As many firms expand beyond traditional allocations to fixed income and mortgage-backed securities, this report provides a guide to 11 alternative asset classes insurers may wish to consider.

A breakdown of 11 alternative asset classes for life insurers

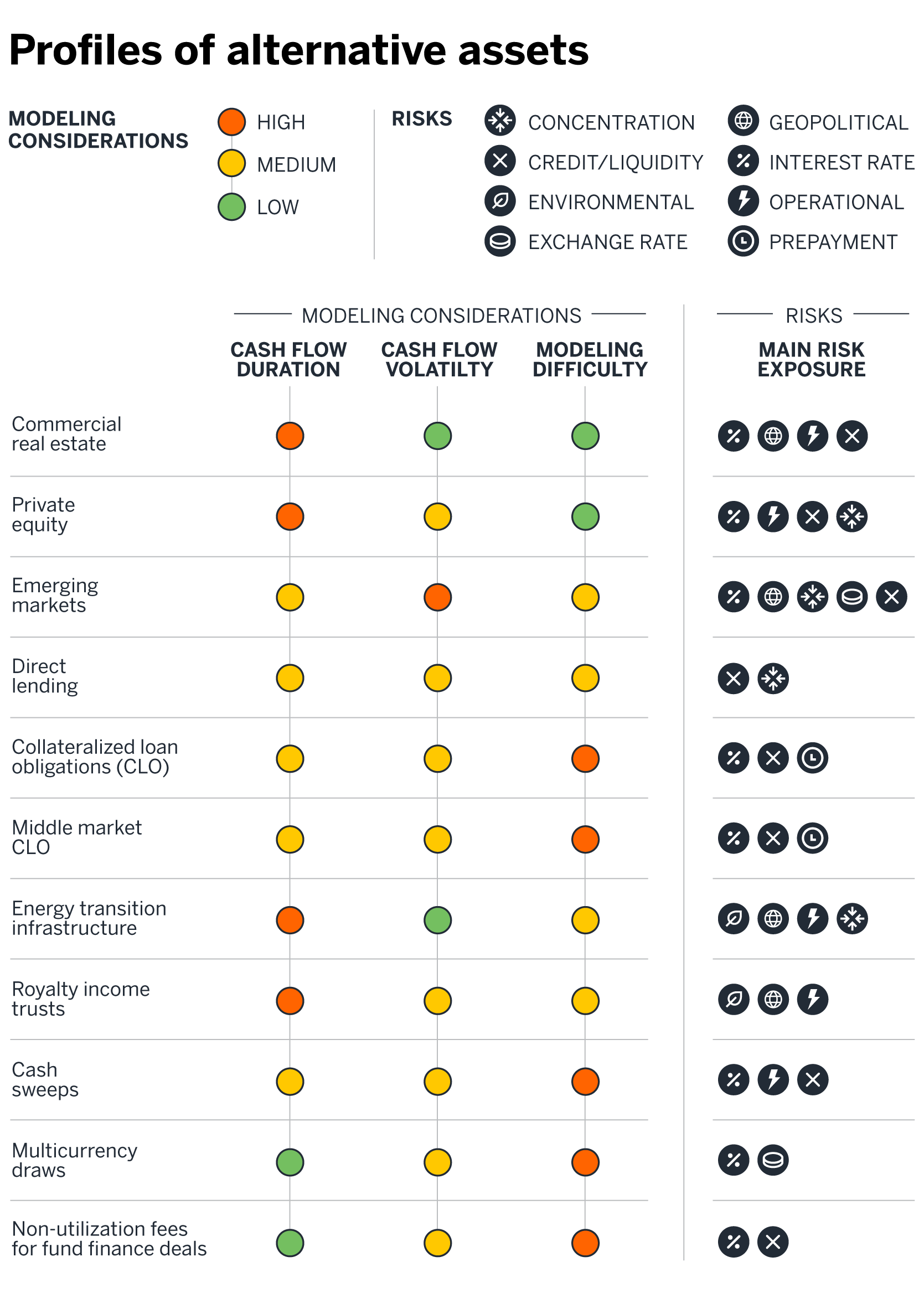

This report details the following investment vehicles:

Five-part profile of alternative investment types

For each of these alternatives, we provide a five-part profile consisting of that asset class’s:

- Structure and characteristics, including performance and current and projected future value

- Cash flow profile

- Risks to consider, as well as mitigation techniques to help reduce exposure to these economic risks

- Asset and liability management considerations

- Simplifications to help ease the inherent difficulties of modeling these complex asset types

Conclusions for life insurers considering alternatives

While investing in alternatives may provide attractive opportunities for diversification and potentially high returns, it is important for life insurers to keep in mind that some investment vehicles, including commercial real estate, private equity, and energy infrastructure, often lack the liquidity and transparency of traditional asset classes. Before pursuing a new allocation, insurers should be cautious and conduct thorough research. It is also important to remember that, while this research details 11 alternative asset classes that are gaining in popularity, this paper is not an exhaustive source of every alternative investment type available.