In July 2020, Milliman published the research report "Reinsurance as a capital management tool for life insurers." This report was written by our consultants Eamon Comerford, Paul Fulcher, Rik van Beers and myself.

Capital management is an increasingly important topic for insurers as they look to find ways to manage their risks and the related capital requirements and to optimise their solvency balance sheets. Reinsurance is one of the key capital management tools available to insurers. The paper investigates common reinsurance strategies, along with new developments and innovative strategies that could be implemented by companies.

This blog post is the ninth in a series of posts about this research. Each post provides an overview of a certain section of the Milliman report.

Lapse risk reinsurance

One of the largest capital requirements for most life insurers arises in respect of lapse risk, which results from adverse changes in policy surrenders, paid-ups and other discontinuances. For most business, higher-than-expected policy lapses result in the loss of profitable policies, although the converse is sometimes the case, with the risk of loss-making policies remaining in force for longer durations.

The focus of this post is on lapse reinsurance, which can be designed to cover the lapse stresses under Solvency II, where the reinsurer pays out if lapses are higher or lower than expected. Lapse risk reinsurance solutions mainly focus on tail risk transfer and Solvency Capital Requirement (SCR) reduction, rather than full lapse risk transfer. A 100% quota-share reinsurance of a block of business fully transfers lapse risk, in the absence of other risks, if full lapse risk transfer is required.

Lapse reinsurance transactions are written to be "out-of-the-money" at inception, so may be a low-cost way to transfer lapse risk. An insurer considering entering a lapse reinsurance contract will reinsure the biting SCR lapse stress, thus allowing the insurer to hold less capital against the biting lapse risk. This structured reinsurance strategy is most likely to be used by an insurer calculating its Solvency II capital requirements using the Standard Formula (SF). The strategy is most practical where the biting lapse stress requires significantly more capital than the other lapses stress. If any of the other lapse stresses are at a similar level of magnitude, the usefulness of a reinsurance arrangement just covering one type of lapse stress as a capital relief tool is minimal. In this case, it may be necessary to use a lapse reinsurance strategy that covers multiple lapse stresses.

Overview

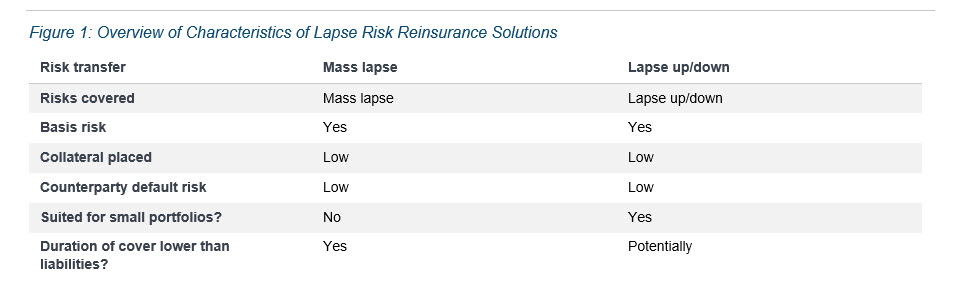

Lapse risk exists on most portfolios of life insurance business other than business for which lapses are not possible, such as traditional whole-of-life annuities. There are three main types of lapse reinsurance currently in existence, one for each of the three prescribed shocks under the SF, as shown in Figure 1.

Mass lapse reinsurance

Mass lapse reinsurance protects the insurer against the adverse financial impact of a mass lapse in its portfolio (usually surrenders only). Subject to regulatory approval, it may be possible to use mass lapse reinsurance as a risk mitigation technique in the calculation of the lapse SCR, where the mass lapse stress is the biting SCR stress. This type of reinsurance is not yet very common in some European countries. However, we know that it has been used in Sweden, Norway, Gibraltar and, initially, the Netherlands, as well as some others.

A mass lapse treaty is set up with an attachment point which, upon being reached, will result in the reinsurer beginning to pay out. The treaty will also typically have a detachment point that places a cap on the reinsurer's risk, and above which the reinsurer will not make any further payments. The attachment point ensures there is not an immediate loss to the reinsurer and the detachment point is typically set around the Solvency II stress for maximum capital relief. All assumptions underlying the reinsurance contract, other than lapses, are typically fixed at the outset of the contract.

As an example, a typical mass lapse reinsurance arrangement may be written with an attachment point of 20% and a detachment point of 40%. The contract is structured so that a payout is triggered when mass lapse rates lie between the interval (20%-40%). Lapses outside this interval are not covered. Setting the attachment point at 20% reduces the reinsurance cost, as the hedge is initially out-of-the-money at the start of the contract, whilst obtaining capital relief. The detachment point of 40% is typically used as there is little capital relief in setting a detachment point at a higher level when using the SF to calculate SCR. However, a higher detachment level would result in a higher transfer of risk. Indeed, it could also be argued that aligning the detachment point with the SF stress is effectively arbitraging the SF stress. Justification that the SF remains appropriate to the insurer in question will be important in this scenario.

In order to maintain full capital relief for the reinsurance structure, it is necessary to ensure that the risk mitigation is initially longer than 12 months in duration. The Solvency II SF mass lapse stress is an immediate 40% lapse and so mass lapse risk reinsurance contracts are typically structured as two-year contracts with a one-year transaction period to ensure regulatory efficiency. It is also possible to structure mass lapse treaties as multiyear hedges where the terms are altered each year to also reduce risk margin requirements. An additional regulatory factor here in determining effective risk transfer is that the SF mass lapse scenario is based on extreme lapses experienced in the next 12 months. In practice, lapses arising from trigger events could manifest over a longer period.

Lapse up/down reinsurance

Lapse up and lapse down reinsurance transactions have not gotten as much focus as mass lapse reinsurance. But lapse up/down reinsurance has been considered by some companies in recent years, although we are not aware of any public examples of deals being completed.

Lapse up/down reinsurance is where a portfolio is reinsured against a +/-50% change in lapses in order to mitigate against the applicable SCR shock. Lapse up/down stresses are permanent stresses to the insurer's portfolio and so the coverage period for lapse up/down reinsurance is generally fixed for the lifetime of the contract. As with mass lapse reinsurance contracts, all assumptions other than lapses are generally fixed at the outset to calculate the contract cash flows. Terms can be added to the reinsurance treaty to allow commutation of the contract after a certain period, such as three or five years after the treaty has started. The commutation will take into account projected experience based on what has been observed from the insurer during the initial period. Attachment and detachment points are used in a way similar to mass lapse reinsurance to reduce the cost of the reinsurance and maximise capital relief, with the transaction written out-of-the-money.

Other overall considerations for lapse risk reinsurance

- When designing the structure of the reinsurance arrangement, it should be taken into consideration that regulators may not allow arrangements that are purely designed to reduce regulatory capital without an appropriate risk transfer.

- The reinsurer will aim to avoid the moral hazard that the insurer itself may be able to influence the lapse experience. Reinsurance might, for example, exclude contracts that are lapsed where the proceeds are reinvested in a new contract with the insurer.

- The use of lapse reinsurance may also introduce basis risk. A risk-mitigating technique cannot be partially reflected in the SF SCR to reflect the presence of material basis risk; it should either be reflected fully in the SCR if there is no material basis risk, or else not reflected at all.

- Reinsurance in respect of lapse risk is unlikely to be suitable for small portfolios where the benefit may not be worth the ongoing administration effort, particularly in the case of lapse up/down reinsurance.

- It is possible that the biting lapse risk SCR will change over time as the insurer's portfolios evolve, reducing the effectiveness of a particular lapse reinsurance transaction as a capital relief technique.

Milliman research paper

The full research paper can be found on Milliman's website here. At the same site, you can also find an executive summary version that notes some of the key highlights of the research and acts as a guide to the full paper.