Women in Ethiopia and the world over play a huge and growing role in farming and food production. Yet they have limited access to the resources and services that smallholder farmers need – including finance, extension services, and improved technologies. In addition to these disadvantages, they are also much more vulnerable than men to the risks and shocks that threaten their livelihoods, particularly those connected with climate change. At the MicroInsurance Centre at Milliman (MIC@M), we are working with partners to strengthen women’s access to insurance and build knowledge about the challenges faced by providers and clients.

Women farmers take part in a focus group discussion in Tigray. Photo credit: Anuja Jaitly

Recently, we took part in a joint research initiative aiming to develop guidance on how to improve the delivery and increase the value of agricultural and climate risk insurance to women clients (read more about climate risk insurance). Our current grant project entitled Managing Risk for Rural Development: Promoting Microinsurance Innovations (MRRD), funded by the International Fund for Agricultural Development (IFAD), worked with George Washington University’s (GWU) Capstone Program and the INSURED program (Insurance for Rural Resilience and Economic Development).

Four student researchers from GWU (Vanessa Dos Santos, Jennie Persson, Lucia Amiri-Talesh, and Esther Ongay) conducted a global desk study on making climate insurance gender inclusive, and this was complemented by fieldwork in rural areas of Ethiopia. The student researchers were supported by an advisory committee of industry experts, including members from MIC@M, IFAD, the German Agency for International Cooperation (GIZ), the International Labour Organisation (ILO), InsuResilience, the Platform for Agricultural Risk Management (PARM), Women’s World Banking, and the World Food Programme (WFP). In Ethiopia, our local MRRD coordinator, Mebrahtu Brhan, facilitated a short field immersion in the northern Tigray region during March 2019.

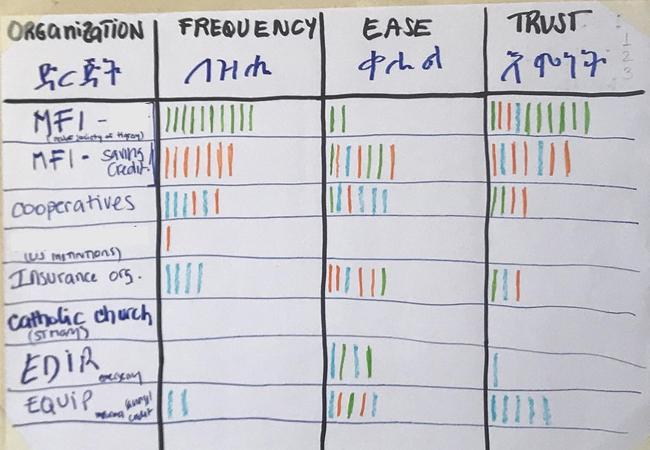

Focus group participants' ranking (green = top choice, orange = second choice, blue = third choice) of potential insurance distribution channels according to various criteria. For this group, microfinance institutions (MFIs) stand out as the most frequented and trusted channel. Photo credit: Anuja Jaitly

In order to better understand the types of information that can improve the design of gender-inclusive climate risk insurance programs, the student research team met with over 120 smallholder farmers in six rural kebeles, or communities, in northern Tigray. The team carried out 12 focus group discussions centered around issues related to insurance delivery and ways to create more gender-responsive insurance programs. These included:

- Potential distribution channels. Women and men participants were asked to identify, discuss, and rank various channels and organizations according to the levels of frequency and ease with which they accessed them, and their trustworthiness. Groups also discussed how likely they were to purchase insurance through those channels.

- Value-added services and bundling. Specific gender roles, risks, and responses in the context of agriculture were identified and prioritized in order to identify ways to improve the value and composition of insurance programs, including whether it was effective to bundle them with other services.

- Marketing and education. Participants discussed sources of information that they use and trust in order to identify dissemination approaches that would reach both women and men effectively.

What we learned

The discussions revealed both similarities and differences between women and men, which could feed into the design of agricultural and climate risk insurance in the Ethiopian context. For example:

- According to the research, women farmers in Tigray were far less likely than men to interact with local agricultural extension agents or cooperatives, making these channels less effective for delivering products or information to women. For insurers, this type of knowledge about how best to reach women farmers is key to informing the distribution partnerships they enter into.

- In addition, as reported in the 2015 SheforShield study by IFC, AXA, and Accenture on the market for women’s insurance, women want to understand the details of their insurance more than men, further underlining the need to select appropriate channels for women and to invest in gender-sensitive client education.

- The research also emphasized the importance of practicing gender-sensitive research methodologies to ensure that women’s voices are heard and their needs and constraints are understood. Minimum requirements for a gendered approach include holding separate focus groups for women and men, thus creating a supportive environment for women to openly share their experiences, ideas, wants, and needs.

More information is available in the related brief How to improve access to insurance for rural women

The MRRD team in Ethiopia is currently preparing for a second pilot season of an index-based drought insurance product for cereals farmers who take part in IFAD’s Participatory Small-scale Irrigation Development Programme (PASIDP II). We are working in partnership with WFP’s R4 Rural Resilience Initiative as well as with local insurers in the Amhara and Tigray regions to reach farmers through the PASIDP irrigation water users’ associations. Although no claim payout was triggered for the last season (June – October 2019), work is ongoing to inform the communities and provide technical support to the insurers regarding distribution, among other things. Many more rural smallholders – women and men – are expected to benefit from insurance protection this year.

MRRD is a four-year grant project implemented by the MicroInsurance Centre at Milliman and funded by IFAD, with the goal to increase resilience, strengthen capacity to manage risks, and improve the livelihoods of poor rural households who depend on off-farm and on-farm income in China, Ethiopia, and Georgia. We are doing this by developing innovative microinsurance solutions in each country. These solutions also seek to include additional, non-insurance components so that clients benefit from a comprehensive risk management package. Where possible, we are also linking MRRD activities with the IFAD-financed project portfolio to leverage existing development efforts.

Resources

- Making agricultural and climate risk insurance gender inclusive: How to improve access to insurance for rural women (brief)

- Building women’s resilience and livelihoods

- INSURED: Insurance for rural resilience and economic development (brief)

- PARM: Gender in Agriculture Risk Management

- InsuResilience Global Partnership: Applying a Gender Lens to Climate Risk Finance and Insurance