Important Work Happening at Milliman

Long-term care pharmacies importance in delivering quality care

LTC pharmacies play a crucial role in providing pharmaceutical services to residents of long-term care facilities, such as nursing homes, assisted living communities, and skilled nursing facilities. These pharmacies specialize in meeting the unique medication needs of individuals living in these settings, where complex health conditions and ongoing medical management are common. Milliman wrote an informational article that describes the relationships between LTC pharmacies and payers, and the operational level of effort to provide services to individuals in nursing homes and elsewhere.

LTC pharmacies are most often contracted by long-term care facilities to provide services to their residents. These relationships are typically contractual business arrangements, and most LTC pharmacies are not owned by or located within the facilities they serve. These pharmacies may service a wide geographic area, sometimes spanning more than 100 miles from the long-term care facility that ultimately dispenses or administers the medication to patients or residents. As a result of recent trends due to the pandemic and increasing population of aged desiring to stay in their own residences, LTC pharmacies are now providing prescription services to individuals' homes.

Clinical pharmacists play a critical role in medication management within long-term care settings. They conduct thorough reviews of residents' medication records to ensure safe and effective medication use, focusing on accuracy, interactions, adverse effects, lab results, and more. Collaboration between pharmacists, healthcare providers, and caregivers improves medication therapy, reduces adverse events, and enhances patients' quality of life.

LTC pharmacies face economic challenges, including reimbursement pressure from payers, increased competition, and complex reimbursement policies, as well as a changing marketplace due to aging, consumer expectations, and shifting government policies. Navigating economic concerns while maintaining high-quality care and compliance with regulations requires overall risk management, strategic financial planning, operational efficiency, effective resource management, and staying informed about industry changes.

Read the full article at https://www.milliman.com/en/insight/long-term-care-pharmacy-quality-care-financial-sustainability

Milliman LTC Advanced Risk Analytics (Milliman LARA™)

In 2023, the Milliman LARA team has gone into production. As more carriers and vendors focus on aging-in-place, LARA unlocks insights with advanced analytics:

- Wellness interventions (pre-claim and on-claim)

- Risk stratification for population health initiatives

- Study and control group determination for pilot programs

- Evaluation of program effectiveness and profitability including return on investment (ROI)

- Population experience benchmarking

- Enhanced expectations for near-term planning

- Comparisons to industry expectation

- Benefit eligibility and claim management

- Streamline claim eligibility

- Early insights on expected claim severity and duration

- Fraud detection and investigation

- Long term support services (LTSS) and Medicaid

- Risk stratification for population health initiatives

- Early identification of incidence and severity

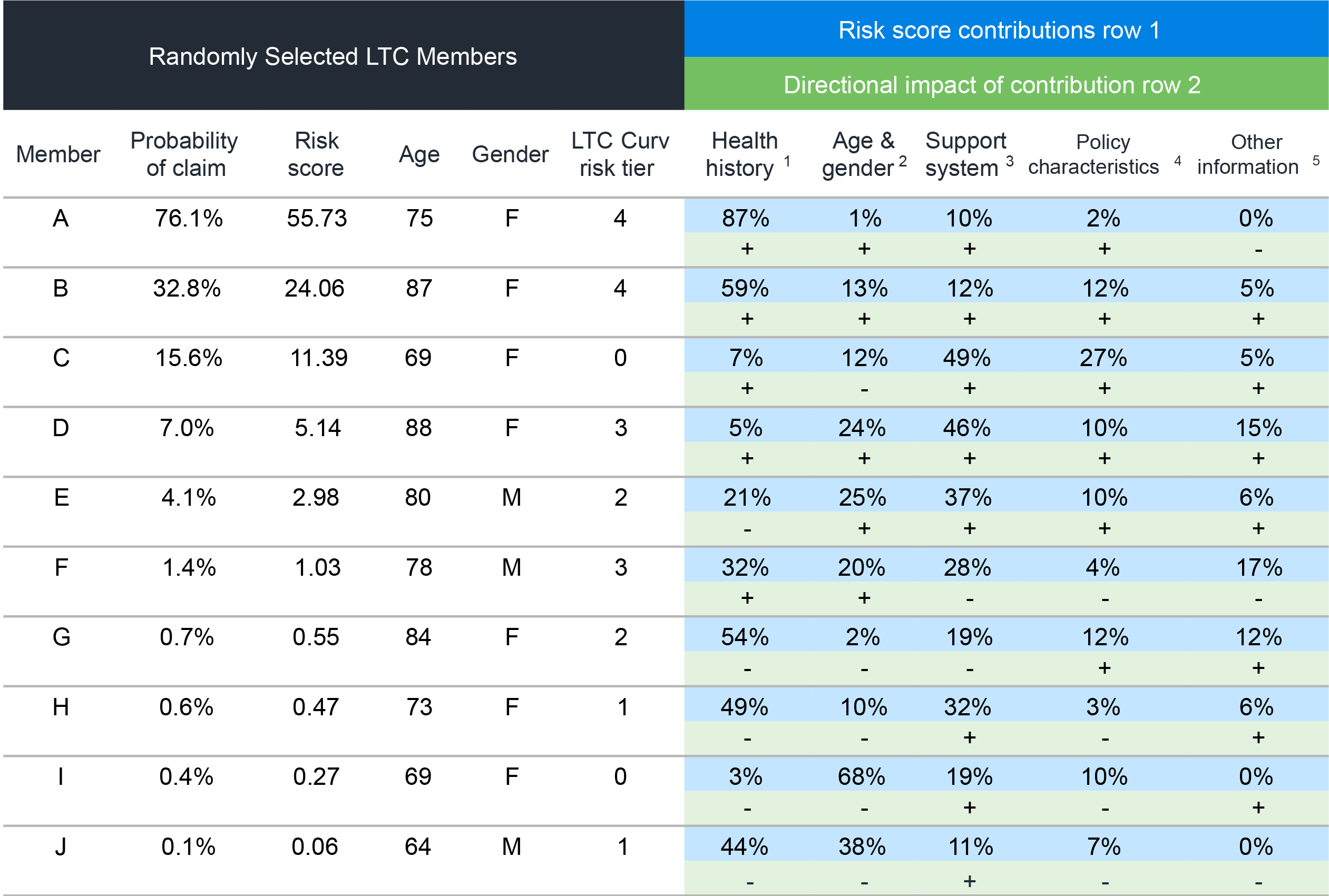

Here is a sample of the LARA output. For more information on how to use the output, please refer to a short article: Milliman LARA Pre-claim Risk Model Sample Output.

The LARA team has appeared at major LTC conferences; demoed for dozens of individuals, including LTC carriers, wellness vendors, and other interested parties; and begun delivering production LARA risk scores to our clients. We’re also supporting our clients in analyzing the effectiveness of various wellness pilot programs. For the remainder of the year, we will continue to offer thought leadership and lead in the aging-in-place space.

2023 Long-term care aging-in-place initiatives

As wellness and aging-in-place programs in the LTC industry gain traction, we recently surveyed 20 market leaders on trends they see. The results of this survey, done in collaboration with Faegre Drinker Biddle and Reath LLP, are intended to provide general benchmarks on insurers’ current wellness program practices. The insights we present will be a valuable resource to risk managers and others to understand emerging practices and experience with LTC insurance wellness programs. The paper includes discussion of:

- Business objectives

- Wellness program descriptions

- Data

- Lists of participating companies and survey questions

Please reach out to [email protected] if you would like to participate in our next survey which will be commencing soon. You can find the results of our recent survey here.

Upcoming Studies

2023 Milliman LTC Guidelines

Development of the 2023 edition of the Milliman LTC Guidelines (Guidelines) is well underway. We’ve completed our analyses of COVID-19 experience and claim transfer rates and are currently working on analyzing disabled mortality, recovery, and claim incidence rates.

Our analysis of experience during the COVID-19 pandemic confirmed several patterns we observed as we have supported our clients over the last few years. The highlights include:

- A decrease in incidence rates in 2020 of approximately 20%, driven by decreases in facility care;

- An increase in total claim termination rates in 2020-2021 of approximately 20%, with increases in disabled mortality rates of approximately 15% and increases in recovery rates of approximately 25%; and

- A decrease in transfer rates in 2020-2021 of approximately 15%.

Over the last decade, we’ve utilized a variety of predictive analytics methods to support the development of the Guidelines. We’ve continued to refine and expand our use of predictive analytics over time and this year have analyzed transfer rates using predictive analytics for the first time. Overall, we’ve observed transfer rates increase compared to the 2020 edition of the Guidelines, with variability by transfer path and claim duration.

Thank you to our client data contributors, which now include two additional carriers in the top 20 based on lives in force! We expect the updated edition of the Guidelines to be finalized and available for use with clients in the first half of 2024.

2023 Combination Product Experience Study

Milliman Long-Term Care consultants are concluding the 2023 Combination Product Experience Study. This study is the largest of its kind, collecting combination product (aka “hybrid” product) claims and summarizing these for use in assisting clients with assumption setting.

New to this study, our participating carriers include those with worksite-sold as well as individual business. The experience study includes combination products that couple life or annuity products with LTC or chronic illness riders. We evaluate policyholder incidence rates, lapse rates, and overall insured population mortality.

Combination product LTC incidence continues to emerge substantially lower than standalone LTC company incidence rates. Combination product LTC claim termination rates in the first claim year continue to trend lower than what we observe in standalone LTC company experience.

Our study notes substantial differences in experience for policies with extension of LTC benefits than those policies that only accelerate the life insurance policy values.

The participating companies receive a free copy of the report summarizing our results.

If you’d like to know more, or if you’d like to participate in future studies, please contact [email protected] or Dan Nitz ([email protected]), Robert Eaton ([email protected]), or Alyssa Lu ([email protected]) .

Industry News

LIMRA/LOMA/SOA Supplemental Health, DI & LTC Forum, August 2-4, 2023

We had a great time attending the 2023 Supplemental Health, DI & LTC Conference and taking in a more advanced array of content! While there were opportunities at every breakout session to focus on LTC, there were also great sessions for related lines of business to help broaden our perspectives on caring for an aging population. Also, a great mix of actuarial content existed along with perspectives from leaders in underwriting, marketing, and claim processing. From learning how prevalent and scandalous LTC fraud schemes can be, to seeing how epigenetics might uncover meaningful correlation of lifestyle and future health needs, there was something interesting to learn from or apply no matter your area of LTC expertise. Innovative tech and artificial intelligence were major themes underlying many presentations, which made sessions feel very relevant.

LTC Reform Update

We offer the following update on reform happenings in two states:

- Washington: Beginning July 1, 2023, payroll contributions to the WA Cares Fund began for workers in Washington state. This first-in-the-nation public LTC program was initially proposed to go into effect in January of 2022 but was delayed as lawmakers explored modifications to the program. Updates to the program included expanded eligibility of partial benefits to those over 55, as well as opt-out provisions extended to out-of-state workers, disabled veterans, military spouses, and workers with non-immigrant visas. Milliman continues to conduct actuarial analysis to support the Long-Term Services and Supports Trust Commission as it evaluates policy changes and program solvency (published here).

- California: California established the Long-Term Care Insurance (LTCI) Task Force to explore the feasibility of developing and implementing a public LTC program. At the end of 2022, the Task Force recommended several options for a program design, published in a feasibility report. The LTCI Task Force Actuarial Sub-committee recently met to discuss preliminary cost estimates for the plans recommended in the 2022 feasibility study. Work that Milliman performed in 2020 quantifies similar plan designs and is being taken into consideration as part of the ongoing feasibility work by the Task Force.

New York Department of Financial Services LTC Insurance Report

On June 7, 2023, the New York Department of Financial Services (DFS) issued a report on LTC insurance. The report both looks back on the struggles of the LTC industry and looks ahead, while also considering the need for LTC care faced by most Americans during their lifetimes.

As part of the retrospective, the report describes the reasons for rate increases being requested on many LTC policies. The report also discusses the impact that rate increase denials or reductions from the DFS (and its predecessor agency, the New York State Insurance Department) had on consumers and the LTC insurance market as a whole.

Looking ahead, the DFS discussed four focus areas for the LTC insurance market:

- Review and reform premium rate approval methodologies

- Establish affordability measures to help consumers manage LTC insurance premium rate increases

- Promote the adoption of LTC insurance offerings in New York

- Enactment of the New York Health Insurer Guaranty Fund to protect consumer investments

Finally, the report stated that in looking forward LTC funding issues must be addressed by policymakers in ways that go beyond LTC insurance solutions.

The report can be found in its entirety here.

Merger and Acquisition (M&A) News

Is now the time for an M&A wave to hit standalone LTC blocks? A recent article considers this question by drawing parallels between legacy LTC blocks and other lines of business which have seen more M&A activity, such as fixed deferred annuities and universal life with secondary guarantees. The article can be found here.

Two M&A deals were announced this year related to LTC:

- In March, Continental General Insurance Company announced a deal to acquire a block of standalone LTC policies from Elevance Health, Inc. (formerly Anthem).

- In May, Lincoln Financial Group announced an agreement with Fortitude Reinsurance Company Ltd. to cede nearly $12 billion of its MoneyGuard statutory reserves, representing about 80% of Lincoln’s total in-force for MoneyGuard. MoneyGuard is a life/LTC hybrid product.

Milliman Publications and News

Broker World Survey

The 2023 Milliman Long-Term Care Insurance Survey is the 25th consecutive annual review of stand-alone LTC insurance published by Broker World magazine. It analyzes the marketplace, reports sales distributions, and describes available stand-alone LTC products. The Washington Cares Fund stimulated tremendous market demand in the state of Washington, causing sales distributions to vary greatly from recent history.

A follow-up Broker World article discussed worksite LTC sales, including a comparison of worksite sales and distributions versus non-worksite sales distributions. Washington state accounted for over 90 percent of reported worksite stand-alone LTC insurance policies sold in 2021. Stand-alone worksite sales receded significantly in 2022.

Voices of LTCI podcast

Milliman’s Robert Eaton was recently featured on the “Voices of LTCI” podcast where he explained how long-term care companies have evolved from financial institutions to more healthcare focused.

https://podcasts.apple.com/us/podcast/voices-of-ltci/id1675580672?i=1000603644069

Milliman in the Community

Milliman awarded three 2023 Military Friendly Designations

Milliman was awarded three 2023 Military Friendly Designations for its commitment to veterans and families.