The COVID-19 pandemic is no longer declared a U.S. public health emergency, but its effects are still rippling through the medical professional liability (MPL) industry. Notably, court closures during the pandemic have led to a significant increase in the duration of lawsuits (measured as the time between the date the lawsuit was reported to an insurer to the date the lawsuit closed), and it appears the average duration is continuing to rise. Duration is an important consideration when projecting liabilities and significant changes should be understood, monitored, and reflected in actuarial methods and assumptions.

Milliman’s Datalytics-Defense® platform has data on nearly 75,000 closed MPL lawsuits from over 20 MPL insurers since 2018. In addition, there are approximately 37,000 open lawsuits included in the data as of June 1, 2023. This allows for a unique opportunity to analyze characteristics of MPL lawsuits on an industry and state-wide basis, including lawsuit duration.

Pandemic impacts on MPL litigation countrywide

In the early months of the COVID-19 pandemic, courts were closed and operations limited, leading to an increase in the backlog of both criminal and civil litigation, including MPL lawsuits. Quarterly statement data retrieved from S&P Global Market Intelligence, displayed in Figure 1, shows a significant drop in MPL industry claim payments in the second quarter (Q2) of 2020, illustrating the impact of these operational challenges. Paid amounts remained lower than the pre-pandemic average for several quarters and just recently increased to totals above average. The industry may have started to catch up on the backlog of payments, leading to the above average payments over the last couple of quarters.

Assuming the average payments from the eight quarters before the pandemic would otherwise have been paid in each of the pandemic-impacted quarters as well, there was about $2 billion in payments missing from Q2 2020 through Q3 2022. In Figure 1, the gray shaded area represents pre-pandemic quarters, the red shaded area post-pandemic quarters, and the horizontal green line the average expenditure before the pandemic. With the increase in payments in Q4 2022 and Q1 2023, the overall remaining deficit is approximately $1.8 billion, indicating that the higher-than-average quarterly payments may continue for several quarters in the future.

Figure 1: Quarterly statement industry MPL payments ($ millions)

It is important to note that the industry also experienced a decline in reported claim counts during this time, perhaps driven by a decrease in elective healthcare taking place during the height of the pandemic. The decrease in reported claims will offset some of the payment deficit discussed above. Using Annual Statement data, Figure 2 summarizes the total reported claims for the MPL industry. Reported claims sharply declined in 2020, then slowly increased in 2021 and 2022. If we assume that, absent COVID-19, the reported claim count would have remained at approximately 2018 levels (the horizontal green line in Figure 2), then reported claims were cumulatively about 15% lower than expected from 2020 to 2022. Therefore, the deficit of about $2 billion discussed above may be overstated by about 15%.

Figure 2: Annual statement industry MPL reported claims, relative to 2018

There are other possible consequences from the pandemic that are not yet observable. For example, the avoidance of elective healthcare may be significant in the future because the industry could experience an increase in MPL claims that would otherwise have been diagnosed earlier.

Lawsuit duration – and what it tells us about payment lag

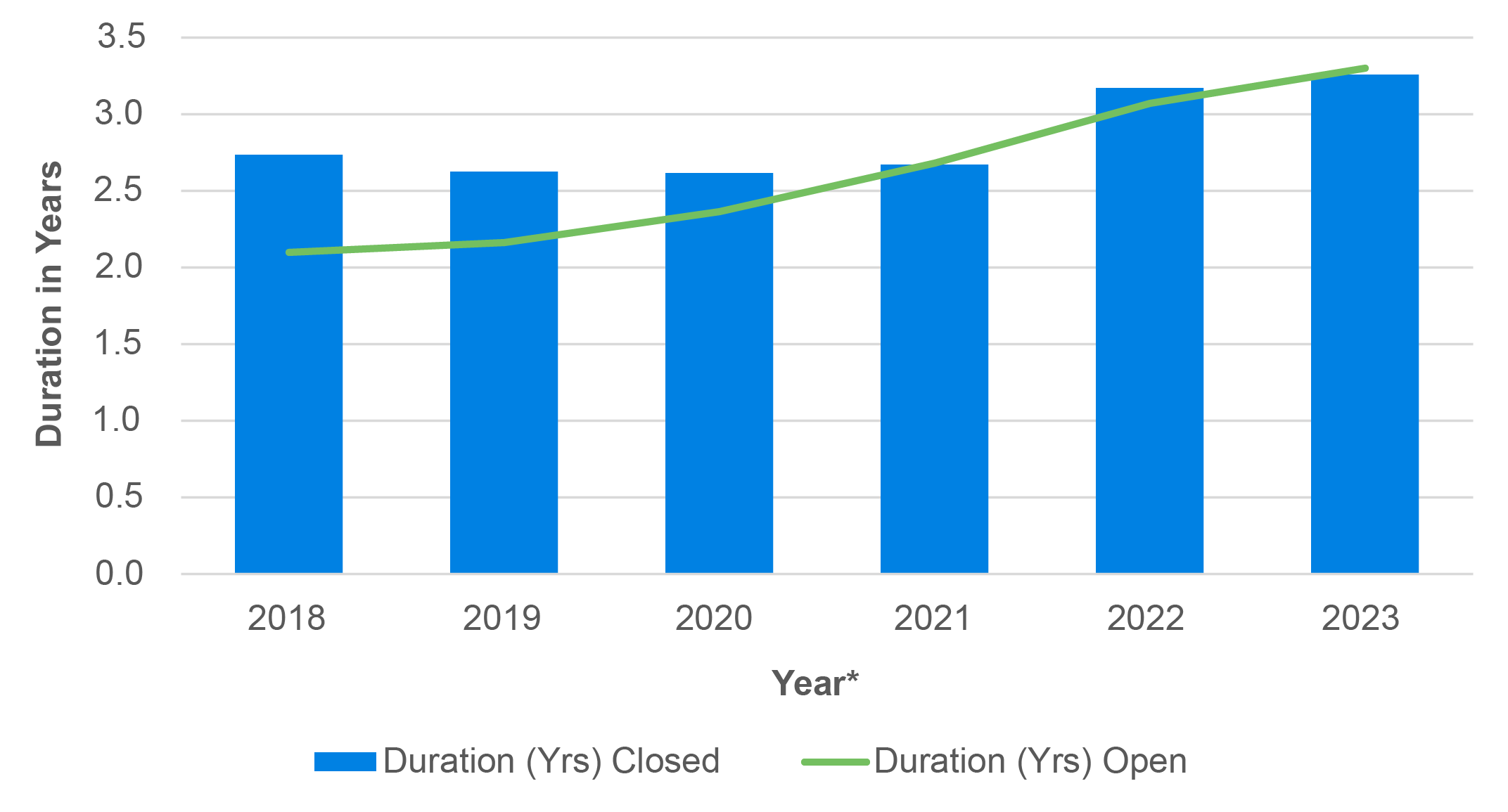

The increased backlog of lawsuits is also evidenced by data from Datalytics-Defense, displayed in Figure 3. On a countrywide basis, duration for closed lawsuits had been relatively stable at about 2.7 years for suits closed from 2018 through 2021. In 2022, the average duration for closed suits increased by about half a year to 3.2 years, indicating that suits reported just before the pandemic took, on average, about six months longer to reach a conclusion. The average duration of lawsuits closed in 2023, through June 1, has remained elevated.

This closed lawsuit data helps us better understand what the payment data implied. The decrease in payments was a function not of a decrease in severity or even reported counts, but rather a delay in the ability to close claims. The fact that lawsuits closed in 2022 were, on average, six months older than their counterparts in 2021 and prior speaks to the anecdotal court delays we all heard about over the last few years.

Perhaps the more interesting part of Figure 3 is the open suit duration. Open suit duration is a good indicator of closed duration because, by definition, closed suits come from the population of open suits. Given that the open duration is, as of June 1, 2023, higher than the closed duration, it would seem we should expect the closed duration to remain elevated or move even higher. We will be monitoring the open claim duration to see when it reaches its peak. That should be a leading indicator as to when closed duration begins descending to pre-pandemic levels.

Figure 3: Industry MPL lawsuit-only duration

* For closed duration, closed during the year. For open duration, duration on open claims as of December 31, yyyy. The 2023 data is through June 1.

How MPL litigation changed at the state level

The average duration of MPL lawsuits varies on a state level. Prior to the pandemic, Louisiana had the longest average duration of 5.1 years, measured from 2018 through 2021, while Arizona and Montana had the shortest average duration of 1.7 years. The table in Figure 4 summarizes the states with the longest and shortest average durations, based on Datalytics-Defense data.

Figure 4: Average duration (in years) by state, measured on lawsuits closed from 2018 through 2021

| States With Longest Duration | |

|---|---|

| State | Average Duration |

| Louisiana | 5.1 |

| New York | 4.7 |

| Rhode Island | 4.4 |

| Tennessee | 4.1 |

| Maine | 4.1 |

| States With Shortest Duration | |

| State | Average Duration |

| Arizona | 1.7 |

| Maryland | 1.7 |

| Kansas | 1.8 |

| Oregon | 1.8 |

| Alaska | 1.9 |

| Countrywide Average Duration | 2.7 |

Several state requirements within the lawsuit life cycle can impact the duration of lawsuits, including medical review panels, certificates of merit, testimonies from medical experts, existing backlogs of claims in the state, etc.

The impact on duration due to COVID-19 also differs by state. As seen in the industry data (Figure 3 above), the impact on duration begins in 2022, and we have therefore estimated the pre-pandemic duration as an average of claims closed in the 2018-2021 period, and post-pandemic duration using years 2022 and 2023. While most states experienced an increase in duration, some states maintained a steady duration or even slightly decreased. Other states’ durations increased by nearly two years. Figure 5 shows the distribution of average duration changes on closed claims.

Figure 5: Histogram of average change in duration on closed claims by state

Vermont experienced the largest increase in duration, followed by Illinois and Alaska.

A Vermont response and recovery plan proposal dated March 2021 identifies challenges such as technology limitations, short staffing, and courthouse infrastructure issues that contributed to a large increase in Vermont’s backlog of cases.1 Across the country, jury trials resumed at different paces, impacted by court decisions and the severity of COVID-19 case counts in the area. In Alaska for example, the resumption of civil jury trials needed to be delayed due to high case counts, and jury trials did not resume until January 10, 2022.2 A court’s ability to adapt quickly and efficiently as well as the length of time courts remained at limited operations seemingly contribute to the magnitude of the impact on a state-by-state basis.

The speed at which states return to pre-pandemic duration levels will depend on how quickly the backlog of claims can be cleared. Certain states have already shown a peak in duration, and the duration on open claims in other states indicates that a turn in duration may be in the near future. Other states may continue to experience elevated duration for months or years to come.

Future considerations

Several actuarial considerations should be made regarding this industry-wide shift in lawsuit behavior, including:

- Claim development patterns: It may be tempting to treat the COVID-19 pandemic as a “data anomaly,” ignoring shifts in claim development patterns and choosing factors around the impacted years. However, data is signaling an elevated duration for months, quarters, and possibly even years to come. Patterns may be missing the mark for future claim development if the latest diagonals are not considered.

- Elevated quarterly payments: As the backlog of lawsuits begins to clear, insurers may see higher-than-expected payments for the foreseeable future. It is important to be cognizant of this and keep a pulse on the drivers of the increased quarterly payments, whether it is a frequency, severity, or duration issue.

- Varying impact by state: The pandemic’s impact on duration varies countrywide, so there may not be a one-size-fits-all solution for addressing the changes in lawsuit behavior.

- Holding more IBNR for longer: This is perhaps implied by points 1 and 2, but it’s worth noting explicitly that, if open duration is increasing, then the open claims and suits feeding most carriers’ balance sheets are from older accident/report years than we have seen historically. The lack of resolution means that more incurred but not reported (IBNR) may be required to be held in older years than we would have seen pre-pandemic.

It is imperative that lawsuit duration continues to be monitored, paying particular attention to a peak in duration that may indicate a return toward pre-pandemic durations. Beyond this, with an improvement to technology and a shift toward more remote court operations resulting from the pandemic, certain efficiencies may result in a long-term average duration below pre-pandemic averages. Several iterations of adjustments and considerations may be needed in actuarial analyses while we wait to see what the new normal may be.

1 Vermont Judiciary Pandemic Response and Recovery Plan (March 15, 2021). Retrieved June 27, 2023, from https://legislature.vermont.gov/Documents/2022/WorkGroups/Senate%20Appropriations/Bills/H.439/H.439~Patricia%20Gabel,%20Court%20Administrator~Vermont%20Judiciary%20-%20Pandemic%20Response%20and%20Recovery%20Plan~4-16-2021.pdf.

2 In the Supreme Court of Alaska Special Order of the Chief Justice Order No. 8340. Update Regarding COVID-19 and Civil Jury Trials. Retrieved June 27, 2023, from http://www.courts.alaska.gov/covid19/docs/socj-2021-8340.pdf.