An in-depth study of life insurance company best practices

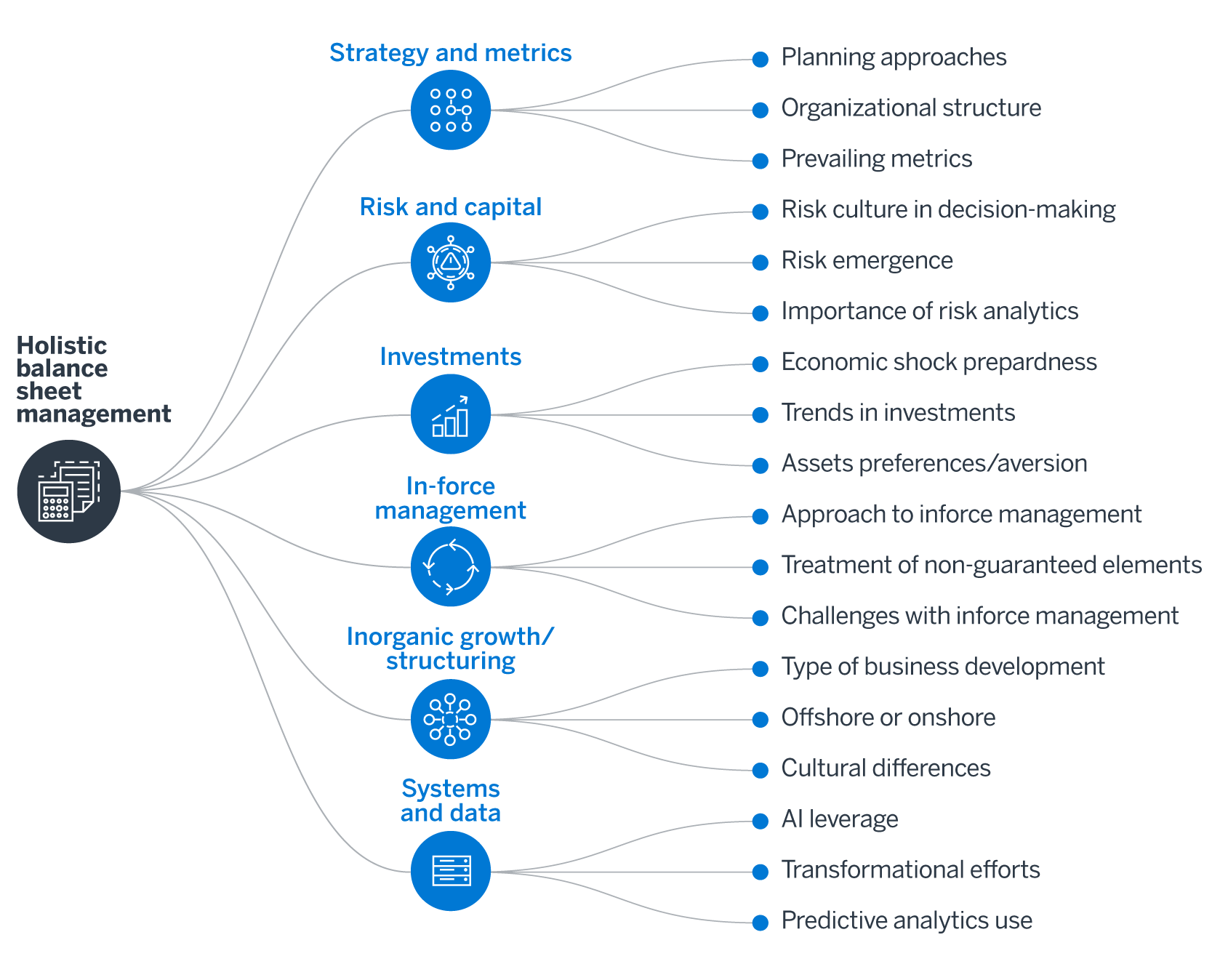

In the competitive American market, life insurers are increasingly considering how all aspects of their operations interact. But how do they approach strategic decision-making in practice? How are insurers varying their approach as they pursue overall goals in growth, customer service, and innovation? We interviewed C-suite executives from a variety of leading insurers to establish how they approach holistic decision-making with reference to six key aspects of their business in particular.

Our findings illustrate how U.S.-based life insurance companies:

- Balance the needs of policyholders, investors, regulators, and employees

- Measure and manage their performance, risk, and capital

- Respond to changing market conditions, customer preferences, and regulatory and accounting standards

- Use technology to enhance operations and customer experience

Life insurers tend to be focused on acquisitions, service, and innovation

No two life insurance companies are identical. But our research revealed that in terms of business development, structure and planning, and adaptability and transformation, insurers take different approaches, depending on their greatest area of focus. Click to see the comparison of the three theoretical profiles.

Comparing theoretical profiles

Each individual company has a different degree of focus on acquisitions, service, and innovation. See the full report for more of our findings and analysis.