The property and casualty (P&C) insurance industry published financials for the second quarter (Q2) of 2020, which show a decline in net premium mainly attributable to COVID-19, reversing the growth the industry has experienced in recent years. The premium decline was accompanied by a slightly more than offsetting decrease in incurred losses and other underwriting expenses, resulting in a P&C industry combined ratio in Q2 2020 of 99%, a one-point improvement over the prior year.

Premiums decline—but so do losses

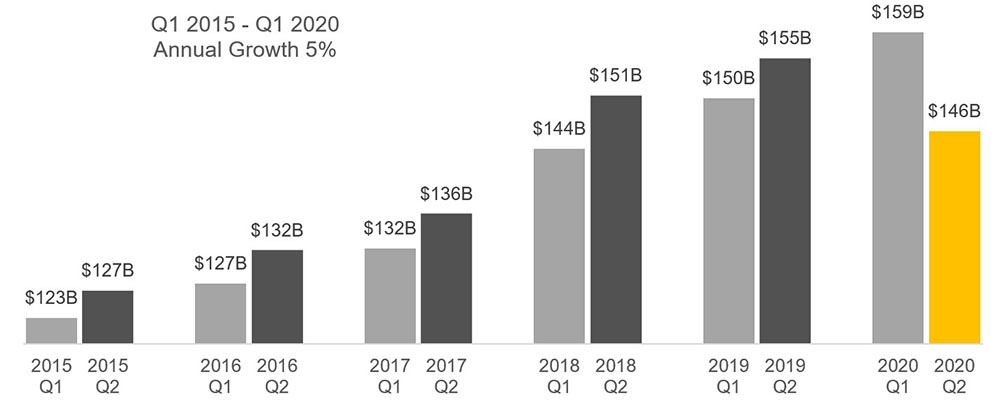

The industry annual net premium growth for the past five years has averaged 5%. This growth has been, at least temporarily, halted by the pandemic. The aggregate industry net earned premiums for Q2 2020 are $12 billion lower than those for Q1 2020 ($146 billion in Q2 versus $159 billion in Q1), representing a quarter-on-quarter (QOQ) decrease of 8%. It is possible that the decline in premiums is understated as the lines of business subject to premium audits may adjust downward in the future.

Figure 1: P&C Industry Net Premiums Earned during Calendar Quarter

Source: Quarterly statements for P&C industry.

The net incurred losses, loss adjustment expenses, and other underwriting expenses also decreased between Q1 and Q2. Due to the seasonality of certain lines of business, the year-over-year (YOY) comparison to Q2 2019 is a better metric, and this shows a $10 billion or 6% decrease in total underwriting losses and expenses and a similar decline in net earned premiums. The calendar quarter combined ratio for Q2 2020 was 99%, a one-point improvement over Q2 2019 as shown in Figure 2.

Figure 2: P&C Industry Net Combined Ratio during Calendar Quarter

| ($B) | 2019 Q1 |

2019 Q2 |

2020 Q1 |

2020 Q2 |

Change $ | Change % | |||

|---|---|---|---|---|---|---|---|---|---|

| YOY | QOQ | YOY | QOQ | ||||||

| (1) Net Premiums Earned | 150 | 155 | 159 | 146 | (9) | (12) | (6%) | (8%) | |

| (2) Net Losses Incurred | 86 | 95 | 90 | 87 | (7) | (3) | (8%) | (3%) | |

| (3) Loss adjustment expenses incurred | 16 | 17 | 16 | 16 | (1) | (0) | (6%) | (2%) | |

| (4) Other underwriting expenses incurred | 42 | 43 | 45 | 42 | (1) | (3) | (3%) | (7%) | |

| (5) Total underwriting losses and expenses ( 2 through 4 ) | 145 | 155 | 152 | 145 | (10) | (7) | (6%) | (4%) | |

| (6) Net underwriting gain (loss) (1 minus 5) | 6 | 0 | 7 | 1 | 1 | (6) | |||

| (7) Combined ratio (5 divided by 1) | 96% | 100% | 96% | 99% | (1%) | 3% | |||

Notes:

YOY change compares the current quarter (Q2 2020) to the same quarter of the previous year (Q2 2019).

QOQ change compares the current quarter (Q2 2020) to the previous quarter (Q1 2020).

Source: Quarterly statements for P&C industry.

Uneven impact by line of business

While the premiums and losses have declined overall, the results by line of business are varied. Some lines of business—notably, the three major auto lines (private passenger auto liability, auto physical damage, and commercial auto liability), workers’ compensation, and homeowners multiple peril—saw large reductions in premiums. For other liability-claims made, on the other hand, premiums have modestly increased YOY as shown in Figure 3.

Figure 3: P&C Industry Direct Premiums Earned by Line during Calendar Quarter

| Direct Premiums Earned ($B) | 2019 Q1 |

2019 Q2 |

2020 Q1 |

2020 Q2 |

Change $ | Change % | |||

|---|---|---|---|---|---|---|---|---|---|

| YOY | QOQ | YOY | QOQ | ||||||

| Private passenger auto liability | 37 | 37 | 37 | 33 | (4) | (4) | (11%) | (12%) | |

| Auto physical damage | 27 | 28 | 28 | 25 | (3) | (3) | (10%) | (12%) | |

| Workers' compensation | 13 | 14 | 13 | 11 | (2) | (2) | (18%) | (14%) | |

| Homeowners multiple peril | 24 | 25 | 26 | 24 | (1) | (2) | (4%) | (7%) | |

| Commercial auto liability | 8 | 8 | 9 | 7 | (1) | (1) | (8%) | (14%) | |

| Other liability-claims made | 6 | 6 | 7 | 7 | 1 | (0) | 12% | (2%) | |

| Other | 50 | 53 | 54 | 52 | (1) | (2) | (2%) | (4%) | |

| Total | 165 | 171 | 174 | 159 | (11) | (15) | (7%) | (9%) | |

Notes:

YOY change compares the current quarter (Q2 2020) to the same quarter of the previous year (Q2 2019).

QOQ change compares the current quarter (Q2 2020) to the previous quarter (q1 2020).

Source: Quarterly statements for P&C industry.

The decline in auto premiums is not surprising given the significant drop in miles driven in the wake of the stay-at-home orders implemented across the country. Workers’ compensation exposure has similarly declined as many businesses were shuttered and employees have shifted to working from home. The increase for other liability-claims made is likely due in part to the rate increases the industry has experienced recently for lines of business such as directors and officers (D&O) and professional liability.

Turning to the loss side, while the industry direct losses incurred1 decreased by $10 billion YOY during Q2 2020, four lines of business experienced marked increases in losses: inland marine, homeowners multiple peril, mortgage guaranty, and commercial multiple peril. These increases were more than offset by considerable decreases for the three auto lines and workers’ compensation.

Figure 4: P&C Industry Direct Losses Incurred by Line during Calendar Quarter

| Direct Losses Incurred ($B) | 2019 Q1 |

2019 Q2 |

2020 Q1 |

2020 Q2 |

Change $ | Change % | ||

|---|---|---|---|---|---|---|---|---|

| YOY | QOQ | YOY | QOQ | |||||

| Lines with Increases | ||||||||

| Inland marine | 3 | 3 | 4 | 5 | 2 | 1 | 62% | 26% |

| Homeowners multiple peril | 13 | 17 | 12 | 18 | 1 | 6 | 8% | 51% |

| Mortgage guaranty | 0 | 0 | 0 | 1 | 1 | 1 | * | * |

| Commercial multiple peril | 6 | 6 | 6 | 7 | 1 | 1 | 8% | 21% |

| Lines with Decreases | ||||||||

| Private passenger auto liability | 24 | 25 | 24 | 16 | (9) | (8) | (36%) | (34%) |

| Auto physical damage | 16 | 17 | 15 | 11 | (6) | (4) | (35%) | (28%) |

| Workers' compensation | 7 | 7 | 7 | 5 | (2) | (2) | (25%) | (29%) |

| Commercial auto liability | 5 | 6 | 6 | 5 | (1) | (1) | (13%) | (18%) |

| Other | 20 | 23 | 24 | 25 | 2 | 1 | 9% | 4% |

| Total | 93 | 105 | 99 | 94 | (10) | (5) | (10%) | (5%) |

* Percentage change not meaningful.

Notes:

YOY change compares the current quarter (Q2 2020) to the same quarter of the previous year (Q2 2019).

QOQ change compares the current quarter (Q2 2020) to the previous quarter (Q1 2020).

Source: Quarterly statements for P&C industry.

Loss ratios provide a more complete picture and, as shown in Figure 5, five lines experienced significant YOY increases in calendar quarter direct incurred loss ratios, with mortgage guaranty topping the list, followed by inland marine, other liability-claims made, and multiple peril-related lines. On the other hand, aircraft, the three auto lines, and workers’ compensation experienced the largest improvements in loss ratios.

Figure 5: P&C Industry Direct Incurred Loss Ratios by Line during Calendar Quarter

| Direct Incurred Loss Ratios | 2019 Q1 | 2019 Q2 | 2020 Q1 | 2020 Q2 | Change in Loss Ratios | |||

|---|---|---|---|---|---|---|---|---|

| YOY | QOQ | |||||||

| Lines with Increases | ||||||||

| Mortgage guaranty | 8% | 6% | 12% | 80% | 74% | 68% | ||

| Inland marine | 48% | 50% | 62% | 86% | 36% | 24% | ||

| Other liability-claims made | 49% | 51% | 50% | 59% | 8% | 9% | ||

| Homeowners multiple peril | 53% | 69% | 47% | 77% | 8% | 29% | ||

| Farmowners multiple peril | 50% | 78% | 42% | 85% | 7% | 43% | ||

| Lines with Decreases | ||||||||

| Aircraft (all perils) | 64% | 82% | 78% | 60% | (21%) | (17%) | ||

| Private passenger auto liability | 66% | 67% | 64% | 48% | (18%) | (16%) | ||

| Auto physical damage | 60% | 62% | 55% | 45% | (17%) | (10%) | ||

| Commercial auto liability | 64% | 71% | 70% | 66% | (4%) | (3%) | ||

| Workers' compensation | 52% | 49% | 55% | 45% | (4%) | (10%) | ||

| Total | 57% | 61% | 57% | 59% | (2%) | 2% | ||

Notes:

YOY change compares the current quarter (Q2 2020) to the same quarter of the previous year (Q2 2019).

QOQ change compares the current quarter (Q2 2020) to the previous quarter (Q1 2020).

Source: Quarterly statements for P&C industry.

For mortgage guaranty, the high unemployment rate and economic fallout from the crisis have driven up the mortgage delinquency rates and resulted in a jump in loss ratios observed. In contrast, aircraft, with little change in premiums but fewer losses, probably explained by a sharp decline in operating flights of the airline industry, saw sizable improvement in loss ratios. These loss ratio results could be driven by a number of other factors in conjunction with COVID-19. For example, riot-related damages may have contributed to the increased losses for property lines. Furthermore, the premium audits mentioned earlier will presumably alter the picture of loss ratios for auto and workers’ compensation in particular. If the premiums are subsequently adjusted downward, either for the drop in exposures such as miles driven and payroll, or for premium refunds, which have been seen in auto and workers’ compensation lines, then the loss ratios may go up, perhaps substantially.

Finally, while it is interesting and informative to review this early data, it is important to keep in mind that the full impact of COVID-19 on the P&C industry will take much longer than one quarter to know, especially for long-tailed lines of business.

1That is, the direct counterpart to the net incurred losses shown in row 2 of Figure 2.