Most retirees will have access to Medicare at age 65, but many planning for retirement do not have a clear understanding of what Medicare covers, what additional options are available, or, most importantly, what their retiree healthcare will cost. In this article, we review the average projected cost for a 65-year-old retiree under the two most common pathways for Medicare-eligible retirees and explore how these costs may vary so you can begin to prepare for managing these unavoidable expenses.

The cost of healthcare in retirement

An average 65-year-old retiring in 2022 is projected to pay north of six figures for healthcare over the course of their remaining lifetime. Figure 1 shows the expected cost for both a male and female retiree under two typical coverage options. It is important to keep in mind that just how much you will pay in retirement may vary substantially from the average amounts in Figure 1 and is dependent on your individual circumstances. There are factors you can control such as when you retire, where you live during retirement, or what benefit plan you choose. You will have less control over factors such as your health status or how long you will live, both of which are primary drivers of how much your healthcare will cost. The costs for the average retiree presented in Figure 1 are a helpful starting point, but you must consider all of these factors and more in order to ensure you are financially prepared to address your healthcare needs during retirement.

Figure 1: Projected remaining lifetime healthcare expenses for a healthy 65-year-old retiring in 2022

What options do Medicare-eligible retirees have?

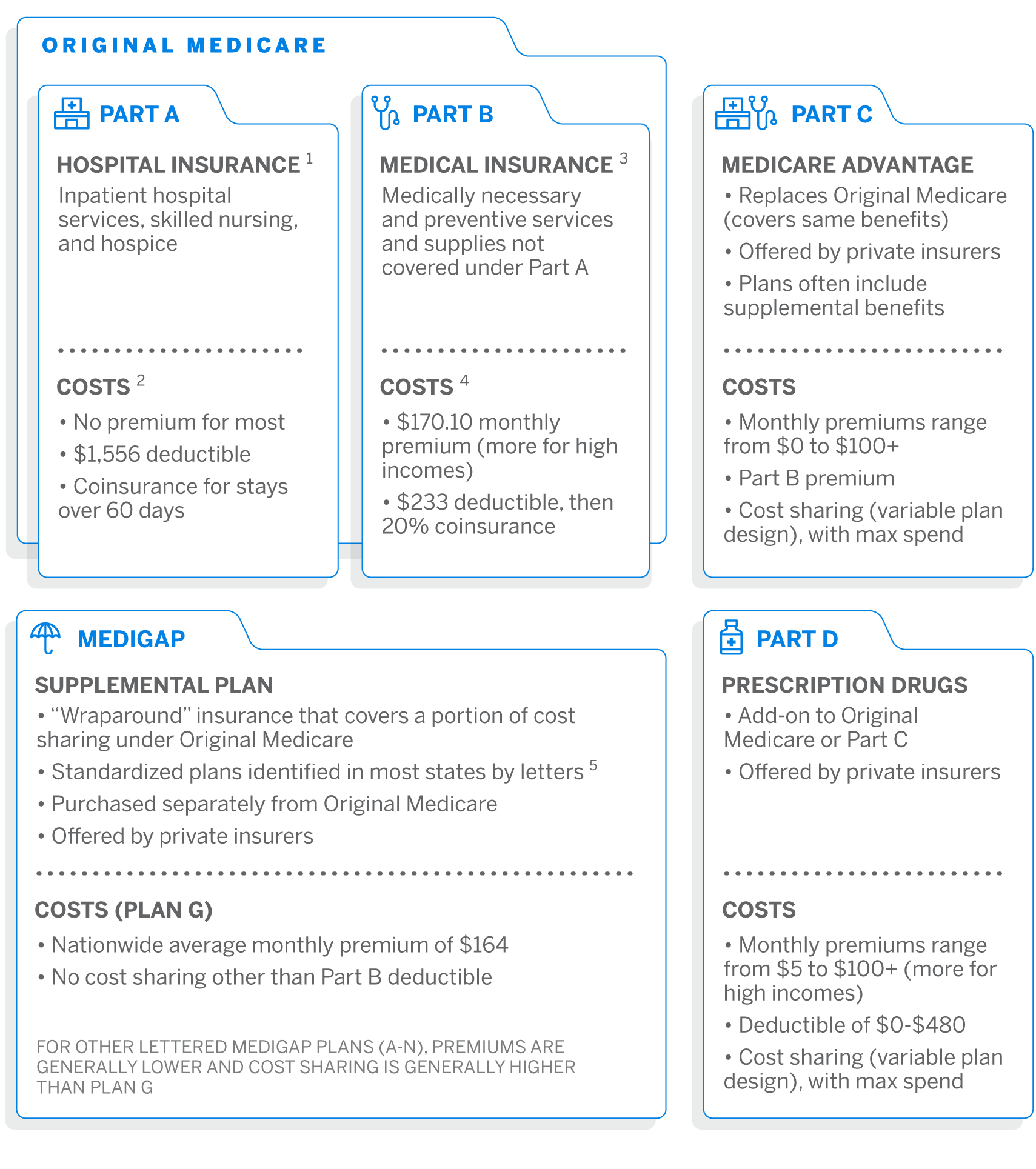

Most retirees are eligible for Medicare at age 65 (or earlier, in some cases). Figure 2 gives a brief overview of the medical and prescription drug coverage options available to retirees through Medicare.

Coverage options and costs

We review costs under the two most common pathways taken by Medicare-eligible retirees:

- Original Medicare plus Medigap plus Part D

- We assume Medigap Plan G, as it is the most popular plan for new enrollees

- We assume the 2022 Part D standard benefit design6

- Medicare Advantage plus Part D (MAPD)

- We assume an enrollment-weighted average premium and out-of-pocket cost across all MAPD plans7 (i.e., not limited to a specific plan design)

Although the majority of Medicare beneficiaries are covered under either Medigap or Medicare Advantage,8 we acknowledge that retirees may have other coverage such as employer-sponsored coverage, Medicaid, or Veterans Affairs (VA) healthcare that would likely reduce their cost of healthcare during retirement. Retirees may also choose not to add any supplemental coverage to Original Medicare, which may increase or decrease overall healthcare spending, depending on utilization.

Original Medicare plus Medigap (Plan G) plus Part D (standard benefit)

A healthy 65-year-old male retiring in 2022 is projected to spend approximately $264,000 on healthcare expenses during his retirement. The retiree is assumed to have a life span of 88 years. To cover this future spend in today’s dollars, he needs $177,000 in savings in 2022.

A healthy 65-year-old female retiring in 2022 is projected to spend approximately $300,000 on healthcare expenses during her retirement. The retiree is assumed to have a life span of 90 years. To cover this future spend in today’s dollars, she needs $194,000 in savings in 2022.

If the female lives the same number of years as the male retiree (to age 88), she is projected to spend approximately $260,000 ($4,000 less than the male). She needs $175,000 in savings in 2022 to cover this future spend in today’s dollars.

Medicare Advantage plus Part D

A healthy 65-year-old male retiring in 2022 is projected to spend approximately $137,000 on healthcare expenses during his retirement. The retiree is assumed to have a life span of 88 years. To cover this future spend in today’s dollars, he needs $92,000 in savings in 2022.

A healthy 65-year-old female retiring in 2022 is projected to spend approximately $158,000 on healthcare expenses during her retirement. The retiree is assumed to have a life span of 90 years. To cover this future spend in today’s dollars, she needs $103,000 in savings in 2022.

If the female lives the same number of years as the male retiree (to age 88), her costs are projected to be about the same as the male retiree.

Comparing Medigap and Medicare Advantage

The table in Figure 3 highlights some of the key differences between an average Medigap and Medicare Advantage plan.

Figure 3: Medigap vs. Medicare Advantage

| Medigap | Medicare Advantage (MA) | |

|---|---|---|

| Services offered | Same as Original Medicare. | Same as Original Medicare. Often also includes other supplemental benefits (dental, vision, hearing, etc.). |

| Relationship to Original Medicare | “Wraps around” Original Medicare to provide coverage for out-of-pocket (OOP) costs. | Replaces Original Medicare. |

| Part D prescription coverage | Not included. Would need to be purchased separately. | Often included, referred to as “MAPD” plan. If not, may be purchased separately. |

| Provider network | Same as Original Medicare. | Typically more limited than Original Medicare. |

| Prior authorization/referrals | Generally no prior authorization or referral required. | May require prior authorization and/or a referral. |

| Premium level | Varies widely based on age, geography, plan design. Generally higher than MA. | Varies widely based on geography, plan design. Generally lower than Medigap. |

| Out-of-pocket costs | Limited cost sharing provides greater protection against unexpected OOP costs at the expense of higher monthly premiums. | Varies widely, with potentially high limits and a risk of substantial additional costs. |

While retirees may not be enrolled in both plan types at the same time, a participant may switch between plan types during annual open enrollment periods. Medigap premiums are often “issue-age” and may cost more at ages after 65 if enrolling late or switching from MA. Insurers may also charge more or not offer coverage at all if you are applying for Medigap coverage after an initial six-month enrollment period (starting the first month you have Medicare Part B and are 65 or older).

Choosing which coverage option is right for you will depend on your individual situation. A healthier retiree who values lower premiums over freedom to choose any healthcare provider may prefer Medicare Advantage. A retiree with higher expected healthcare utilization either currently or expected in the future may prefer Medigap. Whatever your situation, it is important to understand the options available to you and their differences so you can make the best decision for both your health and your finances.

Financial impact of retiring earlier or later than age 65

Financial impact of retiring earlier

Most people cannot apply for Medicare until age 65, and if you retire before then your healthcare costs will generally be much higher. For example, if you retire five years earlier, at age 60, you can expect to pay approximately the following over your remaining lifetime:

- 53% more for healthcare expenses than if you wait until age 65 and enroll in Original Medicare plus Medigap (Plan G) plus Part D (standard benefit).

- 77% more for healthcare expenses than if you wait until age 65 and enroll in an MAPD plan.

Note that the healthcare costs prior to age 65 are the same in each scenario.

Financial impact of retiring later

Conversely, delaying retirement allows retirees to boost retirement savings and continue earning income and employer-sponsored benefits, including healthcare. This can also mean significant healthcare cost savings. For example, if you retire five years after turning age 65 (at age 70), you can expect to pay approximately the following over your remaining lifetime:

- 28% less for healthcare expenses than if you retired at age 65 and are enrolled in Original Medicare plus Medigap (Plan G) plus Part D (standard benefit).

- 29% less for healthcare expenses than if you retired at age 65 and enrolled in an MAPD plan.

Taking your health into consideration

Out-of-pocket costs for healthcare are an important part of retirement planning, and how much you will spend depends on a variety of health factors:

- Your current health status including heart problems, arthritis, and other chronic or recurring ailments.

- Risk factors that could affect your future health status, such as tobacco use or high blood pressure.

- The level of financial risk that you are willing to take on (or withstand) by trading off lower premiums for higher deductibles and out-of-pocket costs.

Retirees with above average health

Healthier retirees (representing the average of the lowest-cost third of Medicare beneficiaries) can expect to spend approximately the following over their remaining lifetime:

- 12% less on healthcare costs for Original Medicare plus Medigap (Plan G) plus Part D (standard benefit)

- 28% less on healthcare costs for an MAPD plan

Retirees with below average health

Retirees with below average health (representing the average of the highest-cost third of Medicare beneficiaries) can expect to spend approximately the following over their remaining lifetime:

- 18% more on healthcare costs for Original Medicare plus Medigap (Plan G) plus Part D (standard benefit)

- 45% more on healthcare costs for an MAPD plan

Even if you don’t have any current health issues, it is important to consider that your health status can change rapidly. There is great potential for considerable healthcare spending in the later years of life, especially if you have a chronic condition or an acute episode such as a heart attack or stroke. If you have health issues or are at risk for developing health issues, consider addressing this potential risk by budgeting for a below average health status in retirement.

Life span considerations

While you can’t control your life span, you should plan for it. A range of plus or minus five years in life span can increase or lower retirement healthcare costs significantly. Under either plan option:

- Living five years longer increases the amount you spend by approximately 40%

- Living five years less reduces the amount you spend by approximately 32%

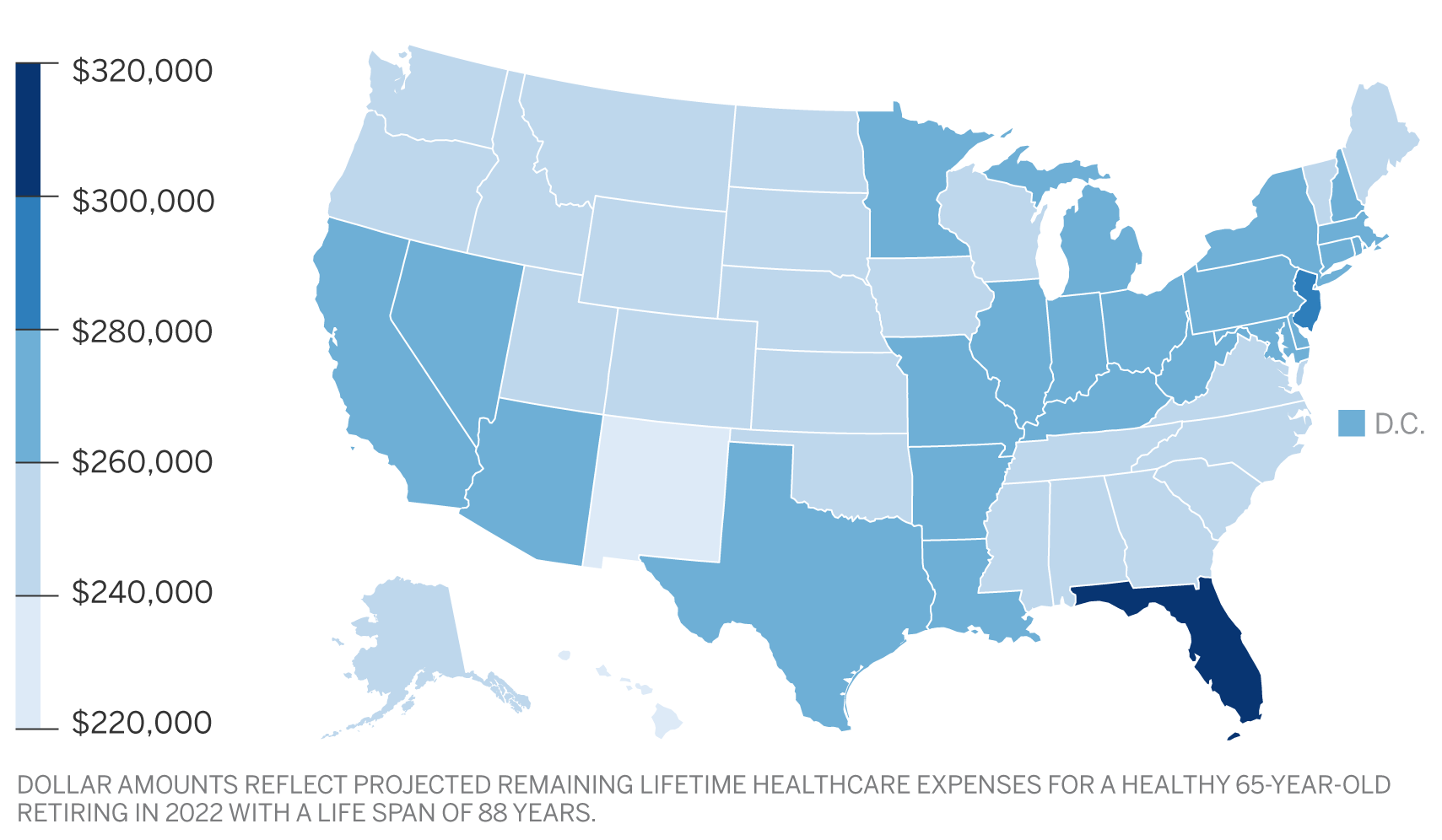

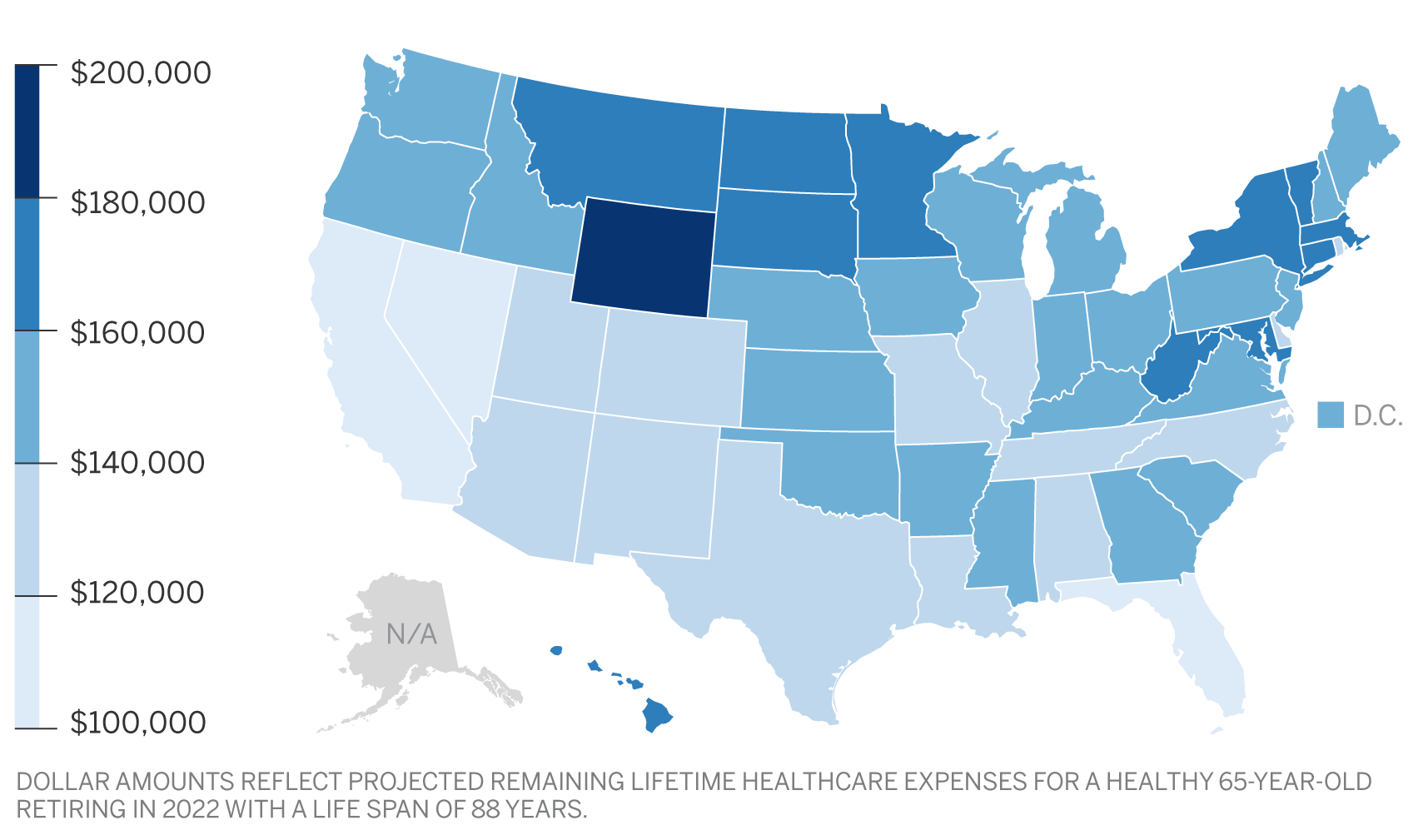

Cost variation by state

When it comes to the amount you will pay for healthcare in retirement, where you live can also be a significant factor. Although Original Medicare has standardized costs that are the same in each state, the cost of Medicare Advantage, Medigap, and Part D plans can vary greatly by state. The maps in Figures 4 and 5 show which states have higher, lower, and average costs for both pathways; for Original Medicare plus Medigap plus Part D, and for Medicare Advantage plus Part D.

Figure 4: Total spend by state – Original Medicare Plus Medigap Plan G Plus Part D

Figure 5: Total spend by state – Medicare Advantage Plus Part D (MAPD)

Summary

Healthcare expenses are an important, and sometimes overlooked, component of overall retirement planning. Start by asking yourself the following questions, and even discuss some of them with your healthcare and financial advisors:

- What is my health status (average, above average, or below average) and what can I do to improve my health status now and in the future?

- At what age am I going to retire?

- At what age am I going to enroll in Medicare, and what other types of coverage will I need?

- Do my healthcare providers participate in Medicare Advantage plans? If not, am I willing to switch providers to access reduced premiums with Medicare Advantage?

- Do I want to pay higher premiums for the freedom to see any healthcare provider I choose, or am I willing to limit my choices to in-network providers to pay lower premiums?

- Do I want to spend less money on my retirement healthcare plan monthly premiums and take on more risk around out-of-pocket expenses?

- Where am I going to live in my retirement years, and how will it affect my health costs?

- How should I change my retirement savings strategy to pay for the retirement healthcare plan of my choice?

By taking a realistic look at your health and healthcare expenses as part of your overall retirement plan, and budgeting accordingly, you position yourself to enjoy a less stressful, more healthy retirement.

Sources and assumptions

Projected costs have been calculated using the following assumptions:

- Projected costs are based on the Milliman Health Cost Guidelines™ and premium information obtained from the Centers for Medicare and Medicaid Services (CMS).

- Projected costs include both premiums and out-of-pocket expenses for the medical and prescription drug plans and benefits outlined under each option.

- The health status of the retiree is assumed to be average for their entire life span. This average is based on a typical commercially insured population in the Milliman Health Cost Guidelines.

- Expected life span for current 65-year-old male and female is based on the 50th percentile using the PubG-2010 mortality table9 for general populations with mortality improvement scale MP-2021.10

- To calculate increasing healthcare costs over time, Milliman estimates a future medical trend of 4.6% annually over the next 25 years. This estimate is derived using long-term economic and medical assumptions based on the Getzen-SOA trend model11 and Milliman research.

- Aging trend is also included, in addition to medical trend, where applicable (i.e., out-of-pocket expenses are generally expected to be higher for older retirees).

- For calculations of present values in today’s dollars (i.e., needed savings net of taxes), an investment return of 3.0% per year is used.

Limitations and qualifications statement

The information contained in this report has been prepared by Milliman for the purpose of retirement planning. The data and information presented may not be appropriate for any other purpose.

Any distribution of the information should be in its entirety. Any user of this report must possess a certain level of expertise in actuarial science and healthcare modeling so as not to misinterpret the information presented.

The projection of retiree healthcare costs is a complicated exercise, and actual results will vary from projections for a variety of reasons, including but not limited to changes in the following key factors:

- Laws, regulations, and rules governing healthcare plans in the United States at the federal and state levels, such as changes to the Medicare eligibility age and state Medicaid eligibility requirements

- Market forces that impact healthcare costs and plans that are available to retirees

- Changes in health status of retirees

- External shocks, such as epidemics or trends in new diseases

All of these factors may have a material effect on retiree healthcare costs. Thus, it is important to continually monitor all of the factors influencing healthcare costs and modify projections as needed.

The COVID-19 pandemic has had a dramatic effect on healthcare costs since March 2020, and there remains substantial uncertainty regarding the future impact of COVID-19. The effect on 2022 premiums may vary significantly by carrier, and it is unclear what portion of the premium changes from 2021 to 2022 are due to COVID-19. While some premiums may have explicit COVID-19 adjustments, we have chosen not to make any other explicit adjustments to the projected premium or out-of-pocket costs in this analysis due to COVID-19. It is possible that the COVID-19 pandemic could have a material impact on the projected costs.

The Inflation Reduction Act became law after this analysis was performed, and the figures included herein do not reflect any impact it may have on projected retiree healthcare costs.

Milliman makes no representations or warranties regarding the contents of this report to parties that receive this report. Parties are instructed that they are to place no reliance upon this report prepared by Milliman that would result in the creation of any duty or liability under any theory of law by Milliman or its employees. Parties receiving this report must rely upon their own experts in drawing conclusions about the premium rates, out-of-pocket costs, trend rates, and other assumptions.

Milliman has developed certain models to estimate the values included in this report. The intent of the models was to estimate future expected premiums and out-pocket claims costs. We have reviewed the models, including their inputs, calculations, and outputs, for consistency, reasonableness, and appropriateness to the intended purpose and in compliance with generally accepted actuarial practice and relevant actuarial standards of practice (ASOP).

The models rely on data and information as input to the models. We have relied upon certain data and information (as described above) for this purpose and accepted it without audit. To the extent that the data and information provided is not accurate, or is not complete, the values provided in this report may likewise be inaccurate or incomplete.

The models, including all input, calculations, and output, may not be appropriate for any other purpose.

We performed a limited review of the data used directly in our analysis for reasonableness and consistency and have not found material defects in the data. If there are material defects in the data, it is possible that they would be uncovered by a detailed, systematic review and comparison of the data to search for data values that are questionable or for relationships that are materially inconsistent. Such a review was beyond the scope of our assignment.

Guidelines issued by the American Academy of Actuaries require actuaries to include their professional qualifications in all actuarial communications. The authors of this report, who are credentialed actuaries, are members of the American Academy of Actuaries and meet the qualification standards for performing the analyses contained herein.

1 Medicare.gov. What Medicare covers. Retrieved September 8, 2022, from https://www.medicare.gov/what-medicare-covers.

2 Medicare.gov. Costs. Retrieved September 8, 2022, from https://www.medicare.gov/your-medicare-costs/medicare-costs-at-a-glance.

3 What Medicare covers, op cit.

4 Medicare.gov, Costs, op cit.

5 Medicare.gov. How to compare Medigap policies. Retrieved September 8, 2022, from https://www.medicare.gov/supplements-other-insurance/how-to-compare-medigap-policies.

6 CMS (November 2021). 2021/2022 Standard Drug Costs. Retrieved September 8, 2022, from https://cmsnationaltrainingprogram.cms.gov/sites/default/files/shared/Standard%20Drug%20Costs_2022_FINAL.pdf.

7 We excluded MA-only plans, employer group waiver plans (EGWPs), Medicare Cost plans, Medical Savings Account (MSA) plans, Medicare-Medicaid Plans (MMPs), and special needs plans (SNPs).

8 Milliman. Medicare Beneficiary Out-of-Pocket Cost Exposure for Part B Drugs and Services. Retrieved September 8, 2022, from https://www.milliman.com/-/media/milliman/pdfs/2022-articles/7-19-22_medicare-part-b-oop-infographic.ashx.

9 Society of Actuaries (February 25, 2019). Pub-2010 Public Retirement Plans Mortality Tables. Retrieved September 8, 2022, from https://www.soa.org/resources/research-reports/2019/pub-2010-retirement-plans/.

10 Society of Actuaries. Mortality Improvement Scale MP-2021. Retrieved September 8, 2022, from https://www.soa.org/resources/experience-studies/2021/mortality-improvement-scale-mp-2021/.

11 Society of Actuaries. Getzen Model of Long-Run Medical Cost Trends Update for 2022-2030+. Retrieved September 8, 2022, from https://www.soa.org/resources/research-reports/2021/2021-getzen-model/.