If your 401(k) plan could speak, what would it have to say? Here are 10 things that your 401(k) would like you to know.

1. Average 401(k) account balances are up but that average account still won’t support the average person’s retirement. During November, Fidelity Investments published research that said that the average account balance as of the end of the third quarter of 2012 was the highest they’ve seen since they began tracking account data in 2000, at $75,900. Although this is a significant increase from 2009, when the average account balance was $46,200,1 the fact is that $75,900 may not be enough to support the average American’s retirement.

2. You should utilize tools to calculate your retirement readiness and adjust your savings strategy. In a 2011 retirement confidence survey conducted by the Employee Benefit Research Institute, 42% said they determined their retirement savings needs by guessing.2 The fact is this percentage is much higher than it needs to be. Recordkeepers and administrators have made enormous strides in creating calculators that work to align your retirement saving strategy to your estimated required retirement savings need. Of those surveyed who have utilized a calculator to estimate required retirement savings, 59% reported saving or investing more as a result. Please take the time now to utilize these calculators so you won’t find yourself unprepared when nearing retirement.

3. It’s important that you understand the fees you pay to participate in your 401(k) plan. Fee transparency is important on a participant level because the fees assessed to your account will impact your account growth.

Your employer is required to deliver fee information to you in two ways. Your quarterly statement must include an itemized listing of fees, if any, that were assessed to your account over the quarter. The second requirement is an annual notice that discloses fund performance, fund expense ratios, benchmarks, information about designated investment managers, the use of revenue sharing to offset plan expenses (if applicable), and any fees that you may incur if you initiate transactions from your account. Even if you’re not currently contributing to your employer’s 401(k) plan, you should expect to receive a copy of this notice every year. This document is full of useful information and shouldn’t be discarded.

While these disclosures are important to you as a participant, it’s also vital to note that an individual retirement account (IRA) may sometimes be more costly to maintain than a 401(k) plan through your employer. Fees for investment advisors or administration are often split between all of the active participant accounts in a 401(k) plan while with an IRA you may be standing alone in funding those fees. Please take the time to stay informed about the fees associated with your accounts.

4. Diversification is a key component to a successful investment strategy. A couple of years ago a story circulated through the news. A daughter wanted to do something nice for her mother and replaced her old lumpy mattress; only to discover the mattress she had discarded had been packed with her mother’s retirement savings, nearly one million dollars. Likewise, investment advisors recommend that you do not invest all of your retirement savings in one place, or one fund, within a 401(k) plan. Diversification is a method to help protect your 401(k) account from market volatility by creating a balanced portfolio, and it also means that you will need to continue to actively review the funds. Some plans offer target date funds or model portfolios designed to diversify the funds for you without an individual investment advisor to help. Remember, if too much of your savings is in one place, your account could be hit hard by losses in one investment.

5. Compounding interest works for you. You put money into your 401(k), it earns interest; and over the years you continue to earn interest on both the original contribution and the accumulated interest. Thinking back on the woman saving her money in her mattress for retirement, if she puts a million dollars in her mattress, 10 years later she still has a million dollars. Had she contributed the money into a 401(k) plan where interest is compounded, the value of her retirement savings could have grown much more.

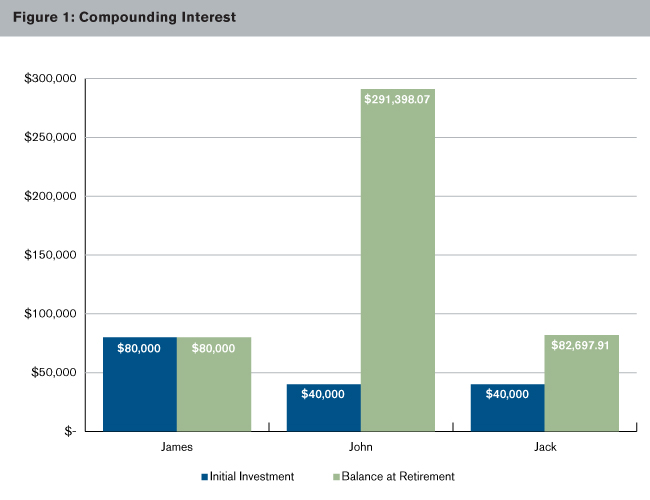

The example in Figure 1 illustrates this point. Triplets James, John, and Jack graduate college and go to work at the same company, but the three employ different retirement savings strategies. James puts $2,000 a year from age 25-65 into his home safe. John invests $2,000 a year from age 25-45 and then stops. Jack spends $2,000 a year on vacations for 20 years and then invests $2,000 a year from age 45-65. Both Jack and John receive 6.5% interest compounded annually. What will their retirement funds look like when they all retire at age 65?

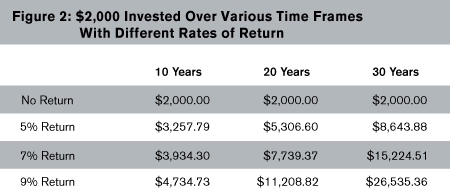

Figure 2 shows how the same investment of $2,000 grows over a ten to thirty year period with returns ranging from five to nine percent.

6. Loans in a 401(k) plan may be a double-edged sword. If you contribute to your 401(k) plan on a pre-tax basis and take a loan from your account, you will be paying yourself back on an after-tax basis. When you retire and distribute your account, you will have to pay taxes again. This double taxation is the double-edged sword of loans.

In addition, if you take a loan and are unable to pay it back within the outlined time period, your loan will become a premature distribution, taxable in the year your loan goes into “default,” and may be subject to an additional 10% in penalty taxes. If you terminate employment with an outstanding loan, while your account balance may be eligible to stay in the plan, your loan will default if you cannot pay the amount in full prior to the end of the grace period.

It’s also important to keep in mind that removing your hard-earned money from your 401(k) plan reduces the amount of time that money could be accruing earnings and compounding interest. Please take the time to consider the consequences prior to requesting a loan from your 401(k) account.

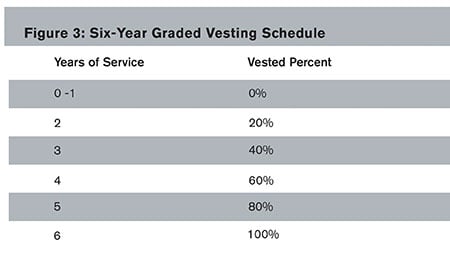

7. You may not be entitled to your entire account balance if you terminate and take a distribution. While any money deferred from your compensation is always 100% yours if you leave the company, employer contributions may be subject to a vesting schedule. What is a vesting schedule? A vesting schedule lays out the number of years in which you must be employed in order to earn full ownership of those employer contributions. Different types of employer contributions may be subject to different vesting schedules. A very common example of a vesting schedule is the six-year graded vesting schedule, shown in Figure 3 below. What this schedule means is that you have to work six years in order to attain full ownership of the employer contributions in your account. If you terminate employment with less than six years of service you will be entitled to the corresponding vested percent but the remainder of the account will be forfeited back to the employer.

If you’re unsure whether your employer contributions are subject to a vesting schedule or whether your plan offers 100% immediate vesting, you should consult your summary plan description.

8. 401(k) accounts are portable. If you have more than one 401(k) account, you can consolidate your accounts by moving (or “rolling over”) the account with your prior employer into your new employer plan. Rolling over your accounts is beneficial because it allows you to move your money from the prior employer’s plan without incurring any distribution penalties.

9. 401(k) plans could be affected by tax reform. In the wake of the recent election, the news has been littered with headlines focused around tax reform. Circulating rumors speculate that the goal of the U.S. Congress in 2013 will be to eliminate or reduce tax deductions and cut the deficit. I’m sure you’re thinking these deduction cutbacks will mostly affect employer-sponsored healthcare and won’t mean anything for your 401(k), but the truth is that 401(k)s have been negatively affected by tax reform in the past.

While it would be logical to argue that you’re still going to pay taxes on those contributions upon withdrawal, Congress is looking for immediate sources of relief, which could mean we may see a reduction in the contribution limit. Sound like hearsay to you? It has happened before. In 1986, the Tax Reform Act implemented deferral limits on participants, reducing maximum potential participant contributions from $30,000 to $7,000, indexed annually for inflation.

According to the Employee Benefit Resarch Institute (EBRI), in 2010 the percentage of employees whose employers offered a defined benefit plan fell to 17.9% from 40% in 1992, while the percentage of those offering a defined contribution plan grew to from 37.5% to 61.3%.3 If tax reform lowers the limits of deductibility, it will also reduce the incentive for employers to offer a 401(k) plan to their employees, which may mean that the number employees who currently have access to a 401(k) plan could decrease—leaving the vast majority of the American population to fund their own retirements on their own time.

10. Take advantage of buying shares in bulk. Sam’s Club and Costco have built empires on a successful business strategy. Buying in bulk tends to make purchases less expensive for the consumer. The same applies to the funds in a 401(k). When your contributions are withheld from payroll and invested at the same time as all of your co-workers’ contributions, it’s like buying into those funds in bulk. As a group, you have greater buying power. The result is that many plans can offer lower-expense funds that aren’t available to individual investors, providing higher returns. Most 401(k) employers hire an investment advisor and establish an investment committee that together actively review the funds within the plan to make sure the funds offered are the best options for their participants.

1 CBS Money Watch (November 8, 2012). (401)k average balances hit record high last quarter, Fidelity says. CBSNews.com. CBS Money Watch, 8 Nov. 2012. Web. 06 Dec. 2012. Retrieved January 16, 2013, from http://www.cbsnews.com/8301-505146_162-57546813/401-k-average-balances-hit-record-high-last-quarter-fidelity-says/.

2 Employee Benefit Research Institute (March 15, 2011). 2011 Retirement Confidence Survey: Workers' pessimism about retirement deepens, reflecting ‘the new normal.’ Employee Benefit Research Institute press release. Retrieved January 16, 2013, from http://www.ebri.org/surveys/rcs/2011/.

3 Copeland, Craig, Ph.D (September 2012). Individual Account Retirement Plans: An Analysis of the 2010 Survey of Consumer Finances. Issue Brief 375. Retrieved January 16, 2013, from. http://www.ebri.org/publications/ib/index.cfm?fa=ibDisp&content_id=5112 .