In July 2020, Milliman published the research report "Reinsurance as a capital management tool for life insurers." This report was written by our consultants Eamon Comerford, Paul Fulcher, Rik van Beers and myself.

Capital management is an increasingly important topic for insurers as they look to find ways to manage their risks and the related capital requirements and to optimise their solvency balance sheets. Reinsurance is one of the key capital management tools available to insurers. The paper investigates common reinsurance strategies, along with new developments and innovative strategies that could be implemented by companies.

This blog post is the eighth in a series of posts about this research. Each post provides an overview of a certain section of the Milliman report.

Mortality and catastrophe risk reinsurance

Two common interrelated risks that life insurers can face are mortality risk and catastrophe risk. Mortality risk is the risk of both policyholders dying earlier than expected and more policyholders dying than expected. This risk occurs gradually throughout the duration of the portfolio. If best estimate mortality rates are set too low then, as a result, provisions for mortality covers are insufficient to cover liability payments.

Catastrophe risk is the risk of many policyholders dying or falling sick due to a sudden event, such as a pandemic. The effects of a catastrophe shock are felt more immediately than the effects resulting from a mortality shock. A recent example of this is the COVID-19 pandemic.

Determining mortality risk and catastrophe risk

Setting robust best estimate mortality parameters for an insurer's portfolio can be subject to a substantial amount of expert judgement, especially in the case of smaller portfolios or where the insurer does not have a lot of experience. Mortality risk can be quite material, as a small variance in the portfolio's mortality can readily lead to insufficient reserves. This especially holds true if this variance occurs on life covers from individuals with above average sums assured. Estimating catastrophe risk can be challenging. Parameters and models used to determine the catastrophe risk are dependent on the event driving it. In the case of a pandemic, variables such as social distancing, contagiousness, population age structure and lethality are important when calibrating a catastrophe risk model.

Overview

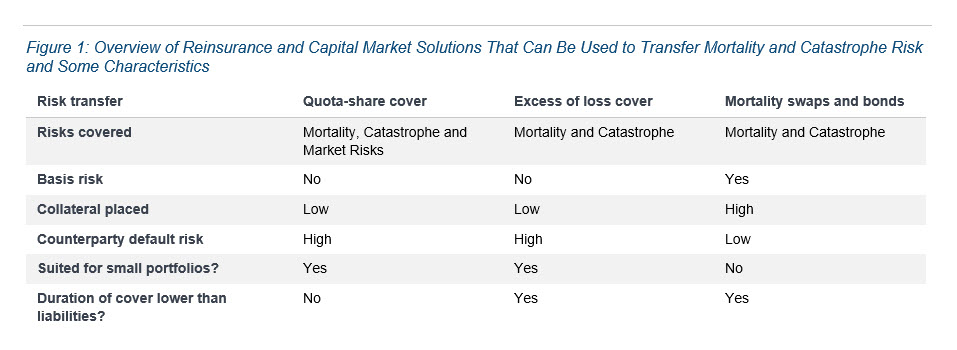

Mortality and catastrophe risk are introduced to the insurer's balance sheet when writing protection covers. In the table in Figure 1, we look at the risks that are introduced with commonly used reinsurance covers such as quota-share, excess of loss and mortality/catastrophe bonds and swaps.

Quota-share reinsurance cover

A quota-share treaty is one of the covers that can be implemented for the transfer of mortality risk. For catastrophe risk this type of cover would be less suited. The cover enables the insurer to balance its risk profile, maximising diversification or maximising the offset with longevity risk, whilst retaining some of the premium income received. It is an indemnity cover, meaning that all mortality risk is transferred (in this case pro rata) and there is no basis risk. In practice, the quota-share cover will be mainly beneficial for smaller portfolios. Smaller portfolios can employ the law of large numbers to a lesser extent and, therefore, individual losses tend to have bigger relative impacts on the portfolio, increasing the portfolio's volatility. To sufficiently reduce the portfolio's volatility, make the transfer attractive from a reinsurer's point of view and keep the reinsurance premium low, the quota-share percentage for these covers tends to be quite high. As a result, these quota-share treaties could be considered as more a coinsurance construction rather than a risk cover. Advantages and disadvantages of a quota-share cover are included in our previous post on longevity risk.

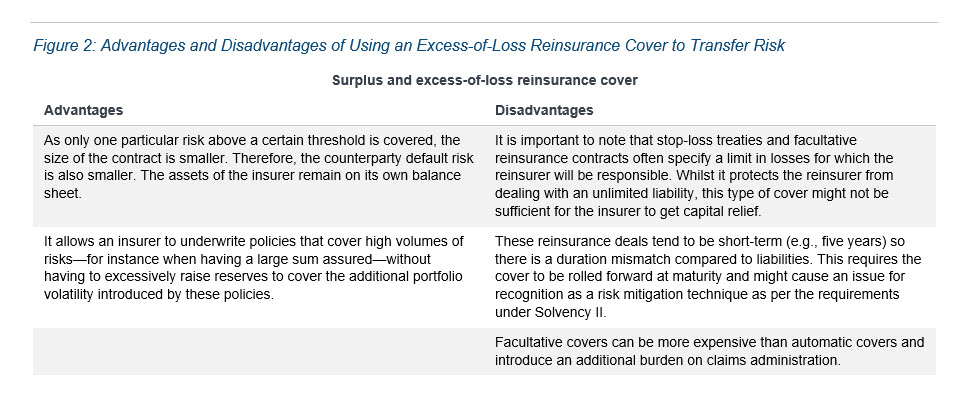

Surplus and excess-of-loss reinsurance cover

Surplus and excess-of-loss type reinsurance covers are a form of nonproportional reinsurance, where the reinsurer indemnifies the insurer for (a percentage of) losses that exceed a specified limit. It is possible to set the thresholds in different ways. It can, for instance, apply to all loss events during the policy period or only losses in aggregate. Treaties may also use bands of losses that are reduced with each claim.

Mortality and catastrophe swaps and bonds

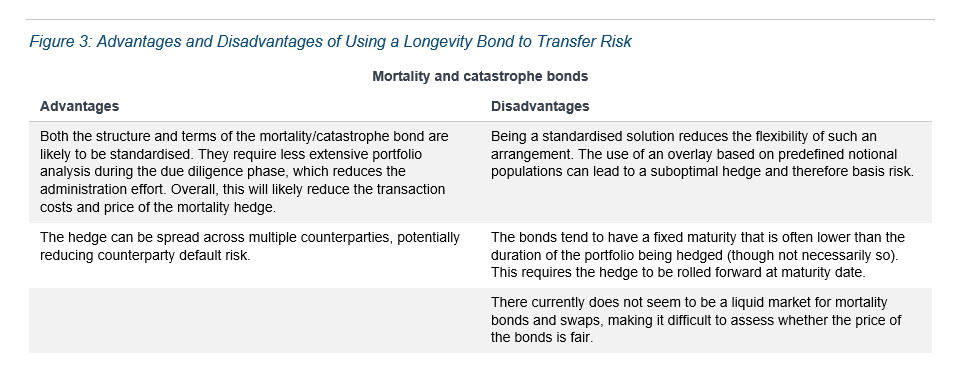

Catastrophe bonds are usually linked to losses due to a (series of) prespecified event(s) over a prespecified coverage period. Only in the case that this event occurs, and the costs related to it exceed a specific amount over the specified coverage period, will the bond pay out.

Mortality bonds and swaps (also known as survival swaps) work in the same way as longevity bonds and swaps. They enable the insurer to transfer mortality risk and catastrophe risk to capital markets rather than reinsurers. Instead of using a mortality improvement as an underlying index, a mortality index based on expected mortality is used. If the mortality swap or bond operates as an over-the-counter transaction, then this mortality index could be set equal to the expected mortality on the insurer's portfolio. If traded on capital markets, a standardised mortality table is more likely to be used instead.

Milliman research paper

The full research paper can be found on Milliman's website here, where you can also find an executive summary version that notes some of the key highlights of the research and acts as a guide to the full paper.