to pay $532,000 in 2019 dollars and $1.4 million over their lifetime for retiree health care. For a couple currently 65 years of age, their future spending on healthcare is projected to be approximately $369,000 in 2019 dollars.

In other words, if a couple in average health, both of whom are age 45 in 2019 has $532,000 in savings and they earn 3% in investment return per year, it projects that they will have sufficient resources to pay their retiree healthcare expenses. These expenses are estimated to be $1.4 million, over the balance of the couple’s lifetime, beginning at age 65.

A comparative analysis by the Employee Benefits Research Institute (EBRI) estimates that a 65-year-old couple will need approximately $363,000 to cover all healthcare expenses.2

No matter the study or research published regarding healthcare expenses in retirement, the message is the same - healthcare costs are going to be a significant consideration as people start to enter retirement. What options might be available to trustees to provide a solution to this challenging issue? For the most part, health and welfare plans provide healthcare coverage until Medicare begins at age 65. At the time Medicare takes over, it is likely retired individuals will be required to cover out-of-pocket premiums and expenses for healthcare services, which may put a strain on their finances.

What about the pension plan?

Many union members receive a traditional pension plan. However, they should ask themselves if the benefit will be enough to cover both daily and unplanned expenses in retirement. As calculated by Milliman, based on 2017 and 2018 IRS Form 5500 filings covering more than 1,300 multiemployer pension plans (excluding large, national supplemental plans), the average union worker, or his/her survivor, is receiving approximately $13,000 in retirement per year. Is this enough to meet the healthcare needs of union members who, in many cases, are in difficult, labor-intensive jobs? This is the question that trustees and plan professionals are trying to answer for union members and their dependents.

How a 401(k) plan can help

One potential solution is to allow members to save for their retirement healthcare needs via a voluntary, supplemental retirement system, specifically a 401(k) plan. A 401(k) plan allows individuals to make pre-tax contributions automatically from their paychecks before federal income taxes are withheld, which reduces the taxes they pay today. Members can enjoy the benefits of avoiding taxes on the front end as well as avoiding taxes on the earnings as long as the monies remain in the qualified account. When the member retires and starts to withdraw assets, the distributions are then taxed as ordinary income. In addition, plans can add Roth after-tax contributions, which are deducted from members’ pay after federal income taxes are withheld. While the initial contribution is made after normal taxes are withheld, all earnings attributable to those contributions grow in a tax-sheltered account and when distributed, come out of the account with no taxes on earnings, creating a tax-free distribution.3

Members can invest their 401(k) contributions in a variety of different investment options, depending on their risk tolerance, retirement horizon, and investment strategy. For example, they may choose from a low risk stable value fund or a more aggressive option, such as small cap stocks or something in between.

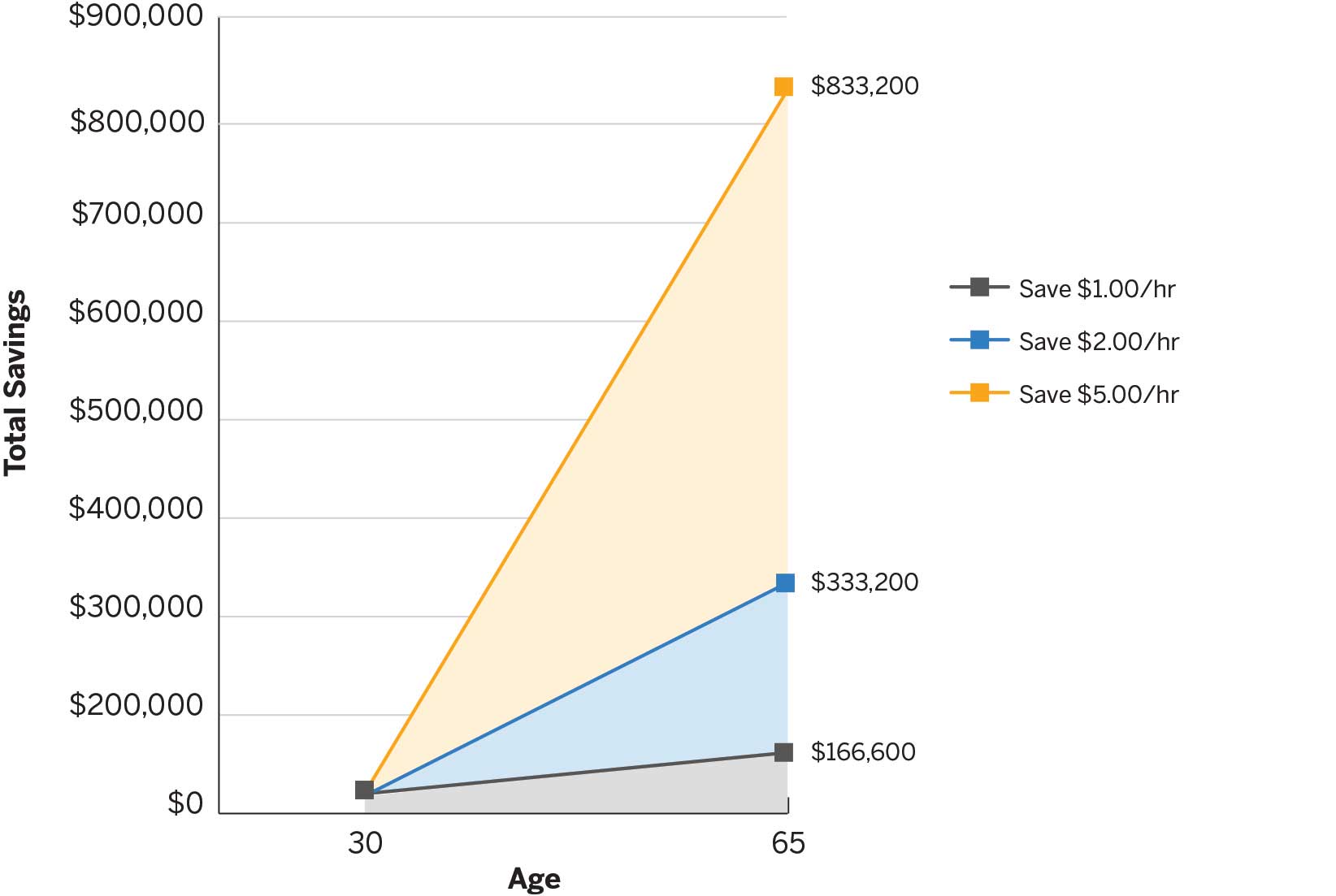

How much can be accumulated within a 401(k) plan? It can be significant. For example, if a member starts to contribute $1 per hour at the age of 30, and we assume that that member earns an average rate of return of 5% for 35 years, he or she can accumulate an account balance of approximately $167,000.4 At $2 per hour, given the same time horizon and rate of return, savings can grow to more than $330,000, and at $5 per hour, given all the same variables, savings can grow to more than $830,000. A small, hourly contribution can grow into a significant nest egg over a career thanks to the power of compounding interest. As people take advantage of a 401(k) plan, they can better prepare for the high cost of healthcare they may face in retirement.

Figure 1: The power of compound interest

Living longer

One of the arguments that many union members make about working in the trades is that most people will not be able to work until age 65 due to the harsh, intense labor involved. While this is true in many instances, the reality is that individuals are living longer today in retirement.

Based on the Social Security Administration’s Life Expectancy webpage, the average life expectancy for a male turning 65 on April 1, 2019, is 84, and for a female turning 65, the life expectancy is 86.5. Additionally, one-third of society is expected to live past 90 and one-seventh is expected to live past 95.5

The U.S. government has recognized that, with people living longer, there will be issues of longevity risk with retirement benefits. In December 2019, the Setting Every Community Up for Retirement Enhancement Act of 2019 (SECURE Act) became law. The SECURE Act requires plan sponsors to update language in plan documents regarding mortality tables to reflect the increase in life expectancy. People are living longer and will experience additional healthcare costs as they get older – especially those working in the building and construction trades.

Adding a voluntary feature to your retirement program

What are the next steps that boards of trustees can take to help members better prepare for increasing healthcare costs in retirement? Consider the voluntary component of their retirement programs. This requires establishing a 401(k) plan. Within this plan structure, boards of trustees can work with the employers to establish a voluntary contribution, which can be remitted to the fund office or the third-party administrator (TPA), similar to other fringe benefits being administered. There does not need to be a collectively bargained contribution that accompanies the voluntary feature (although these plans are typically more successful by including even a small bargained contribution). The 401(k) feature can “stand alone” on its own as a benefit for the membership.

If the Local currently offers a collectively bargained profit sharing contribution, a 401(k) feature can be added to the existing design. If the trustees decide to implement a new 401(k) feature to allow their members to save for retirement and commensurate healthcare-related costs, there are some specific design features that need to be addressed, such as handling delinquent contributions and non-discrimination testing. Trustees should consult with their legal counsel or consultant to understand these unique provisions so the best possible plan can be implemented.

Special considerations for money purchase pension plans

If the Local already supports a defined contribution (DC) plan in the form of a money purchase pension plan, some additional steps need to be taken in order for the board to sponsor a voluntary component. The board will need to change the structure of the plan from a money purchase pension plan to a profit sharing plan and notify the membership of the structural change. Fund counsel can easily draft this notice, called the 204(h) Notice, and deliver it to the membership. This notice announces the change to the membership and explains that voluntary contributions can now be accepted and invested on behalf of the members. In addition, it is critical for the plan administrator, whether a recordkeeper, fund office, or TPA, to account for the different money types due to specific rules surrounding benefits, rights, and features of the plan. While easy to account for, government regulations require that money purchase pension plan funds follow different rules than profit sharing plan funds. Once these changes have been made, the “new plan” can start to receive the voluntary contributions of the membership.

If the current money purchase pension plan is trustee-directed, where the board oversees the asset allocation and monitors the performance of the investment managers, a 401(k) plan can still be added. All the voluntary contributions made by the members can be invested, along with all the other collectively bargained contributions, into the trustee-directed pool of assets. Again, trustees should consult with their legal counsel and/or other plan professionals when implementing this change.

All retirement plan professionals recognize that people are living longer and costs in retirement will only increase over time. In the retirement industry, it is generally acknowledged that healthcare costs will likely be the number one expense for retirees. To mitigate the financial impact that healthcare costs will impose on union members in their golden years, boards of trustees should establish a 401(k) feature to assist their members in achieving greater savings for those future expenses.

1Schmidt, Robert L. (June 28, 2019). Milliman. Retiree health cost estimates. Retrieved on January 29, 2020, from us.milliman.com/insight/retiree-health-cost-estimates

2Fronstin, Paul and VanDerhei, Jack. EBRI Issue Brief. (May 16, 2019). Issue 481: Savings Medicare Beneficiaries Need for Health Expenses in 2019: Some Couples Could Need as Much as $363,000. Retrieved on January 29, 2020, from www.ebri.org/docs/default-source/ebri-issue-brief/ebri_ib_481_savingstargets-16may19.pdf?sfvrsn=56b83f2f_10

3Pursuant to current Roth 401(k) distribution rules

4Assumes an 1,800-hour work year and normal retirement age of 65

5Benefits Planner/Life Expectancy from www.ssa.gov/planners/lifeexpectancy.html