Should insurtechs reposition for success in the changing insurance value chain?

A timeless principle of insurance is that certain “affinity groups” of similar buyers have better-than-average risk profiles, allowing insurers to target such groups for favorable risk classification, underwriting, pricing, and service. Farmers, teachers, government employees, and military members are all examples of affinity groups that spawned several of today’s name-brand insurers. As valid now as it was a century ago, this principle is deployed by insurtechs that use advanced technology to interface directly with buyers and agents, predict claims more accurately, lower operating costs, improve customer satisfaction, and build trusted relationships with the ultimate risk-bearers—insurance companies, reinsurers, and investors. Unlike the traditional business model in which a large insurer conducted all functions under one roof, today’s insurance value chain is best depicted as an exploded view. Figure 1 shows the major players and flows of risk data and risk capital.

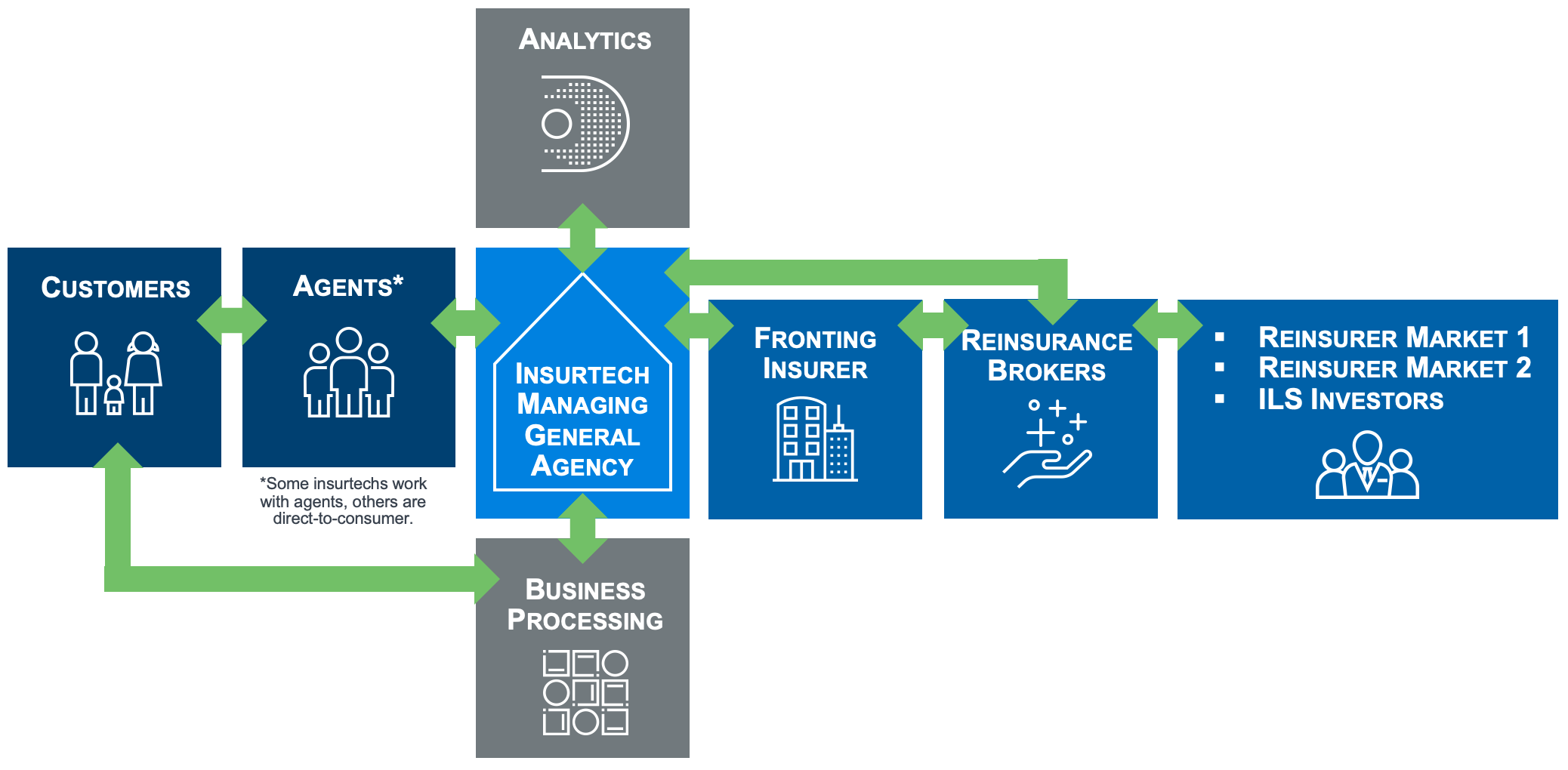

Figure 1: Today’s Insurance Value Chain

Policyholder data, whether gathered directly by the insurtech or by an agent using its portal, is passed to a risk analytics system that augments the buyer’s application with third-party data concerning creditworthiness, claims history, geography, and other factors. Then the risk analytics system applies cutting-edge artificial intelligence (AI) and actuarial algorithms to deliver underwriting options and prices in real-time. The accepted risk is underwritten by a managing general agent (MGA), who has authority to use the insurance policy and capital (“paper”) of an existing fronting insurer acceptable to state regulators. The fronting insurer typically retains little or none of the insurance risk. The risk is instead distributed to a panel of reinsurers, some using traditional contracts and others using fully collateralized contracts backed by insurance-linked securities (ILS), assembled by a broker or intermediary working for the MGA. The MGA acts as the servicing hub for policy issuance and premium billing, often using a business process outsourcing (BPO) vendor for the supporting systems. Not pictured in Figure 1, the MGA also typically contracts with a third-party administrator (TPA) to handle claims. This claims TPA, in turn, may have contingent agreements with a wide variety of specialist claims firms to provide additional resources, particularly if catastrophe exposure exists.

This dizzying and fragmented array of niche specialists exists because each adds unique value to the ultimate objective of matching large pools of risk capital to a large number of individual insurance customers. In the long “soft market” cycle of the past decade, in which abundant capital drove cheaper premiums, the use of MGAs conferred many business advantages to insurtechs. By concentrating their efforts on customer acquisition and growth rather than regulatory compliance and risk capital allocation, insurtechs could prioritize the build-out of MGAs or partnerships with existing MGAs to more efficiently approach potential customers, inject new data and analytics to provide faster acceptance and pricing decisions, and enhance the customer experience using advanced technology platforms. This arrangement could attract affinity groups, avoid the drag on returns on equity from heavy regulation and conservative capitalization, and allow sometimes lucrative exit strategies for founders. In the private words of one insurtech executive, “We don’t want to own an insurer, because when we go public in five years, we want a Tesla Motors valuation, not a Ford Motor Company valuation.” (Re)insurers that chose to assume risks at inadequate prices in soft markets lived with the consequences; the insurtech and MGA did not.

Since 2019, the market has changed dramatically across both property and casualty lines of insurance. Driven by outsized catastrophe losses from sometimes unexpected perils, as well as persistent social inflation and aggressive litigation, all insurance lines of business, with the possible exception of workers' compensation, are now seeing a hardening of the market wherein insurers reduce the supply of insurance and raise prices year-over-year. Rising reinsurance and capital costs strain an insurtech’s ability to invest in other sources of value, such as proprietary technologies. As a result, predicting whether insurtechs will seek closer connections among the players in the value chain, or a greater separation, requires consideration of factors that could cut both ways.

On one hand, as underwriting profits become paramount, insurtech founders and investors who once shunned the “Ford Motor Company” model may be more attracted to the notion of taking risk. As capital expects higher returns per unit of risk, insurtechs may find that the benefit of stable insurance capacity begins to outweigh the potential drag on the expected future returns that determine their valuations. Hippo’s acquisition of Spinnaker Insurance Company2 could foreshadow a wave of strategic integrations predicated upon a persistently harder market.

On the other hand, a hard market also increases the value of risk selection and pricing relative to customer access. In soft markets, MGAs and customer-facing ventures have leverage as (re)insurers compete aggressively for customers on coverage terms and conditions, price, eligibility, and service. When the cycle turns, insurers face pressure to increase rates, tighten underwriting, and perhaps exit certain markets altogether. In response, insurtechs may wish to strategically double down on the analytics and big data that enhance risk selection and classification. The aim can be to become the preferred partners of discerning (re)insurers, while avoiding the high cost of capital that comes with being an insurer in a tumultuous environment.

The increasingly valuable role of risk analytics and risk data

Just as in past hard markets, today’s environment is poised to accelerate the already rapid evolution of consumer data collection and risk analytics—the fundamental tools necessary for precise underwriting and pricing. Insurtechs may see an opportunity to apply their competencies, earn higher returns, and support the strategies of capital providers by refocusing priorities away from new market entry, customer acquisition, and growth toward risk assessment, profitability, and cost control. For example, incumbent insurance companies may need to absorb higher reinsurance costs at the same time that they are unable to raise prices quickly or reduce the aggregate risk on their books in some jurisdictions. In California’s property market, increased wildfire risk and reinsurance costs are driving primary insurers out of high wildfire-risk areas and eroding the capital base of those who must remain.3 An insurtech that once focused on efficient, scalable ways to engage and acquire customers for California insurers might now consider pivoting to offering a more rigorous measurement of the elevated risk of those customers at a hyper-local level. As more resources are applied to challenging insurance problems, greater value will be placed than ever before on having the best data, tools, and analytics.

How better risk analytics and quicker scale enables social benefits and equity

An important bonus of such investments is that social goals, including those often championed by insurtechs, can be enabled by enhanced risk data and analytics. We observed an early example of this —driven by the adoption of catastrophe modeling technology—which supported hurricane mitigation premium discounts to Florida homeowners beginning in 2003 and has helped strengthen the overall building stock in Florida. Faster, individualized, and more precise risk signals may enable emerging and incumbent insurers to improve their risk selection procedures, at the same time incentivizing risk reduction by rewarding beneficial policyholders with lower prices or broader coverage.

Many tech-enabled devices now create data sources to track a wide variety of insurance risks. Telematics, or usage-based insurance, has seen tremendous growth in personal auto insurance, with many brand-name insurers offering products that support a premium plan based on how much and how safely someone drives. A better approach in normal times also worked in unprecedented times; COVID-19 and the ensuing shelter-in-place policies had significant impacts on driving patterns, but only policyholders of telematics-based insurance programs saw the full benefits. In addition, the use of robust, stable data that is clearly predictive of risk has enabled some insurtechs to pledge to end the use of risk classification proxies, such as creditworthiness, that are perceived by some as less fair.4

How to accelerate strategic shifts

To maximize the chance of outsized returns, insurtech companies must always be nimble and ready to quickly pivot to investing in the greatest market needs. As a result, they can sometimes struggle to maintain stable alliances that provide what they need, when they need it, whether it is support for new pricing and underwriting approaches, delivery of insights at point-of-quote, or assistance with regulatory matters.

Fortunately, there are tools and services emerging that can provide a helping hand in areas to speed new products and strategies to market. Such tools include predesigned rates and risk analytics, application program interfaces (APIs) that deliver such rates or risk analytics, and vehicles such as insurance advisory organizations that can help obtain regulatory approval for new products and data sources. As business-to-business products are often less widely advertised than direct-to-consumer products, the ability to identify and evaluate the quality of such tools, services, and data sources is of paramount importance.

Insurance market changes, whether persistent or transitory, disruptive or orderly, are best faced with effective risk analytics, strong alliances, and seasoned strategic advice. The next wave of insurtech success will certainly be rooted in these foundations.

1The choice of whether to engage buyers directly or to primarily engage independent insurance agents is a strategic decision for insurtechs. Openly’s CEO did an interview explaining its thinking on the topic, available at https://www.insurancejournal.tv/videos/17040/.

2Cision (August 31, 2020). Hippo officially acquires Spinnaker Insurance Company. Press release. Retrieved September 14, 2020, from https://www.prweb.com/releases/hippo_officially_acquires_spinnaker_insurance_company/prweb17360684.htm

3For further information on wildfires see https://www.milliman.com/en/insight/wildfire-catastrophe-models-could-spark-the-changes-california-needs.

4Business Wire (August 8, 2020). Root Insurance commits to eliminate bias from its car insurance rates. Retrieved September 14, 2020, from https://www.businesswire.com/news/home/20200806005211/en/Root-Insurance-Commits-Eliminate-Bias-Car-Insurance.