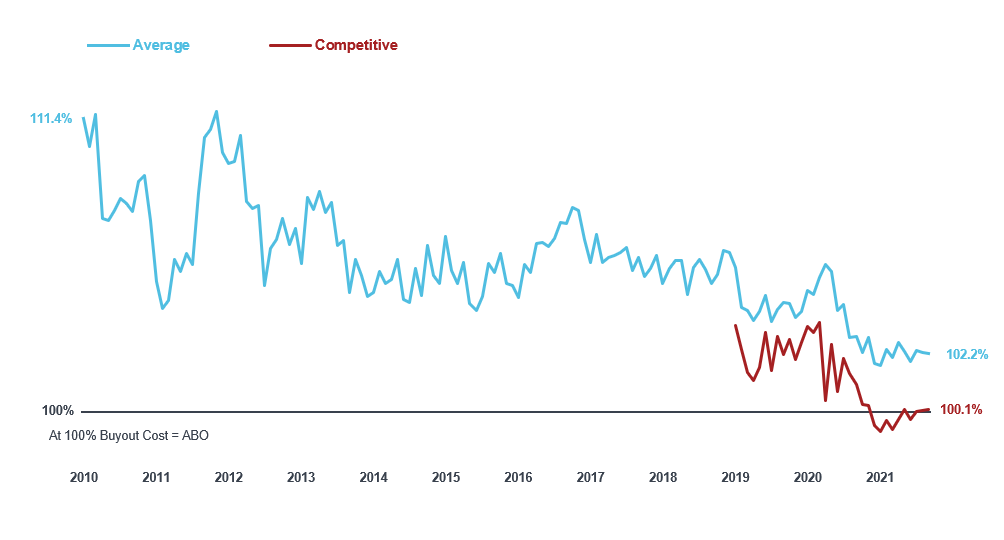

Estimated retiree buyout cost as a percentage of accounting liability decreased by 10 bps from 102.3% to 102.2% in August.

Competitive pricing buyout costs stayed level at 100.1%

As the Pension Risk Transfer market continues to grow, it has become increasingly important for plan sponsors to monitor the annuity buyout market when considering a plan termination or de-risking strategy. Figure 1 illustrates retiree buyout costs based on both an average of all insurer rates in our study and on just the most competitive rates, which represent the price savings that may be achieved when selecting between bids from multiple insurers.

During August 2021, average accounting discount rates increased by 7 basis points (bps), while annuity purchase rates increased by 7 bps (average) and 6 bps (competitive). This caused the average estimated retiree buyout cost as a percentage of accounting liability (accumulated benefit obligation) to stay nearly flat (decreased from 102.3% to 102.2%). Likewise, the competitive pricing trend remained level at 100.1%.

When considering these results, please keep the following information in mind:

- Annuity pricing composites are provided by the following insurers: Prudential Insurance Company of America, American United Life Insurance Company (OneAmerica), American General Life Insurance Company (subsidiary of AIG), Minnesota Life Insurance Company (Securian), Pacific Life Insurance Company, Metropolitan Tower Life Insurance Company (MetLife), Massachusetts Mutual Life Insurance Company (MassMutual), and Banner Life Insurance Company (Legal & General America).

- Baseline accounting obligations are estimated using a representative retiree population, the FTSE Above Median AA Curve, and insurance company data.

- Plan sponsors should note that specific characteristics in plan design or participant population could make settling pension obligations with an insurer more or less costly than estimated.

Figure 1: Milliman Pension Buyout Index

About the MPBI

The Milliman Pension Buyout Index (MPBI) uses the FTSE Above Median AA Curve and annuity purchase composite interest rates from eight insurance companies to estimate the cost, as a percentage of accounting liability, of transferring retiree pension obligations to an insurer. To review previous monthly findings, visit milliman.com/en/periodicals/Milliman-Pension-Buyout-Index.