A shorter version of this article was originally published in Chief Investment Officer

The COVID-19 pandemic has undoubtedly had a massive social and economic impact in the United States and around the world. Yet it did little to slow the ongoing trend of pension risk transfer, whereby corporate pension plan sponsors offload their pension liabilities as a way of minimizing risk. According to Milliman's 2021 Corporate Pension Funding Study, pension risk transfers (including annuity buyouts and lump sums) for the largest 100 U.S. plan sponsors reached $15.8 billion in 2020, a significant increase from the 2019 total of $13.5 billion.1

Even as the funded status of top U.S. corporate defined benefit plan programs reached 95.8% in July 2021,2 continued low interest rates and rising Pension Benefit Guaranty Corporation (PBGC) premiums mean that many companies may consider pension risk transfers to avoid future costs. But while transferring pension liabilities through an annuity buyout to a third-party insurer is often touted as a safer and less costly way to manage a plan sponsor’s risk, there’s a sizable opportunity cost involved with that process that plan sponsors should be aware of when considering the timing of a transfer.

When weighing their pension risk management options, plan sponsors can benefit by taking a longer-term view of their risk tolerance and the options available to them. This is especially true now that passage of the American Rescue Plan Act of 2021 (ARPA) has provided landmark funding relief for pension plan sponsors in the United States. Given the greater flexibility and lower costs provided under ARPA’s provisions, plan sponsors should seize this moment to reevaluate and optimize their risk management strategies by considering the whole picture.

How ARPA changes the game for pension plan sponsors

Prior to ARPA’s passage, some plan sponsors were struggling to make contributions to their pension plans, especially due to financial struggles caused by the pandemic. Pension funding relief was scheduled to expire beginning in 2021 and wear away completely by 2024, which would have resulted in the use of lower interest rates to determine plan liabilities. Plan sponsors, who were already struggling to fund their pension plans, would have faced rising cash contribution requirements over the next few years.

ARPA, passed in March 2021, has changed the game for pension plan sponsors. To begin with, the new legislation offers continued—and even stronger—interest rate support, raising the interest rates used to measure plan liabilities for all future years. In addition, ARPA provides amortization relief, allowing funding shortfalls to be amortized over 15 years (rather than the prior seven years). Finally, ARPA allows plan sponsors to revisit prior valuations as far back as 2019 and revise them to reflect the new law, which will further lower their cash contribution requirements.3

Pension risk mitigation vs. pension risk transfer

Given the lower costs and increased time to pay off underfunding under ARPA, pension plan sponsors should be motivated to take a fresh look at their risk management strategies. Viewed broadly, potential strategies fall into two categories: risk transfer and risk mitigation.

There are two main types of risk transfer. A plan sponsor may transfer its pension benefit obligations to an insurer so that the insurer bears the risk (annuity buyout), or the sponsor may transfer those obligations to a plan participant, in the form of a lump sum buyout. The ultimate pension risk transfer is plan termination, and either of these methods can serve as a precursor to that step.

With pension risk mitigation, plan sponsors can reduce and manage risk according to a plan sponsor’s risk tolerance. This is done through plan design and risk management strategies, including moving assets into safer investments such as fixed-income assets over equities. With a glide path or similar strategy, a plan sponsor can shed equity investments and take on more fixed-income assets as they see their funded status gradually improve. The ultimate goal of any risk mitigation strategy is to balance assets and liabilities and ensure they move in lockstep as the plan goes forward.

Why plan hibernation deserves a closer look

When it comes to weighing the cost of pension risk transfer against risk mitigation, there’s often a perception that the cost of transferring would be less than maintaining an ongoing pension plan. But this perceived value of termination often doesn’t take into account the whole picture.

When plan sponsors transfer pension liabilities to a third-party insurance company, the insurer will often use more conservative estimates—such as lower interest rates or higher mortality assumptions—because they’re taking on the risk themselves. Insurers will also build a profit margin into their pricing for an annuity purchase. Then there’s the current economic environment to consider: as long as interest rates remain low, the cost of plan termination will remain high, often prohibitively so for many plan sponsors.

With the pension risk mitigation strategy known as plan hibernation, sponsors can let a frozen or closed pension plan help fund itself on the path to termination.4 And now, with the passage of ARPA, plan sponsors have more relief and time to let the assets of plans grow, with lower required contributions, until the plan is fully funded. For many pension plans, assets are sufficient enough to grow faster than liabilities, including administrative expenses such as PBGC premiums. Markets can be volatile, but history has shown that over any significant stretch of time, assets have continued to increase. Ultimately, instead of paying a large one-time cost to purchase annuities, which can be burdensome for some plan sponsors, there can be little to no cost to terminate a pension plan after a successful hibernation strategy has been implemented. With pension risk transfer through an annuity buyout, on the other hand, plan sponsors are forgoing potential asset returns, which adds up to a significant opportunity cost that can outweigh the risk reduction of the transfer.

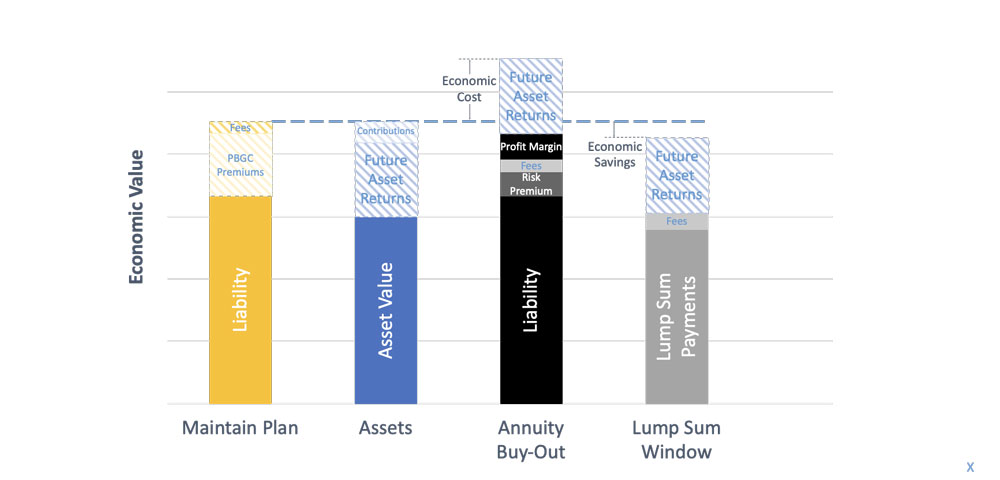

The economic value of different risk management strategies

For pension plan sponsors considering transferring their risk via an annuity buyout, the chart in Figure 1, taken from a sample pension plan with assets over $1 billion, helps illustrate the need to consider the whole picture—especially under the favorable climate created by ARPA’s funding relief measures. Economic value is defined as the present value of future assets or liabilities, taking into account future contributions, expenses, and benefit payments. Any true picture of the economic value of these options should include the future asset returns that could be gained through a targeted hibernation strategy, represented by the sections marked with blue diagonal lines.

Along with the significant costs involved with the annuity buyout (including risk premium, fees, and the insurer’s built-in profit margin), plan sponsors need to consider the opportunity cost of losing the future asset returns that could be gained through hibernation. Capturing these future asset returns is the main benefit of a hibernation strategy. Rather than paying a hefty premium to terminate now, termination occurs at a more opportune time, once the plan’s assets have had time to grow and save the plan sponsor money.

Figure 1: Economic Value

As the example in Figure 1 shows, if a plan sponsor can hibernate and employ some risk reduction and/or liability driven investment (LDI) strategies to manage market volatility, then in many cases future asset returns will likely put it in a far better position in a few years to transfer or terminate the pension plan.

To use one concrete example, one of our clients had a deficit in its pension plan and was considering plan termination on the assumption that it would cost less in the long run. Instead, they chose to implement a hibernation strategy. During this hibernation period, investment returns, along with de-risking strategies, improved the funded status of the plan by more than $220 million. Had the plan sponsor terminated the plan when first considering it, then it would have had to contribute roughly this same amount to the plan. Hibernation allowed them to use funds for acquisitions and other investments, significantly helping it grow the business, all while the pension plan was funding itself. The company is in a far better financial position and can soon terminate its plan with a minimal contribution.

Not all types of pension risk transfer strategies are equal, however. Transferring pension risk to plan participants in the form of a lump-sum payment (represented by the gray bar to the far right in Figure 1) may make economic sense for some plan sponsors when an annuity buyout would not.

While plan sponsors are forgoing future asset returns with a lump-sum window strategy, there can be advantages of offering these windows over an annuity buyout for some participants:

- By transferring (mortality) risk to the plan participant rather than a third-party insurance company, similar to 401(k) plans, there are service fees, but no risk premiums or additional fees based on a profit margin for the insurance company, which is a significant savings.

- A plan sponsor can base the lump-sum payout on an interest rate that was in effect at the beginning of the year, even if it was higher than current interest rates. Depending on how interest rates are moving, plan sponsors can release more in liabilities than they would release in assets, which would result in a balance sheet gain. This is not possible with an annuity buyout transaction.

Of course, plan sponsors also have to consider their fiduciary responsibility to act in the best interest of their plan participants and beneficiaries. A lump-sum window strategy transfers risk to the participant, along with the responsibility to manage their own longevity risk through long-term savings. The plan sponsor must determine whether this is in the best interest of the participant, rather than simply recommend a strategy that’s better for the company’s bottom line.

Conclusion

In the end, there are pros and cons to any risk management strategy. What’s most important is that plan sponsors understand the true economic value (and cost) of any potential strategy, whether pension risk transfer or mitigation. When weighing the decision to transfer pension risk to a third-party insurer, it’s crucial to take into account the opportunity cost of forgoing potential future asset returns. As Textron CIO Charles Van Vleet put it in a recent article on pension risk transfer in Chief Investment Officer: “Why give away perfectly good capital?” 5

With the passage of ARPA, the targeted hibernation strategy can make more sense financially, as pension plan sponsors now have a longer period of time to pay off their deficits and accumulate asset returns—and can do so in a far less risky manner. Under ARPA, plan sponsors now have time on their side. The assets in their pension plans can be put to work for them, generating returns that will help fund their deficits and put them in more favorable position to terminate their plans when it makes more financial sense.

1Wadia, Z., Perry, A.H., & Clark, C.J. (April 2021). 2021 Corporate Pension Funding Study. Milliman White Paper. Retrieved August 18, 2021, from https://us.milliman.com/en/insight/2021-corporate-pension-funding-study.

2Wadia, Z., & Clark, C.J. (July 2021). Pension Funding Index August 2021. Milliman 100 Pension Funding Index. Retrieved August 18, 2021, from https://www.milliman.com/en/insight/pension-funding-index-august-2021.

3Cook, R., Barker, R., Rowland, R. & Sent, S. (April 16, 2021). How the American Rescue Plan Act of 2021 Can Impact Corporate Pension Plans: Four Case Studies. Milliman Insight. Retrieved August 18, 2021, from https://us.milliman.com/en/insight/how-the-american-rescue-plan-act-of-2021-can-impact-corporate-pension-plans-four-case-studies.

4Wadia, Z. (May 18, 2021). Defined Benefit Pension Funding Resurrection. Milliman Insight. Retrieved August 18, 2021, from https://www.milliman.com/en/insight/Defined-benefit-pension-funding-resurrection.

5Light, L. (May 25, 2021). Special Report: Will Pension Risk Transfers Someday Control All DB Plans? Chief Investment Officer. Retrieved August 18, 2021, from https://www.ai-cio.com/news/special-report-will-pension-risk-transfers-someday-control-all-db-plans/.