The Centers for Medicare & Medicaid Services (CMS) contracts with private insurers to offer Medicare benefits through a program called Medicare Advantage (MA). The number of Medicare beneficiaries enrolling in an MA plan has steadily grown since the program’s inception, particularly in the past few years.1 This article describes six important topics insurers should consider as they contemplate entering the MA market.

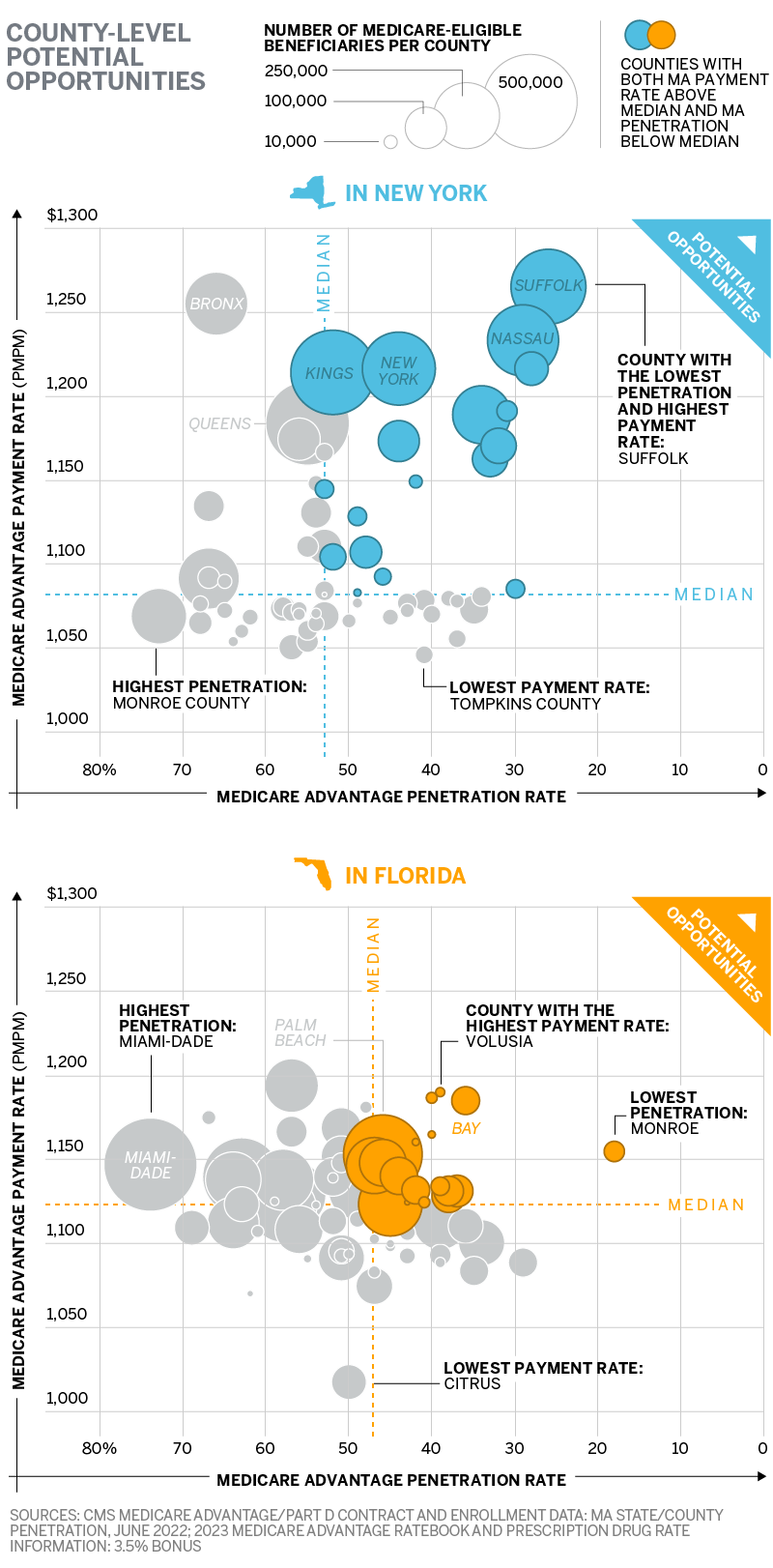

Two states, New York and Florida, will serve to highlight why these topics are important. Three of the six topics (MA service area size, MA penetration rate, and MA payment rate) are shown in the below figure. These county views of New York and Florida show significant differences by county that may indicate varied opportunity. Each of these topics and others will be covered below.

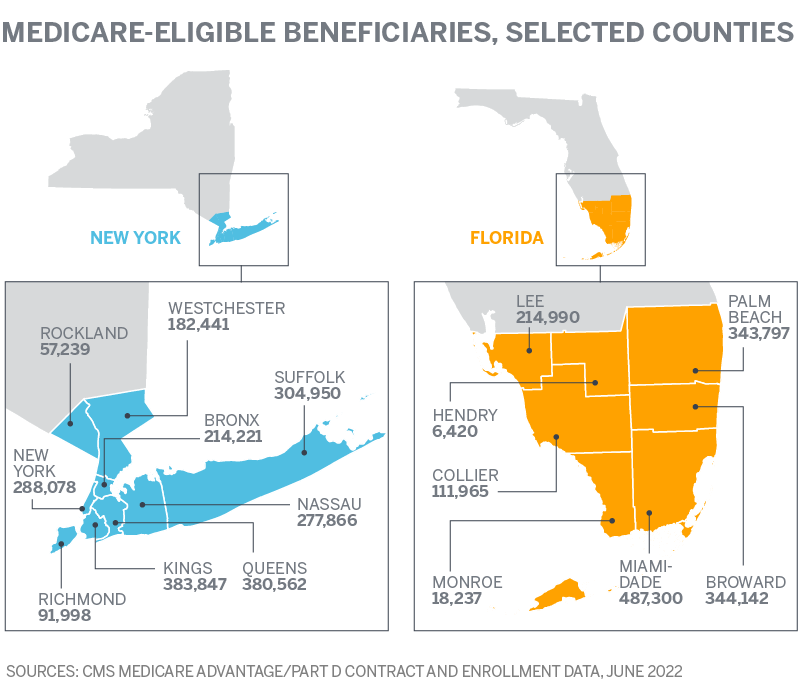

1. MA service area size

Consider what geographic area to bid in and whether there are enough Medicare-eligible beneficiaries within a service area to make the effort worth the investment. MA service areas are defined by county (or groups of counties). The size of the Medicare-eligible population should be evaluated to understand the potential opportunity. As an example, Hendry County in southern Florida has just over 6,000 Medicare-eligible beneficiaries. An insurer should consider whether an MA plan that includes only Hendry County is large enough.

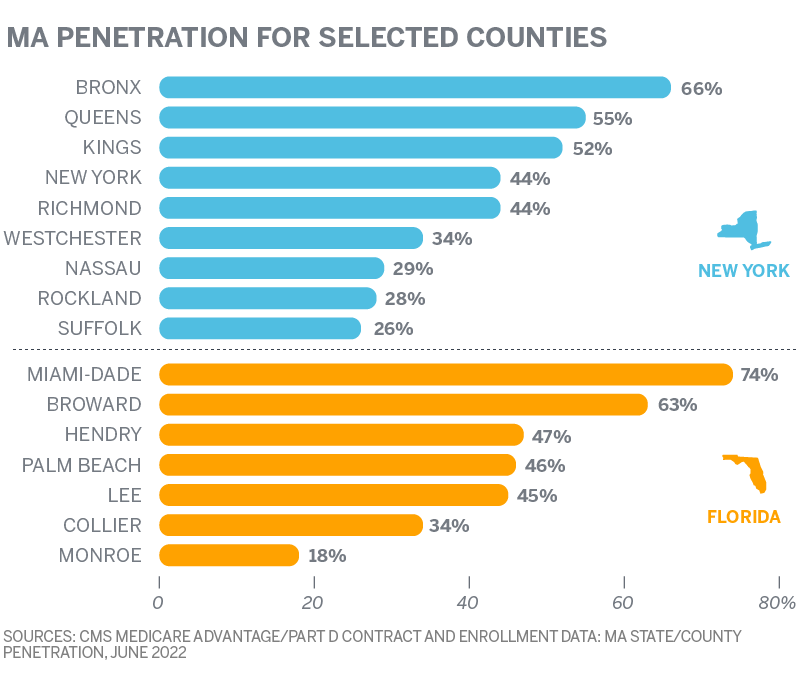

2. MA penetration rate

Consider whether the current MA penetration rate (MA beneficiaries divided by Medicare-eligible beneficiaries) is high within a service area. MA beneficiaries are known to be “sticky”—once enrolled, MA beneficiaries are not very likely to move from plan to plan.2 A service area with significant MA penetration is unlikely to present the same opportunity for a new insurer to capture market share as a less saturated service area.

In the New York City area, for example, MA penetration rates vary from 26% in Suffolk County up to 66% in the Bronx. In south Florida, MA penetration rates vary from 18% in Monroe County to 74% in Miami-Dade County, the most populous county in the state.

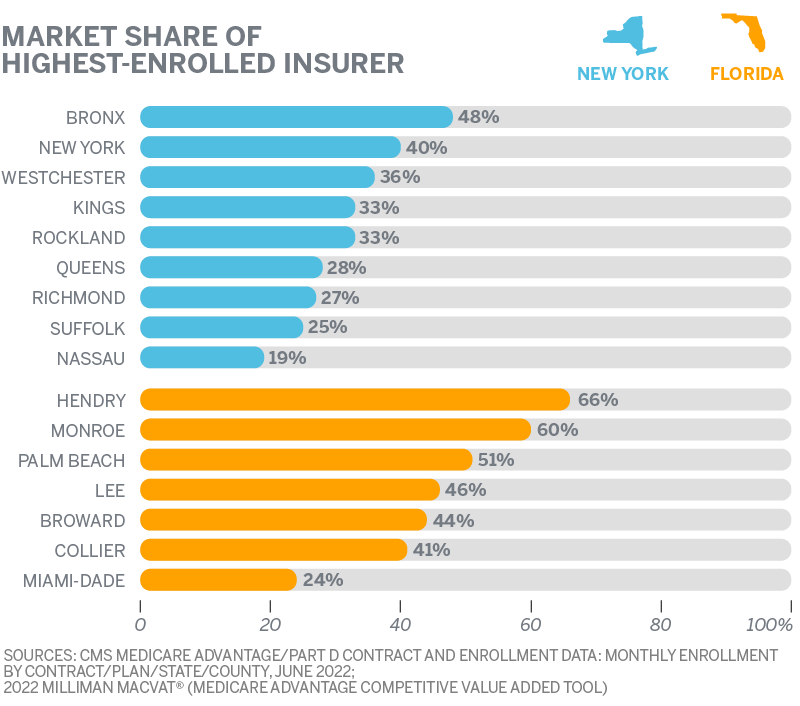

3. Competition

Consider whether the prospective service area is currently dominated by one or more competitors. In Bronx County, for example, the insurer with the highest enrollment has 48% of the MA enrollment. Studies have shown that seniors do not regularly switch from their current plans3 so a service area that is dominated by one or two insurers with a high MA penetration rate may not indicate a significant opportunity for a new insurer in the service area.

4. MA payment rate

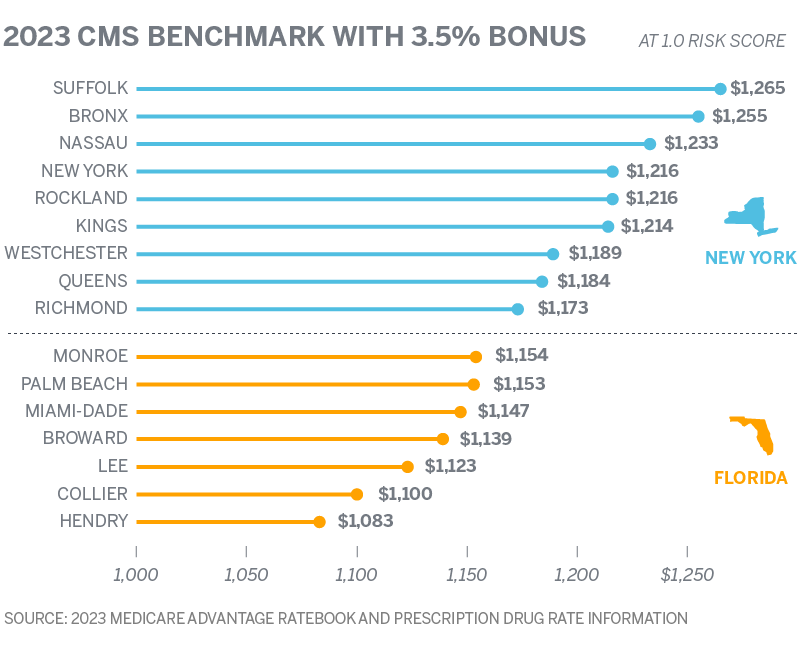

Consider whether the MA payment rate (i.e., CMS benchmark revenue to the plan) is sufficient to cover the expected claims and administrative cost of the plan as well as any desired profit. CMS will pay an insurer, at most, the benchmark amount per beneficiary to provide benefits at least as generous as traditional Medicare. CMS gives a 3.5% bonus for new plans. These benchmark amounts vary by county and, as shown in the table below, the difference between the lowest and highest benchmark counties varies by 6.6% and 7.9% in the southern Florida and New York City regions, respectively. Insurers should consider whether they are able to negotiate provider contracts and offer competitive benefits within a specified service area for a cost less than the MA benchmark. If a plan costs more than the benchmark, beneficiaries are required to pay a premium (rather than $0), which may reduce the plan’s competitiveness if there are $0 plans with similar benefits offered in the same service area.4

5. Star rating

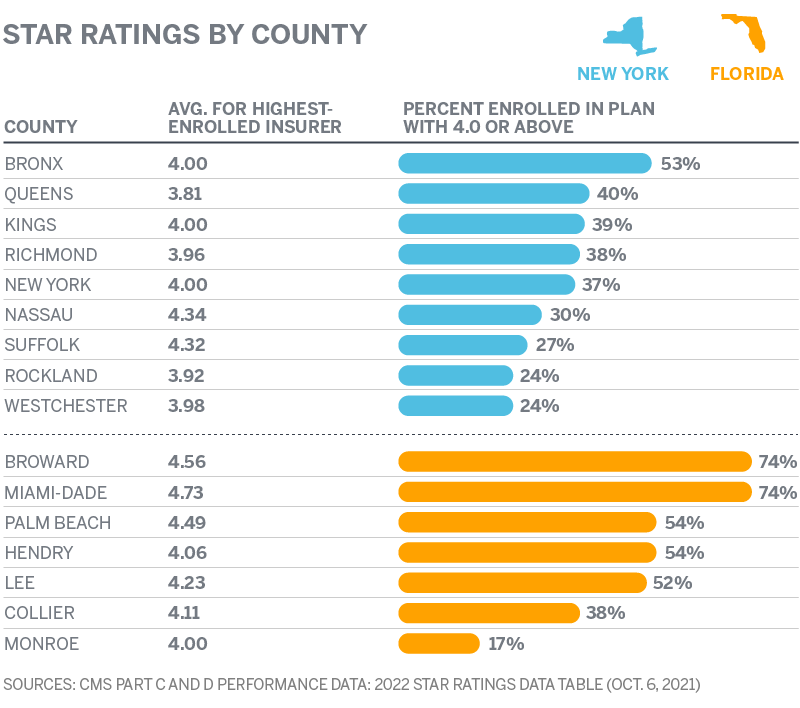

CMS assigns MA plans star ratings, a grading system intended to award high-quality plans with higher MA payment rates.5 Generally, CMS pays a higher benchmark to plans that receive a 4.0-star rating or above. Those higher benchmarks allow insurers to offer better benefits that may attract more beneficiaries. The next table shows the average star rating for the highest enrolled insurer in each county as well as the percentage of all MA beneficiaries within each county enrolled in a plan with a star rating of at least 4.0. The percentage of MA beneficiaries in a 4.0-star plan varies significantly by county. However, the highest-enrolled insurer in almost every county has a 4.0 average star rating or above.

6. Risk scores

The benchmark is adjusted for the health status of the insurer's enrolled beneficiaries. Risk scores based on submitted diagnosis codes serve as a proxy for health status. The higher the risk score, the higher the expected costs for any given beneficiary. Therefore, the insurer will receive higher payments for beneficiaries who have higher risk scores and lower payments for beneficiaries with lower risk scores.

Consider the following:

- Whether the organization is prepared to properly capture beneficiary diagnosis codes through risk score coding initiatives. CMS assumes organizations are increasing their revenue through these coding initiatives and reduces risk scores (and therefore revenue) by approximately 6% with an “MA coding pattern adjustment.”6 In order to be properly compensated for their insured populations, insurers need to have diagnosis coding processes in place to offset this revenue reduction.

- Whether the organization has the capabilities to properly address the disease burden of the incoming population. As shown below, average risk scores can vary significantly among nearby counties. In addition to meeting CMS’s network adequacy requirements, organizations should have the care and utilization management infrastructure required to provide appropriate, efficient, high-quality care and avoid unnecessary and/or duplicative services.

This article covers six important topics insurers should consider as they contemplate entering the MA market, but the list above is in no way exhaustive. Reach out to your Milliman consultant for additional guidance related to other topics such as provider networks, compliance, and medical management, or to understand how the above may apply to another geography.

Sources, caveats, disclosures, and qualifications

The analysis provided in this article is based on enrollment data and other information made available by CMS. We have not audited or verified this data and other information. If the underlying data or information is inaccurate or incomplete, the results of our analysis may likewise be inaccurate or incomplete.

Eric Buzby and Harsha Mirchandani are members of the American Academy of Actuaries and meet its qualification standards to perform the analyses underlying the exhibits contained herein.

1 Freed, M. et al. (June 21, 2021). Medicare Advantage in 2021: Enrollment Update and Key Trends. Kaiser Family Foundation. Retrieved July 13, 2022, from https://www.kff.org/medicare/issue-brief/medicare-advantage-in-2021-enrollment-update-and-key-trends.

2 Koma, W. et al. (December 2, 2019). No Itch to Switch: Few Medicare Beneficiaries Switch Plans During the Open Enrollment Period. Kaiser Family Foundation. Retrieved July 13, 2022, from https://www.kff.org/medicare/issue-brief/no-itch-to-switch-few-medicare-beneficiaries-switch-plans-during-the-open-enrollment-period.

4 Piper, B. & Yeh, M. (April 8, 2019). Hang on tight! Why maintaining a zero-dollar MA-PD premium plan is worth the effort. Milliman White Paper. Retrieved July 13, 2022, from https://www.milliman.com/en/insight/hang-on-tight-why-maintaining-a-zerodollar-mapd-premium-plan-is-worth-the-effort.

5 Grzeskowiak, D. & Zenner, P. (November 8, 2017). Medicare Advantage star ratings: Basics and best practices. Milliman White Paper. Retrieved July 13, 2022, from https://www.milliman.com/en/insight/medicare-advantage-star-ratings-basics-and-best-practices.

6 CMS (April 4, 2022). Announcement of Calendar Year (CY) 2023 Medicare Advantage (MA) Capitation Rates and Part C and Part D Payment Policies. Retrieved July 13, 2022, from https://www.cms.gov/files/document/2023-announcement.pdf.