Like many industries, the mortgage market experienced an upheaval as a result of the COVID-19 pandemic. The pandemic has produced unprecedented spikes in mortgage delinquencies, altered the entire home purchase process, created significant job losses and income uncertainty for home buyers and homeowners alike, and shocked the credit markets supplying capital to the mortgage industry. Now that we are several months into the pandemic, sufficient data exists to analyze its effects on the mortgage market and draw conclusions on the impact this disruption will have on the mortgage marketplace for the rest of 2020 and into 2021.

The mortgage market started the year with robust origination volume, investor appetite, an expanding credit box, and home price appreciation. The pandemic shifted the scene significantly, triggering steep mortgage rate declines, undocumented forbearances to mortgagees, and a freeze of investor appetite. To cap it all off, the Federal Housing Finance Agency (FHFA) released a proposed rule in advance of recapitalizing and potentially releasing Freddie Mac and Fannie Mae (the Enterprises) from conservatorship, which has widespread implications for the future of the mortgage market. This year 2020 is one to remember and there has been a lot to digest. We are going to take each development in turn and discuss the impact of the above events on the mortgage and housing market.

The data indicates the housing market is a bright spot in the economy, with robust demand, home price appreciation, and a return of investor appetite. Interest rate declines have resulted in record refinance activity, and mortgage originators are benefiting from the current economic environment. It is anticipated this strength will continue through the rest of 2020 and into 2021.

The mortgage market started out hot

There are multiple ways to look at the strength of the housing market. Here we look at data from Zillow.1 Specifically, Figure 1 highlights national figures on for-sale inventory (how many homes are for sale), days to pending (how long it takes to sell a home), the percentage of properties with a price cut, and the median sale price for 2019 and the first quarter (Q1) of 2020.

Figure 1: Housing and Mortgage Data, 2019 Q1 and 2020 Q1

| 1/1/2019 | 2/1/2019 | 3/1/2019 | 1/1/2020 | 2/1/2020 | 3/1/2020 | |

|---|---|---|---|---|---|---|

| Housing Data | ||||||

| Sale Inventory | 1,517,919 | 1,469,435 | 1,516,765 | 1,482,973 | 1,433,102 | 1,463,140 |

| Days to Pending | 40 | 38 | 31 | 38 | 34 | 26 |

| % of properties with a price cut | 13.0% | 12.5% | 13.8% | 13.5% | 12.2% | 11.6% |

| Median Sale Price ($) | 248,941 | 249,108 | 249,778 | 260,689 | 261,917 | 262,988 |

| Mortgage Data2 | ||||||

| Purchase Volume ($ Billions) | 49.2 | 43.5 | 52.4 | 63.5 | 52.4 | 63.2 |

| Refinance Volume ($ Billions) | 21.0 | 23.1 | 27.3 | 84.0 | 80.2 | 100.1 |

| Freddie Mac 90+ Day Delq Rate3 | 0.70% | 0.69% | 0.67% | 0.60% | 0.60% | 0.60% |

The data in Figure 1 is at the national level, and there are variations by region. Nevertheless, from the above we can draw the following conclusions:

- The inventory of homes for sale was lower in 2020 Q1 relative to 2019 Q1; however, purchase volume was up 20%. This indicates there were fewer homes to available for buyers, which puts upward pressure on home prices.

- Days to pending (which represents the median number of days from listing on Zillow to pending status) has declined year-over-year, indicating a more competitive market.

- The percentage of homes with a price cut similarly declined from 2019 to 2020.

- The median sale price increased by approximately 5% year-over-year.

The above statistics show a strong housing market in 2019 and 2020 was continuing the trend.

From an investor perspective, demand for mortgage credit risk was at an all-time high in 2020 Q1. Since the inception of government-sponsored enterprise (GSE) credit risk transfer deals in 2014, premium and spread rates have trended downward in spite of lower credit enhancement offered on the securities over time (although the underlying credit quality has remained relatively constant). Comparing 2019 Q1 to 2020 Q1, ceded credit risk sold to the private market from the Enterprises increased from $6.7 billion to $9.7 billion, reflecting a healthy market appetite.

While demand has been consistent and increasing, the Enterprises also saw a $190 billion increase in mortgage refinance volume, driven by record low mortgage rates. The increased volume from refinance originations set the expectation that there would be a commensurate increase in deal issuances in the credit risk transfer (CRT) market over the course of 2020.

The pandemic emerges

In the last week of February 2020, the stock market declined steeply and by April the full force of the pandemic hit the economy. Many states issued stay-at-home orders, shuttering many businesses and causing an unprecedented spike in the unemployment rate from less than 4.0% to 14.7%.4

For the purposes of this article, data has been segmented between 2020 Q1 and 2020 Q2 for pre-pandemic and post-pandemic analysis as the mortgage and home buying process takes time to settle. The table in Figure 2 continues the year-over-year comparison of the above data series through the second quarters of 2019 and 2020.

Figure 2: Housing and Mortgage Data, 2019 Q2 and 2020 Q2

| 4/1/2019 | 5/1/2019 | 6/1/2019 | 4/1/2020 | 5/1/2020 | 6/1/2020 | |

|---|---|---|---|---|---|---|

| Housing Data | ||||||

| Sale Inventory | 1,584,298 | 1,677,816 | 1,759,305 | 1,454,191 | 1,478,228 | 1,479,090 |

| Days to Pending | 19 | 18 | 18 | 19 | 18 | 18 |

| % of properties with a price cut | 13.9% | 15.0% | 16.0% | 11.0% | 11.0% | 11.3% |

| Median Sale Price ($) | 250,223 | 253,678 | 255,859 | 264,418 | 263,957 | 264,196 |

| Mortgage Data5 | ||||||

| Purchase Volume ($ Billions) | 51.1 | 60.9 | N/A | 73.7 | 65.6 | N/A |

| Refinance Volume ($ Billions) | 29.3 | 32.3 | N/A | 138.4 | 171.3 | N/A |

| Freddie Mac 90+ Day Delq Rate6 | 0.65% | 0.63% | 0.63% | 0.64% | 0.81% | 2.48% |

With the exception of the delinquency rate, the above figures show strength in the housing market throughout the pandemic. This is quite surprising considering the dramatic rise in unemployment and the process of buying a home—it historically requires a lot of interaction with the buyer and seller, including having as many strangers as possible view a home during an open house. Initially, many market participants believed the pandemic would slow down home purchases and result in lower home prices, with forecasted declines in home prices of up to 10%. However, with technology advancements and virtual open houses, this did not occur. Aside from a slight decline in the median sale price in May 2020, home prices have held up and continue to be stable through the economic uncertainty. In fact, home prices in July 2020 accelerated at the fastest pace in two years.7

One contribution to this trend is the decline in inventory of homes for sale. Typically, summer months experience an increase in homes for sale, and there is a high level of seasonality in the sale inventory. This trend is observed in 2019, with inventory increasing from 1.58 million units in April to 1.76 million units in June. In 2020, the inventory of homes for sale stayed relatively flat through the summer months. At the same time, purchase volume increased year-over-year, going against initial expectations in light of the pandemic. The flat seasonal inventory, combined with increased purchase volume, has resulted in strength in home prices throughout the pandemic.

In terms of the velocity of transactions, the median number of days from listing to pending stayed constant year-over-year, and it appears the pandemic has had little impact on the median listing time. Further, the percentage of loans with a price cut (i.e., incentive to sell the home) declined quite significantly between 2019 and 2020. This suggests high demand and a sellers’ market.

Now to the elephant in the market: Delinquencies. The pandemic certainly has had an impact on mortgagees and their ability to stay on time with payments. The last row in Figure 2 above is the percentage of loans that are 90 days or more delinquent for loans guaranteed by Freddie Mac. Throughout 2019, this statistic averaged about 60 to 70 basis points. In March 2020, as part of the Coronavirus Aid, Relief, and Economic Security (CARES) Act, a forbearance program was created allowing borrowers to enter forbearance (i.e., delay the mortgage payment) and capitalize the missed payments as a non-interest-bearing note payable upon termination of the mortgage. The program specifically stated that opting for this program would not impact a borrower’s credit score, and the borrower was not required to provide documentation of a hardship. The program was popular, and many borrowers enrolled into it. In May, 8.9% of the active mortgage population had entered into forbearance according to Black Knight.8 However, the initial forbearance figures ending up being slightly misleading, as it was later reported that many borrowers (up to 40%) entering into forbearance actually made their April mortgage payments. The current understanding is that many borrowers entered into forbearance as an “insurance” in the event they were subsequently furloughed or laid off by their employers. As the months progressed, the forbearance numbers sequentially declined.

Notwithstanding the above, the pandemic has had an impact on borrower performance. Along with the rise in forbearance rates, delinquencies also started to increase. For loans collateralizing 2018 CRT deals from Fannie Mae, approximately 1.25% were 30 days or more delinquent as of March 2020. In April, that number increased to 5.5% and increased further to 7.5% in May. Within these figures, we can further break down how many loans transitioned from 30 days delinquent (i.e., one missed payment) to 60 days delinquent (two missed payments). From May to June, the “roll” rate from 30 to 60 was approximately 35%, up from an average of approximately 12.5% over the prior year.9 While this roll rate is higher than average, it nevertheless indicates that a large portion of loans did not transition from one missed payment to two missed payments. A portion of these loans cured (i.e., are no longer delinquent) and others remained delinquent with only one missed payment.

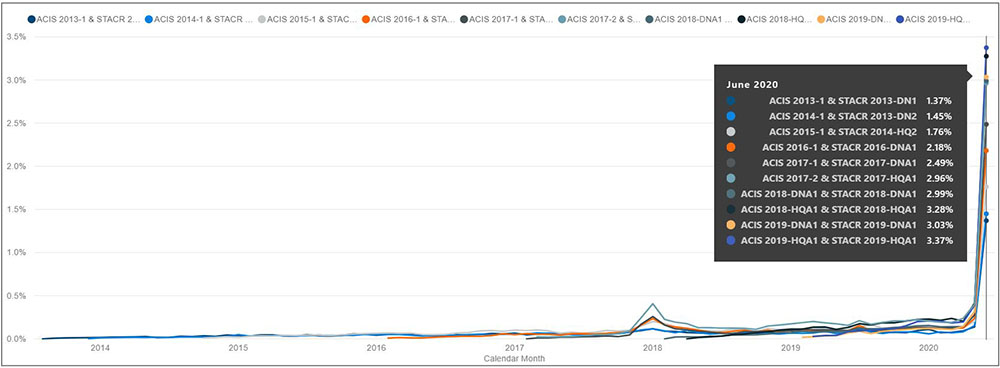

To put these figures into context, the chart in Figure 3 shows the percentage of loans that were 60 days delinquent in a given month for loans underlying various issuance years of Freddie Mac ACIS/STACR transactions. Figure 3 highlights the significant increase in delinquencies as a result of the pandemic.

Figure 3: Conditional 60 Days Delinquency Rates by Calendar Month

Investor response

Mortgage refinance volume was up over 500% in 2020 Q2 relative to the year prior as a function of interest rate declines. This effectively removes risk of older vintages of mortgages from the Enterprises into new originations. Because the new loans are not seasoned, they would typically be associated with higher levels of required capital, all else equal. In normal circumstances, we would anticipate higher CRT deal issuance as a result. However, that has not been the case.

Investor demand for mortgage credit risk froze between April 2020 and June 2020. Contrary to the large volume of deals issued in the first quarter, Fannie Mae has yet to come to market with a single new issuance since the start of the pandemic. And while Freddie Mac did execute two public risk transfer deals through the capital markets in 2020 Q2, the spreads were significantly increased, indicating a higher expectation of risk from investors.

FHFA capital rule proposal

The Enterprises’ reluctance to issue new CRT deals is not solely a function of market conditions. In May 2020, FHFA released a revised proposed capital rule for the Enterprises. The proposed rule was issued for public comment in advance of releasing the Enterprises from conservatorship. The proposed rule is comprehensive and has wide-reaching implications for the mortgage market. Two likely effects of the proposed capital rule are: 1) the Enterprises will be required to hold more capital than originally anticipated, and 2) the credit risk-sharing activities of the Enterprises will be reduced due to decreased capital benefits for CRT.

For borrowers, many commenters (including responses from the Enterprises themselves) believe the capital rule will result in increased guaranty fees and mortgage rates. Additionally, they believe the proposed rule may actually increase the risk profile of the Enterprises as the capital rules contain various top-line adjustments. These top-line, blunt capital requirements may result in a higher risk profile relative to a more risk-based proposal. This is because, no matter the risk level of the mortgage portfolio, the Enterprises would be subject to minimum capital requirements. Therefore, to increase returns, the Enterprises will be incentivized to increase the risk of their mortgage portfolios.

For the CRT market, the capital benefit under the proposed rule is overly punitive for CRT deals and will likely result in a significant reduction in deal issuance.10 Under the proposal, this means the Enterprises will eliminate a significant source of capital for mortgage credit risk and further increase the potential credit losses to the Enterprises during a stress period. For homeowners and mortgage market participants, the proposed rule does not appear to solve the incentives that contributed to the global financial crisis of 2007 to 2010.

The final rule and impact to the mortgage market is still uncertain at this time. FHFA has received many comments on the proposed rule. With 2020 being an election year, it is possible a new administration will have a different viewpoint on the Enterprises and releasing them from conservatorship. Because of these factors, the proposed rule adds uncertainty to the current market.

A look forward

For the rest of 2020 and into 2021, let’s discuss a few extensions we can draw from the events that have already occurred during the year.

The housing market will likely remain strong

There is no sign of a slowdown in the market, even with limited inventory and a change to the way home buyers approach the process. Technology has made the home-buying process more seamless than it has been in the past, and the pandemic does not appear to have a significant impact on the demand for housing.

For mortgage originators, the decline in interest rates and allowance of automated appraisals have resulted in a significant increase in mortgage refinance volume. This will likely result in strong profits and growth for these companies, particularly as the primary market spread (i.e. the difference between the average 30-year mortgage rate and the 10-year treasury) remains elevated. Offsetting this would be a potential decline in the value of their mortgage servicing rights given the fast prepayment speeds and the cost of advancing missed payments due to the pandemic-related forbearance policies. Nevertheless, indications are the mortgage originators have the capital to sustain these costs.

What about the Enterprises?

For the Enterprises, there is significant uncertainty around the FHFA proposal and their potential release from conservatorship. The increased refinance volume will likely result in additional capital requirements relative to those issued in the proposal as older loans have refinanced into newer originations, and the issuance of CRT deals has declined (or halted in the case of Fannie Mae). The recently announced 50 basis point refinance fee would have helped offset this potential capital requirement increase; however, that has been delayed until December 2020.

What about that refinance fee?

As discussed in a separate article from Milliman,11 the refinance fee is likely to have a limited impact on mortgage borrowers and may actually result in a reduction in the primary market spread. As this fee is an up-front fee that is spread over the life of the mortgage, it would not significantly change the incentive of refinancing to a lower interest rate loan from the borrower’s perspective.

Looking into the future

For 2021, barring a significant economic downturn as a result of the pandemic or other unforeseen event, it is likely the housing market will remain a bright spot in the economy. Since the global financial crisis, underwriting has stayed relatively tight and home price growth strong, but not excessive. We anticipate purchase volume remaining consistent or slightly above current levels, and refinance volume to continue along with an extended low interest rate environment.

For the borrowers in forbearance, it appears many of them are getting back on their feet and curing from delinquency. Furthermore, if strong home price growth continues, borrowers who are not able to afford their monthly payments will have the option to sell their homes. If they can obtain a higher sales price than the outstanding mortgage balance, they will be able to avoid foreclosure. If the overall market continues to stay strong, the actual number of loans transitioning from delinquency to claims is likely going to be relatively low and significantly less than the foreclosure rates observed during the global financial crisis.

1See https://www.zillow.com/research/data/.

2Milliman M-PIRe reflects purchase originations for loans acquired or guaranteed by Freddie Mac, Fannie Mae, and Ginnie Mae.

3Freddie Mac. Monthly Volume Summary: July 2020. Retrieved September 11, 2020, from http://www.freddiemac.com/investors/financials/pdf/0720mvs.pdf.

4U.S. Bureau of Labor Statistics (September 4, 2020). The employment situation—August 2020. News release. Retrieved September 11, 2020, from https://www.bls.gov/news.release/pdf/empsit.pdf.

5Milliman M-PIRe reflects purchase originations for loans acquired or guaranteed by Freddie Mac, Fannie Mae, and Ginnie Mae.

6Freddie Mac. Monthly Volume Summary: July 2020, op cit.

7Olick, D. (September 1, 2020). Home prices suddenly see biggest gains in 2 years. CNBC. Retrieved September 11, 2020, from https://www.cnbc.com/2020/09/01/home-prices-suddenly-see-biggest-gains-in-2-years.html.

8Black Knight (June 5, 2020). Number of homeowners in COVID-19-related forbearance plans falls for first time since crisis began; 8.9% of all mortgages now in forbearance. Retrieved September 11, 2020, from https://www.blackknightinc.com/black-knight-number-of-homeowners-in-covid-19-related-forbearance-plans-falls-for-first-time-since-crisis-began-8-9-of-all-mortgages-now-in-forbearance/.

9Fannie Mae Data Dynamics and Milliman M-PIRe.

10See https://www.fhfa.gov//SupervisionRegulation/Rules/Pages/Comment-Detail.aspx?CommentId=15574 .